Insurance in the USA: Merger-acquisition operations in 2021

The high level of capital at stake and the search for profit have prompted external growth. The USA insurance market offers a favorable ground for merger operations among different players and for the emergence of new entities.

Insurance industry in the USA: Mega merger-acquisition operations

Main non-life mergers and acquisitions operations made in 2021:

Main non-life mergers and acquisitions operations made in 2021:

- December 2021, Berkshire Hathaway acquired all shares of the New York-based company Alleghany Corporation for a sum of 11.6 billion USD.

- May 2021, Berkshire Hathaway acquired a stake in Aon. The American group bought 4 million shares from the British broker. The transaction was valued at 942.6 million USD.

- February 2021, the American reinsurer Reinsurance Group of America - RGA - concluded a deal for the buyback of 100% of the capital of the British life insurer Hodge Life Assurance (HLAC), subsidiary of Hodge Bank.

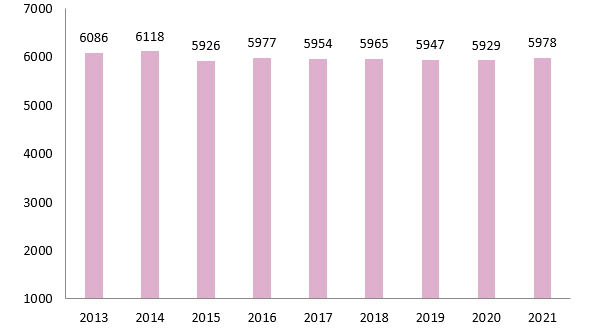

Insurance in the USA: Evolution of the number of domestic companies (2013-2021)

Source: National Association of Insurance Commissioners (NAIC)

Read also | Insurance companies in the USA

0

Your rating: None

Thu, 06/07/2023 - 12:27

The online magazine

Live coverage

15:27

14:22

14:12

10:33

04/25

Latest news