Mergers and acquisitions on the rise again

According to the news agency Thomson Reuters, merger and acquisitions including all areas of business have, for the first quarter alone, amounted to 811 billion USD, up by 21% over one year.

According to the news agency Thomson Reuters, merger and acquisitions including all areas of business have, for the first quarter alone, amounted to 811 billion USD, up by 21% over one year.

The insurance market is not far behind. It was particularly dynamic in 2014 and during the first quarter of 2015. According to a study by Swiss Re, the number of mergers and acquisitions concluded during the past year amounted to 489 operations, thus attaining the highest level since the 2008/2009 crisis.

Insurance companies’ mergers and acquisitions skyrocketing

Confidence helping, the market of mergers and acquisitions is on the rise again. With the improvement of the economic environment, market participants have regained appetite for acquisitions.

In 2014, the transactions carried out by private investors took over those concluded by public sector actors.

This revival of mergers and acquisitions in insurance is accounted for by:

- optimal market conditions,

- interest rates at their lowest,

- abundant liquidity resulting in capital inflows,

- growth of digital distribution,

- the search for critical size,

- fierce competition between insurers and reinsurers,

- the ambition to cover new risks and new regions,

- the poor return of local investments that pushes insurers in mature markets to seek acquisitions in international markets,

- recent regulatory restrictions and new requirements pertaining to minimum capital,

- changes in the business environment,

- shareholders’ profitability requirements.

Recent transactions have resulted in:

- the sale of subsidiaries or business units,

- the transfer of portfolio into run-off,

- the involvement of alternative investors,

- strategic guidance based on extensive distribution and geographical coverage,

- redeployment of capital to new classes of business,

- an increasing number of mergers and acquisitions in non-life reinsurance,

- a consolidation trend among brokers.

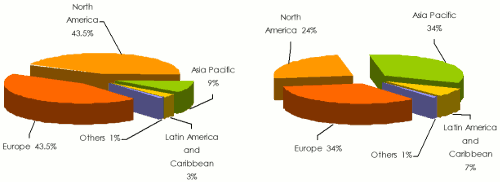

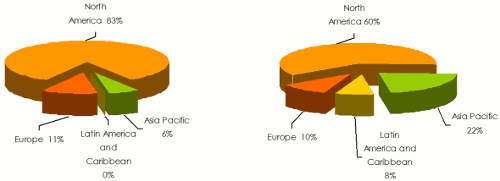

Geographical distribution of mergers and acquisitions

Mergers and acquisitions have in recent years been concentrated in some emerging markets exhibiting high potential for growth.

The center of gravity for these activities has been shifted from North America and Europe to Asia Pacific and Latin America.

Evolution of mergers and acquisitions in life insurance

| 2001-2007 | 2008-2014 |

| |

Evolution of merger-aquisition transactions in non life insurance

| 2001-2007 | 2008-2014 |

| |

Europe and North America

Historically, Europe and North America are the main target regions, especially in life insurance. After the 2008 crisis, the trend has been reversed. The share of Asia-Pacific and Latin America, in terms of life and non-life value transactions, increased significantly at the expense of the first two mentioned regions.

Despite the relative decline of Europe in comparison with Asia and Latin America, consultancy firm PricewaterhouseCoopers (PwC) has reported that in 2014 the total value of insurance transactions made on the old continent totaled 16.3 billion EUR, up by 25% compared to 2013.

This increase in activity is stimulated by the development of cross-border transactions and those involving private equity players. The implementation of Solvency II and the refocusing of companies on their core business have also contributed in a large part to that business growth.

In North America, the consolidation move has targeted mutual companies. The pressure on costs, strengthening capital requirements and diversification of distribution channels have helped to bring different players closer to each other.

The largest transaction reported in the US market was UnitedHealth, the American health insurance giant, which got hold of Catamaran, a health service provider. The transaction value amounted to 13 billion USD.

