Reinsurers’ rating

The increase in natural catastrophe losses in recent years has considerably weighed down the balance sheets of reinsurers, hence the degradation of their ratings.

The economic environment of the last few years and the persistence of low interest rates have also strained reinsurers.

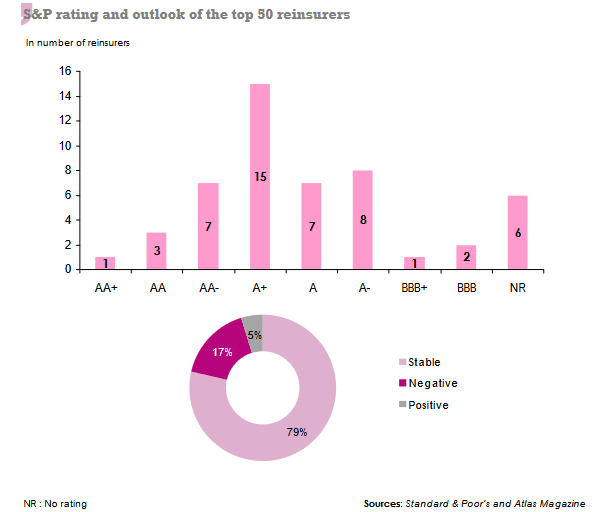

Standard & Poor’s rating

During 2021, the top 10 ranking has undergone a single change. Swiss Re, which now ranks second in the podium in terms of premiums, has had its AA- rating outlook revised downwards from stable to negative.

During 2021, the top 10 ranking has undergone a single change. Swiss Re, which now ranks second in the podium in terms of premiums, has had its AA- rating outlook revised downwards from stable to negative.

The agency has also downgraded seven companies in the top 50 global reinsurers along with the downward review for the outlook of nine other companies.

Only three reinsurers had their ratings revised upwards. They are Mapfre Re (from A to A+), Validus (from A to A+) and Chubb (from A+ to AA).

For the fourth consecutive year, the AA+ rating is held by a single reinsurer, Berkshire Hathaway. Within the same ranking, three reinsurers are rated AA and seven are rated AA-.

Overall, 41 reinsurers have an S&P rating of at least A-.

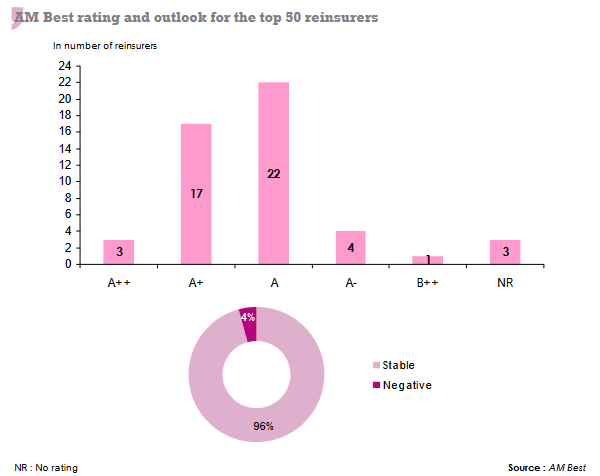

AM Best rating

For the top 50 reinsurers, AM Best has lowered the 2021 ratings of three reinsurers by one notch, namely GIC Re, Axis Capital and Sirus. In contrast, the agency raised Chubb's rating by one notch from A to A++. It has also improved the outlook of the rating for two other reinsurers Axis and Sirus.

For AM Best, 46 out of 50 reinsurers hold a rating of A- or higher. The highest financial soundness rating of A++ has been granted to three companies: Berkshire Hathaway, Tokio Marine & Nichido Fire and Chubb Tempest Reinsurance. Nearly 45% of the reinsurers in this ranking have an A rating.

Read also | Global reinsurers: S&P and AM Best ratings