Jubilee Insurance Holdings

The first life insurance policies were underwritten in 1938. In 1952, the company commenced its international expansion by getting established in Mauritius. Tanzania was the second foreign country where the new insurer settled. Not until 1968 did Jubilee move in Nairobi where it inaugurated its head office.

The first life insurance policies were underwritten in 1938. In 1952, the company commenced its international expansion by getting established in Mauritius. Tanzania was the second foreign country where the new insurer settled. Not until 1968 did Jubilee move in Nairobi where it inaugurated its head office.

There commences the construction of a genuine group with the establishment of Jubilee Insurance Holdings (JIH), still based in Nairobi. This entity now gathers all of the stakes of Jubilee in Africa and in which Kenya, alone, accounts approximately for 63% of the premiums.

Nowadays, Jubilee Insurance Holdings is one of the most important financial service groups operating in East Africa, the Indian Ocean and in the Indian sub-continent.

By the end of 2015, JIH’s turnover amounted to 300 million USD with assets of approximately 820 million USD and a shareholder’s equity of 203 million USD. Jubilee Insurance Kenya, the group’s flagship, stands, by far, as the first non life insurer of the Kenyan market.

|  |

| Nizar N Juma | Dietmar Raich |

| Chairman of the board | Group CEO |

Jubilee Holdings in 2015

| Share capital | 3 277 100 USD |

| Turnover | 300 032 000 USD |

| Assets | 819 496 443 USD |

| Shareholder’s equity | 202 752 247 USD |

| Net result | 31 048 633 |

| Non life gross loss ratio | 58.6% |

| Non life gross expenses ratio | 24.3% |

| Non life gross combined ratio | 82.9% |

| Network in Africa |

|

| Number of employees | 878 |

Shareholding

| Aga Khan Fund for Economic Development | 37.98% |

| Pyrus Investments Limited | 9.82% |

| Freight Forwarders Kenya Limited | 1.95% |

| United Housing Estates Limited | 1.81% |

| Adam’s Brown and Company Limited | 1.79% |

| Other shareholders | 46.65% |

Management

| Chairman of the board | Nizar N Juma |

| Group CEO | Dietmar Raich |

| Chief Financial Officer | Sherali Rawji |

| Claims manager | Mbugua Gathige |

| Head of business strategy | Julius Orayo |

| Head of human resources | Emily Kamunde-Osoro |

| Chief Information Officer | Sachin Samant |

| Head of internal audit | Christopher Ngala |

| Head of compliance | Nicholas Muchangi |

| Regional CEO, Life | Azim Dawood |

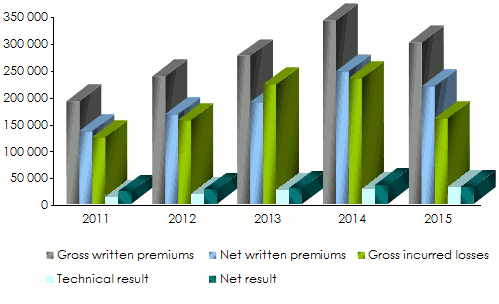

Jubilee Holdings: main technical highlights (2011-2015)

in thousands USD

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

Gross written premiums | 191 157 | 236 532 | 275 185 | 340 831 | 300 032 |

Written premiums net of reinsurance | 134 744 | 166 142 | 189 239 | 245 928 | 218 918 |

Non life gross written premiums | 134 634 | 168 636 | 190 350 | 210 675 | 204 431 |

Gross earned premiums | 144 224 | 179 866 | 212 533 | 278 302 | 229 102 |

Non life gross earned premiums | 121 825 | 153 529 | 179 649 | 205 980 | 192 739 |

Gross incurred losses | 123 778 | 155 662 | 222 267 | 233 015 | 159 590 |

Non life gross incurred losses | 90 833 | 112 856 | 157 018 | 129 720 | 113 005 |

Management expenses(1) | 40 482 | 49 345 | 56 738 | 67 245 | 69 682 |

Non life management expenses | 28 609 | 35 787 | 40 447 | 47 239 | 49 627 |

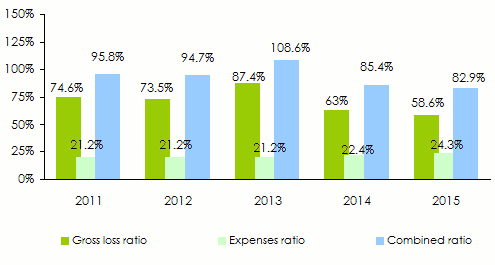

Non life gross loss ratio | 74.6% | 73.5% | 87.4% | 63% | 58.6% |

Non life gross expenses ratio (2) | 21.2% | 21.2% | 21.2% | 22.4% | 24.3% |

Non life gross combined ratio | 95.8% | 94.7% | 108.6% | 85.4% | 82.9% |

Technical result | 12 798 | 18 058 | 26 183 | 28 271 | 31 117 |

Net result | 22 848 | 26 683 | 29 408 | 34 854 | 31 049 |

(1)management expenses + commissions

(2)expenses ratio = management expenses / gross written premiums

Jubilee Holdings: evolution of premiums, losses and results (2011-2015)

in thousands USD

Evolution of the non life gross technical ratios (2011-2015) of Jubilee Insurance Holdings