Major transactions carried out in Europe and North America

en USD| Acquirer | Nationality | Transaction date | Target company | Country | Share/transaction amount |

|---|---|---|---|---|---|

Willis Group | UK | April 2015 | Gras Savoye | France | 70% (592 millions) |

Fairfax | Canada | March 2015 | Africa Re | Nigeria | 7.15% (61 millions) |

Banque Nationale du Canada et Amethis Finance | Canada | March 2015 | NSIA | Côte d’Ivoire | 20.9% |

Amethis Finance | Canada | March 2015 | NSIA | Côte d’Ivoire | 5.4% |

XL Group | Ireland | January 2015 | Catlin | Bermuda | 100% (4.1 billions) |

Aviva | UK | November 2014 | Friends Life | UK | 100% (8.07 billions) |

Discovery | South Africa | November 2014 | Prudential Health | UK | 25%, (246 millions) |

Tokio Marine Europe | Japan | January 2014 | Kiln | UK | Not available |

Fosun | China | January 2014 | Fidelidade, Multicare and Cares | Portugal | 80% (1.4 billion) |

Axa Liabilities Managers | France | September 2013 | Many international subsidiaries of Global Reinsurance | Germany | Not available |

Asia Pacific and Latin America

Major insurance and reinsurance players have placed both regions high on their agenda. Focused on high-growth potential markets, their expansion strategy abroad has mainly targeted China, India, Indonesia, Thailand, Vietnam, Brazil and Mexico.

With the relaxation of merger and acquisition rules in Asia and particularly in China, Malaysia and India, the region has been attracting numerous investors. In China for example, foreigners are since June 2014, allowed to invest simultaneously in several insurance companies marketing similar products. They may also use debt to finance their acquisitions. In India, the new law allows foreigners to increase their equity shares in local insurance companies to 49%, a share that was in the past capped at 26%.

A New phenomenon is worth noting: Asia is no longer just a passive target. A reverse move is taking shape, with Asians on the offensive, especially the Chinese, Japanese and Indian insurers, conducting transactions abroad and particularly in the United States.

Consequently, Japanese insurers have developed an international expansion strategy. In Southeast Asia, Tokio Marine acquired Delphi Financial in 2011 while Dai-Ichi took control, in 2014, of Protective Life in the United States.

This international expansion of Japanese actors is designed to balance the risk portfolio and to reduce their exposure to local hazards which consist mainly of natural catastrophes.

Major transactions carried out in Asia

en USD| Acquirer | Nationality | Transaction date | Target company | Country | Share/Transaction amount |

|---|---|---|---|---|---|

Axa | France | April 2015 | Groupe Bharti | India | 23% (205 millions) |

Sompo Japan | Japan | September 2014 | Nipponkoa | Japan | 100% |

Swiss Re | Switzerland | July 2014 | Sun Alliance Insurance | China | 100% (122 millions) |

Dai-Ichi | Japan | June 2014 | Protective Life | USA | 5.7 billions |

Sumitomo Life | Japan | May 2014 | BNI Insurance | Indonesia | (363 millions) |

Axa | France | February 2014 | Tian Ping Auto Insurance | China | 50% (330 millions) |

Ace | Switzerland | January 2014 | Siam Commercial Samaggi Insurance (SCSI) | Thailand | 60.9% (185 millions) |

Swiss Re | Switzerland | November 2013 | New China Life | China | 4.9% (493 millions) |

MBK Partners | South Korea | August 2013 | ING Life Korea | South Korea | 100% (1.65 billion) |

Ace | Switzerland | June 2013 | Asuransi Jaya Proteksi | Indonesia | 100% (130 millions) |

In Latin America, merger - acquisition operations have greatly accelerated in recent years, particularly in Brazil, Mexico and Chile. An equally noticeable phenomenon consists in the revival of cross-border transactions between countries in the region.

In Latin America, the consolidation wave has been supported by the growth of the middle class.

