Risk mapping throughout the world (Part II)

While risks are most of the time clearly defined, it is well known that each region is exposed to specific perils.

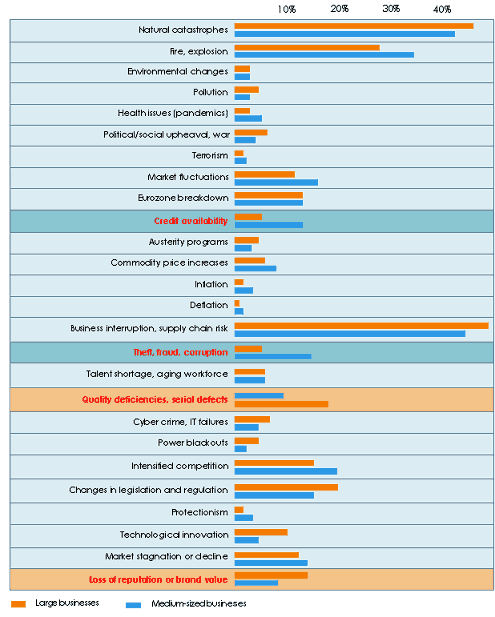

Risk hierarchy per company size

Floods in Louisiana, United States Floods in Louisiana, United States |

Allianz Global Corporate study entitled “risk barometer” is designed to determine risk mapping according to the company’s size, geographical location and line of operation. This project has been achieved thanks to data gathered from risk managers and from the group’s underwriters and consultants. The results ultimately highlighted similarities in risk perception among large-scale enterprises and medium-sized ones.

Risks of business interruption, natural catastrophes, and explosion/fire top the list of the threats sensed by two groups of companies. The perception of the business interruption as a major risk is accounted for by the fact that companies are more and more operating on the just-in-time basis, a management system that allows them to reduce costs, but makes them vulnerable, increasing their interdependence. In such cases, insurers examine the exposure of their clients by studying their logistic risk management and their relationship with their suppliers. The sectors of semiconductors and motor industry are the most exposed to this risk. The 2011 tsunami in Japan, the floods in Thailand in the same year and hurricane Sandy which devastated the east coast of the United States in 2012 proved once again that much work remains to be done in the way insurance companies manage their business interruption risks.

Perception of credit, corruption, fraud, loss of product quality or loss of image risks is proportionate to the size of companies. While small companies are more sensitive to credit, fraud and corruption risks, large companies are more concerned about loss of product quality and loss of image.

Differences between large and medium-sized enterprises

Source: Allianz Global Corporate & Specialty

Source: Allianz Global Corporate & Specialty This table gathers the responses of the companies polled by Allianz Global Corporate & Specialty. The questionnaire was sent to 456 large companies and 387 medium-sized enterprises.

For example, 45% of large companies think that natural catastrophes risk is very important while only 42% of medium-seized enterprises think that this risk is important.

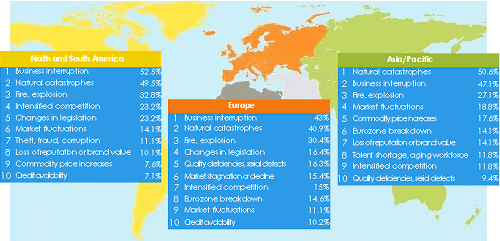

Risk hierarchy per region

Car factory in Japan © Bertel Schmitt, CC BY-SA 3.0 Car factory in Japan © Bertel Schmitt, CC BY-SA 3.0 |

Region-based mapping has highlighted a hierarchy of identical risks despite the persistence of similarities between various world regions.

The three main risks mentioned above, namely those of business interruption, natural catastrophes and explosion/fire top the list followed by generally similar risks within each continent.

However, some specificities remain:

- while the threat of the Eurozone collapse is a stressor in Asia, it is of no influence across the Atlantic.

- the Asia Pacific region regards the lack of qualified personnel as a significant constraining factor.

- in the Americas and Europe, due care is given to risks resulting from changes in legislation and regulation, a constraint that is not considered as such in Asia.

- in 2011, the threat of economic recession was seen as a dominant factor, it is no longer the case in 2013.