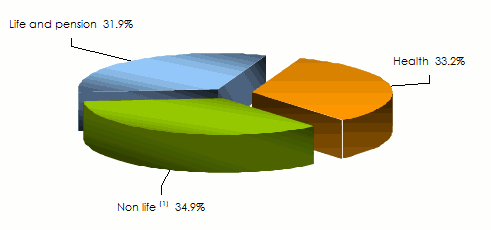

Breakdown of the turnover of Jubilee Insurance Holdings per class of business(2011-2015)

in thousands USD

| 2011 | 2012 | 2013 | 2014 | 2015 | % 2015 | |

|---|---|---|---|---|---|---|

Health | 45 639 | 58 891 | 74 260 | 85 573 | 99 778 | 33.2% |

Non life | 88 995 | 109 745 | 116 090 | 125 102 | 104 653 | 34.9% |

Life and pension | 56 523 | 67 896 | 84 835 | 130 156 | 95 601 | 31.9% |

Total | 191 157 | 236 532 | 275 185 | 340 831 | 300 032 | 100% |

Jubilee Insurance Holdings: breakdown of 2015 turnover per class of business

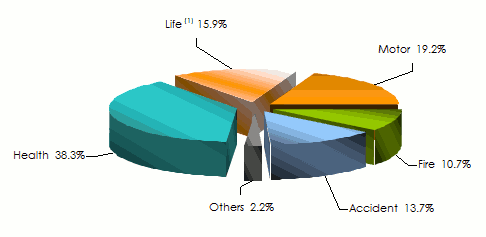

Jubilee Holdings: gross earned premiums per life and non life insurance (2011-2015)

in thousands USD

| 2011 | 2012 | 2013 | 2014 | 2015 | % 2015 | |

|---|---|---|---|---|---|---|

Motor | 28 152 | 36 415 | 44 957 | 49 906 | 44 132 | 19.2% |

Fire | 13 885 | 21 549 | 25 413 | 29 658 | 24 421 | 10.7% |

Accident | 29 756 | 28 310 | 29 657 | 34 211 | 31 409 | 13.7% |

Health | 40 614 | 54 099 | 69 767 | 83 565 | 87 704 | 38.3% |

Others | 9 418 | 13 156 | 9 855 | 8 640 | 5 073 | 2.2% |

Total non life | 121 825 | 153 529 | 179 649 | 205 980 | 192 739 | 84.1% |

Ordinary life | 11 880 | 14 323 | 17 288 | 22 650 | 22 869 | 10% |

Group life | 8 086 | 9 102 | 10 710 | 12 851 | 10 797 | 4.7% |

Pension | 2 433 | 2 912 | 4 887 | 36 821 | 2 697 | 1.2% |

Total life | 22 399 | 26 337 | 32 884 | 72 322 | 36 363 | 15.9% |

Grand total | 144 224 | 179 866 | 212 533 | 278 302 | 229 102 | 100% |

Jubilee Insurance Holdings: breakdown of 2015 earned premiums per class of business

Main technical highlights of the group’s subsidiaries per country in 2015

in thousands USD

| Kenya | Uganda | Tanzania | Mauritius | Burundi | Total | |

|---|---|---|---|---|---|---|

Gross earned premiums | 143 422 | 32 116 | 39 023 | 10 581 | 3 960 | 229 102 |

% in the group | 63% | 14% | 16% | 5% | 2% | 100% |

Gross paid losses | 113 509 | 16 056 | 23 839 | 7 347 | 1 954 | 162 705 |

% in the group | 69,8% | 9,9% | 14,7% | 4,5% | 1,1% | 100% |

Technical result | 10 953 | 16 362 | 3 119 | 274 | 409 | 31 117 |

% in the group | 35% | 53% | 10% | 1% | 1% | 100% |

Net result | 8 194 | 20 541 | 1 849 | 274 | 191 | 31 049 |

% in the group | 26% | 66% | 6% | 1% | 1% | 100% |

Participation of Jubilee Insurance Holdings in its insurance subsidiaires as at 31/12/2015

| Country | Class of business | Jubilee share in the capital | |

|---|---|---|---|

Jubilee Insurance Company of Kenya Limited | Kenya | Non life | 100% |

Jubilee Insurance Company of Tanzania Limited | Tanzania | Non life | 51% |

Jubilee Life Insurance Corporation of Tanzania Limited | Tanzania | Life | 51% |

Jubilee Insurance Company of Uganda Limited | Uganda | Non life | 65% |

Jubilee Life Insurance Company of Uganda Limited | Uganda | Life | 65% |

Jubilee Insurance (Mauritius) Limited | Mauritius | Non life | 80% |

Jubilee Insurance Burundi Limited | Burundi | Non life | 70% |

Source: Figures taken from Jubilee Holdings’ different balance sheets

Exchange rate KES/USD as at 31/12 | 2011 | 2012 | 2013 | 2014 | 2015 |

0.01196 | 0.01168 | 0.01175 | 0.01123 | 0.009948 |

Jubilee Insurance Holdings

| Head office | Jubilee Insurance House, Wabera St. P.O. Box 30376 00100 GPO, Nairobi, Kenya |

| Tel | +254 (0)20 328 1000 |

| Fax | +254 (0) 20 328 1150 |

| Website |