Major transactions carried out in Latin America

en USD| Acquirer | Nationality | Transaction date | Target company | Country | Share/Transaction amount |

|---|---|---|---|---|---|

Axa | France | May 2015 | SulAmérica Companhia de Seguros Gerais | Brazil | 100% (45 millions) |

ACE | Switzerland | July 2014 | Corporate P&C Business of Itaú Seguros | Mexico | 685 millions |

Swiss Re | Switzerland | November 2013 | SulAmérica Group | Brazil | 14.9% (334 millions) |

Ace | Switzerland | May 2013 | ABA Seguros | Mexico | 100% (690 millions) |

Yasuda Seguros, subsidiary of Sompo Japan | Japan | January 2013 | Maritima Seguros | Brazil | 37% (102 millions) |

In the Middle East

According to PwC, the year 2014 was full of local and cross-border merger and acquisition operations. The market analysis firm is forecasting more consolidation in the region, particularly in Saudi Arabia and the United Arab Emirates. Analysts believe the Gulf market has become mature enough to enter the consolidation phase.

In order to deal with market fragmentation, unbridled competition and reduced profitability, supervisors, including Saudi Arabian Monetary Agency (SAMA) for Saudi Arabia and lnsurance Authority (IA) for the United Arab Emirates, are pushing for more mergers and acquisitions. The supervisory authorities have implemented a series of regulatory measures to support this type of transaction and slow down the establishment of new companies.

The main operations carried out recently involved local actors. It is the medium-sized insurers of the Middle East countries that are purchasing small players in order to reach critical mass and achieve economies of scale. Consequently, First Insurance, a Jordanian company, became major shareholder in its sister company Yarmouk Insurance Company while Bahrain Kuwait Insurance (Bahrain) acquired in May 2015 a majority share of 41% in the Bahraini insurer Takaful International.

Seeking external growth opportunities, some insurers and reinsurers in the region do not hesitate to invest in other continents. In June 2014, Qatar Insurance took over Antares Holdings, which is itself in control of the Lloyd's syndicate "Antares Syndicate 1274". The Qatari group, holder of Qatar Re, is therefore making its entry into the UK and Bermuda markets.

Foreign investors, on their part, have for several years been displaying a growing interest in the region. They are nonetheless facing many obstacles:

- reluctance of local players, unwilling to give up control of their company, often family business, to foreign investors,

- restrictions imposed on foreign buyers,

- the State’s presence in many national companies stands as a barrier to the entry of foreign capital in their business.

Major transactions carried out in the Middle East

en USD| Acquirer | Nationality | Transaction date | Target company | Country | Share/Transaction amount |

|---|---|---|---|---|---|

Bahrain Kuwait Insurance (BKIC) | Bahrain | May 2015 | Takaful International | Bahrain | 40.9% (5 millions) |

First Insurance | Jordan | April 2015 | Yarmouk Insurance Co. | Jordan | 15 millions |

Qatar Insurance Company | Qatar | June 2014 | Antares Holdings | UK | 100% |

Axa/Kanoo Group | France/UAE | May 2014 | Green Crescent | UAE | 50% (27.2 millions) |

Kuwait International Bank | Kuwait | August 2013 | Ritaj Takaful Insurance Co. | Kuwait | 33.6% (13 millions) |

Orix Corporation | Japan | June 2013 | MedGulf | Bahrain | 25.75%(225 millions) |

Tokio Marine Holdings | Japan | April 2013 | Nile Family Takaful et Nile General Takaful | Egypt | 59.99% (8.7 millions) |

Oman Investment Fund | Oman | February 2013 | ONIC Holdings | UAE | 41.1% (58 millions) |

Africa

Africa is the subject of much envy. In the sub-Saharan part of the continent, cross-border operations, supported by strong growth of insurance markets and regulatory changes, are speeding up. The traditional groups of Western Europe such as Axa, Swiss Re and Allianz are currently in competition with local actors NSIA, Saham, Old Mutual, Santam, Jubilee, etc.

Even though we are currently witnessing a sharp rebound in mergers and acquisitions globally, they are far from the volume and the number of operations reported before the crisis of 2008. In 2007 alone, 674 mergers and acquisitions were performed whereas in 2014 only 489 operations materialized in 2014.

See our folder dedicated to Africa «Insurance in Africa, an attractive market» where a list of the main mergers-acquisitions had been established.