Saham-Sanlam, North-South rapprochement

Sanlam, which detains a 30% share in the capital of Saham Finances since February 2016, rose its shareholding to 46.6% in May 2017, thus finally getting hold in March 2018 of the entire insurance hub of the Moroccan group. The transaction amounted to 1.05 billion USD.

Thanks to this deal, the most important one so far achieved in Africa, Sanlam is having control over a fast-growing group whose turnover in 2017 amounted to 1.2 billion USD.

Saham, alone, is endowed with 68 subsidiaries, including 35 insurance and reinsurance companies, operating in 26 African and Middle eastern countries.

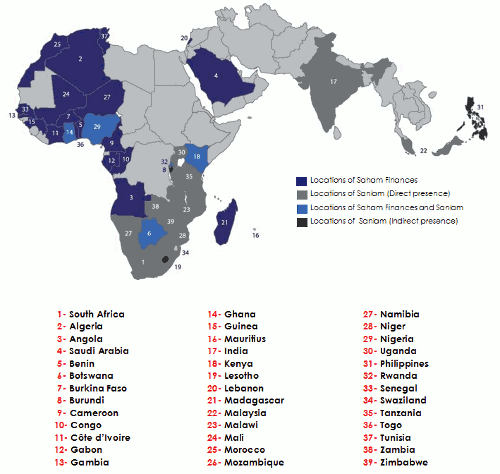

No less than 45 Sanlam companies scattered around five continents, are also to be added to this insurance hub. Following this move, pending approval by the authorities, the group Sanlam/Saham Finances will constitute the biggest African network of insurance and financial services. This set will ensure direct or indirect presence in fifty countries, 39 of which are located in the continent.

Establishment of Saham Finances and Sanlam in Africa and in Asia in 2017

Saham, a quick rise

Set up in 1995 by Moulay Hafid Elalamy, Saham has invested in various businesses among which insurance, assistance, offshoring, education, real estate and health. These activities have mainly extended to Morocco, sub-Saharan Africa and Middle East. The group’s insurance hub, Saham Finances, emerged in 2005 with the acquisition of the company CNIA Assurance. In 2006, Es-Saada, another Moroccan insurance player, joined the new entity. The purchase in 2010 of the Pan African group, Colina, has been a turning point in Saham’s history. This move has paved the way for the group to set foot in sub-Saharan Africa, thus allowing it to be present in 12 new countries. Saham is the first Moroccan insurance group to embark on a large-scale cross-border expansion. Colina’s takeover was just the initial step to be further followed by acquisition moves in Angola, Lebanon, Rwanda, Nigeria and Mauritius. In a short period of time (2010 to 2016), Saham concluded the puzzle, becoming a major insurance player. In 2016, 53% of the premiums came from outside Morocco.

Set up in 1995 by Moulay Hafid Elalamy, Saham has invested in various businesses among which insurance, assistance, offshoring, education, real estate and health. These activities have mainly extended to Morocco, sub-Saharan Africa and Middle East. The group’s insurance hub, Saham Finances, emerged in 2005 with the acquisition of the company CNIA Assurance. In 2006, Es-Saada, another Moroccan insurance player, joined the new entity. The purchase in 2010 of the Pan African group, Colina, has been a turning point in Saham’s history. This move has paved the way for the group to set foot in sub-Saharan Africa, thus allowing it to be present in 12 new countries. Saham is the first Moroccan insurance group to embark on a large-scale cross-border expansion. Colina’s takeover was just the initial step to be further followed by acquisition moves in Angola, Lebanon, Rwanda, Nigeria and Mauritius. In a short period of time (2010 to 2016), Saham concluded the puzzle, becoming a major insurance player. In 2016, 53% of the premiums came from outside Morocco.

The future of Saham Group

According to the group’s officials, the revenues generated from the cession of the insurance division will feed a Pan African investment fund whose operations will focus on: real estate, health, new technologies and education.

The new holding which will be endowed with a sound financial base, is intent on starting its metamorphosis, proceeding to strategic acquisitions in the foreseeable future.

- 2005:Morocco : Acquisition of CNIA Assurance from ARIG (Bahrain)

- 2006:Morocco : Acquisition ofAssurances Es Saada

- 2009:Morocco : Merger between CNIA and Es-Saada, the group is henceforth renamed CNIA-Saada Assurance

- 2010:Africa : Acquisition of Colina group which is present in 12 countries

- 2012:Angola : Acquisition of Global Alliance Seguros Angola Lebanon : Acquisition of LIA Insurance

- 2013:Kenya : Acquisition of Mercantile Insurance Togo : Establishment of Saham Re

- 2014:Nigeria : Acquisition of Unitrust Insurance Rwanda : Acquisition of Corar-AG

- 2015:Nigeria : Entry in Continental Re’s capital

- 2016:Maurice : Acquisition of SUN Insurance Morocco : Cession of 30% of Saham Finances’ capital to Sanlam

- 2017:Morocco : Sanlam raises its shareholding in Saham Finances to 46.6%

- 2018:Morocco : Sale of the entire Saham Finances to Sanlam

Saham Group and Saham Finances : main indicators 2016

| Saham Group | Saham Finances | |

|---|---|---|

2016 turnover | 1.24 billion USD | 1.053 billion USD |

Number of employees | 16 000 | 3 000 |

Presence | 27 countries | 26 countries |

Number of subsidiaries | 103 subsidiaries | 68 subsidiaries, 35 of which insurance companies A network of 700 agencies in Africa |

Activities | Health, estate, education and external service | Insurance, reinsurance, assistance and Third Party Administrator |

Sanlam, a centennial insurer

Sanlam, first insurance group in Africa in terms of market capitalization (16 billion USD), is keen on consolidating its position in the continent.