Top 10 business risks per region

The above rankings have been elaborated according to the percentage of answers collected from respondents. Source: Allianz Global Corporate & Specialty

The above rankings have been elaborated according to the percentage of answers collected from respondents. Source: Allianz Global Corporate & Specialty Risk hierarchy per activity

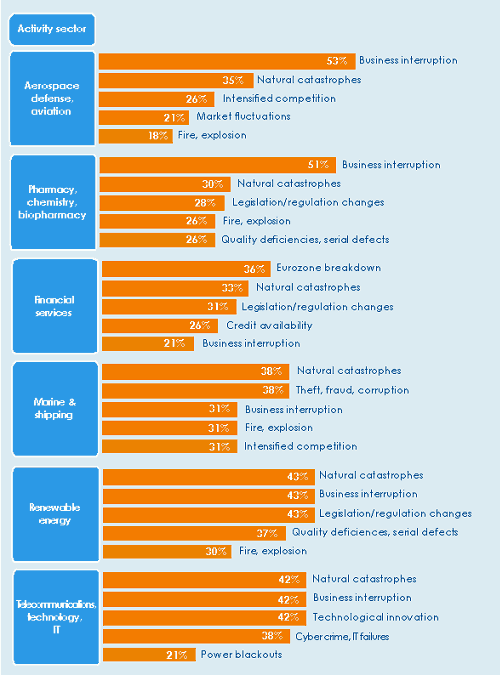

Business line-based analysis does not affect the ranking of the three previous major risks (business interruption, natural catastrophes, explosion/fire), although some exceptions are noted.

Fire and explosion risks are of little importance for service providers (banks, law and accounting firms, etc), telecommunications and IT companies.

The 2005 Buncefield fire in Great-Britain © Robert Stainforth, CC BY-SA 3.0 The 2005 Buncefield fire in Great-Britain © Robert Stainforth, CC BY-SA 3.0 |

In the field of aerospace, defense and aviation, increased competition and market fluctuations are among the major hazards. For companies operating in the chemical business, explosion risk is primordial because of the use of flammable substances.

For financial departments, the collapse of the euro zone comes ahead of the natural catastrophes and changes of regulation risks.

Concerns about the marine activity are multiple. Natural events stand as the main threat on equal footing with fraud, theft and corruption while the business interruption along with fires and explosions come second.

The renewable energies sector gives priority to three risks of similar importance: natural catastrophes, changes in legislation and losses of profit which slightly precede the risks of serial default and quality products.

Top business risks in 2013 per activity

A survey based on a multiple choice questionnaire. Source: Allianz Global Corporate & Specialty

A survey based on a multiple choice questionnaire. Source: Allianz Global Corporate & Specialty The underlying trend in the Euro zone, Middle East and African countries

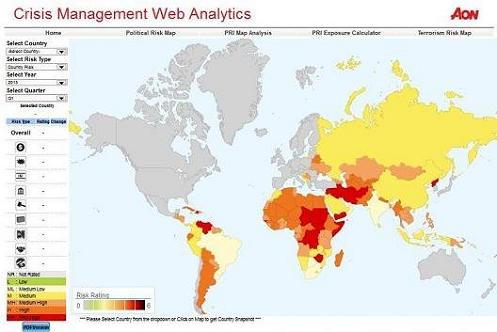

A study conducted by Aon in association with Lloyd's and Roubini Global, a company specializing in the analysis and consultancy, has enabled the development of an interactive risk-mapping tool for 163 countries, designed to visualize the evolution of risk for 15 years. The results of this work are updated every three months. In case of a major event, a daily update is carried out.

Source: www.aon.com/2013politicalriskmap/index.html

Source: www.aon.com/2013politicalriskmap/index.html  Downtown Yaoundé, Cameroon © Touraco.net, CC BY-SA 3.0 Downtown Yaoundé, Cameroon © Touraco.net, CC BY-SA 3.0 |

Thanks to a color game, the map measures the level of political violence, terrorism, currency transfer, debt payment, out-of-stock supply and changes in legislation risks. The map analyzes the vulnerability of the banking sectors, the ability of governments to stimulate local economies and address challenges to trade. Developing countries are scrutinized. An exposure calculator is also available.

The 2013 edition has revealed a change in the rating of 25 countries:

- 13 countries have seen their rating improve: Armenia, Azerbaijan, Bahrain, Barbados, Belarus, United Arab Emirates, Guatemala, Macedonia, Montenegro, Oman, Pakistan, Thailand and Swaziland.

- 12 countries have experienced a decline of their rating: Algeria, Cameroon, Ethiopia, Madagascar, Mali, Moldova, Namibia, Uzbekistan, Panama, Paraguay, Chad and Turkmenistan.

Rating degradation for West-African French-speaking countries and for Algeria is accounted for by an unstable political environment. For some countries, the spread of many weapons in the region and the existence of radical groups have increased political risks.

In the Middle East, countries experiencing political or economic unrest following the Arab Spring wave have seen their situation improve. This is the case of Oman, Bahrain and the United Arab Emirates. For the authors of the study, countries endowed with significant natural resources and stable financial institutions have a higher capacity to withstand political and economic shocks.

In Eastern Europe, the countries which have made efforts to attract investors and organize structural reforms managed to improve their ratings. This is the case of Armenia, Azerbaijan, Belarus, Macedonia and Montenegro. However, the economic problems of Western Europe have worsened Moldova and Uzbekistan’s ratings.