Founded in 1918 as a life insurance company, the South African group has gradually turned towards the establishment of a financial service company. Sanlam is active at the local, regional and international levels.

As soon as operations started, the founders chose to set up two distinct entities: Sanlam (South African National Life Assurance Company Limited) a company specialized in life insurance and Santam (South African National Trust and Assurance Company Limited) a company dedicated to the non-life activity.

Santam has remained the life company’s major shareholder until 1954, when Sanlam became a life mutual insurance company, thus becoming Santam’s sole shareholder.

Throughout the years, Sanlam has broadened its operational scope. From a conventional life insurance, the group has gradually expanded its operations to a wide range of products and financial services.

Throughout the years, Sanlam has broadened its operational scope. From a conventional life insurance, the group has gradually expanded its operations to a wide range of products and financial services.

In 1998, Sanlam was demutualized, getting the name of “Sanlam Life Insurance Ltd.”, a joint-stock company endowed with share capital. During the same period, “Sanlam Ltd.” saw the light of day. It became the parent company tasked with the control and management of all entities. Four divisions of activities were henceforth operational: Sanlam Personal Finance, Sanlam Emerging Markets, Sanlam Investments and Santam. A fifth division, Sanlam Corporate, was later introduced.

Today, Sanlam is present in more than 15 African countries, in India, Malaysia, the Philippines, United Kingdom, Ireland, United States, Switzerland and Australia.

- 1918:South Africa : Establishment of Sanlam a life insurance group (Suid-Afrikaanse Nasionale Lewens Assuransie Maatskappij Beperk)

- 1928:Namibia : Creation of an office in Namibia (South-West Africa)

- 1935:South Africa : Acquisition of African Homes Trust, renamed Metropolitan Life

- 1954:South Africa : Sanlam becomes a mutual life insurance company and a majority shareholder of Santam

- 1960:South Africa : Establishment of Sankor, a development company

- 1985:South Africa : Launch of Sankorp, a central investment holding

- 1998:South Africa : Sanlam de-mutualizes and gets listed on Johannesburg Stock Exchange

- 2003:England: Acquisition of the life insurer Merchant Investors

- 2004:South Africa : Sanlam sells 10% of its capital to Ubuntu-Botho

- 2005:South Africa : Sanlam acquires the totality of African Life Group

- 2010:Uganda : Creation of a life insurance company

- 2013:Kenya :Takeover of Pan African Insurance Kenya

- 2014:South Africa :Acquisition of 51% of MCIS Zurich Insurance Berhad’s capital Sanlam and Santam join their offices in Johannesburg Ghana :Purchase of 40% of Enterprise Insurance Company (EIC)’s capital India : Acquisition of 49% of the Indian financial services company Shriram Capital Nigeria : Acquisition of 71.2% of Oasis Insurance, a non life insurance company Rwanda : Acquisition of 63% of Soras group

- 2015:Mozambique : Acquisition by Sanlam Emerging Markets (SEM) of 51% of the life insurer Nico Vida Zimbabwe : Acquisition of 40% of the insurer Masawara Investments Mauritius

- 2016:South Africa : Acquisition of 28.7% in Afrocentric Healthcare Assets Proprietary (AHA) Morocco : Acquisition of 30% of Saham Finances

- 2017:South Africa : Sanlam buys 53% of BrightRock Kenya : Partnership between Sanlam Insurance and Stanbic Bank Kenya Ghana : Sanlam Emerging Market (SEM) cedes its interest in three subsidiaries of the Ghanaian holding Enterprise Group to Leapfrog Morocco : Increase of Sanlam's stake in the capital of SAHAM Finances to 46.6% Uganda : Acquisition of Lion Assurance Company by Sanlam Uganda Zimbabwe : Sanlam acquires 40% of the capital of Zimnat for an amount of 11.5 million USD

- 2018:South Africa : Sanlam raises funds worth 5.7 billion ZAR (490 million USD) in order to increase its capital Kenya : Sanlam Kenya consolidates its life and non life activities Morocco : Acquisition of the totality of Saham Finances for the amount of 1.05 billion USD

Saham Finances and Sanlam Group : comparative study

| Saham Finances | Sanlam | |

|---|---|---|

Position | First insurance group in Africa (outside South African groups) | First insurance group in Africa in terms of market capitalization (16 billion USD) |

Date of establishment | 1995 | 1918 |

Presence | 26 countries in Africa and the Middle East | 15 countries in Africa, three in Asia, one in United Kingdom, one in Ireland, one in Australia and one in United States |

Number of companies/ subsidiaries | 65 subsidiaries, 35 of which insurance companies | 45 companies |

Number of employees | 3 000 | 10 700 |

Main business activities | Insurance : life and non life Reinsurance Assistance Third Party Administration | Life insurance, financial engineering, retirement, non life insurance, asset management, risk management, wealth management |

Saham Finances and Sanlam Group : main technical indicators in 2016

| Saham Finances | Sanlam Group | |

|---|---|---|

Turnover / Revenues | 1 200 million USD(1) | 6 352 million USD |

Shareholder's equity | 775.2 million USD | 3 912 million USD |

Capital | 92.186 million USD | 1.6 million USD |

Net result | 47.5 million USD(2) | 775 million USD |

(2) The group’s share net result Sources: Saham Group and Sanlam Group’s 2017 annual report