SCOR, featuring among major players: 2000-2004, The difficult years

Its financial strength, reputation, portfolio diversification, prudent investments have made SCOR a reference group in the world of reinsurance. However, the road to success was not easy. Founded in 1970, the company was having difficulties following a series of losses between 2001 and 2003. SCOR had been creeping through the 2000s, ending up with a thorough overhaul of all its structures. It is this climb to glory that we are depicting in this article.

Read also | SCOR group: 2007-2013, the boom

The difficult years

2001-2003 results

By the early 1990s, SCOR started to conquer the North American market, where it managed to develop a large portfolio, directly or indirectly via Bermuda where it owned a subsidiary, Commercial Risk Partners (CRP). SCOR developed long tail classes of business such as third party liability and workmen’s compensation. The significant deterioration of the US. loss ratio for such classes during the 1997-2001 underwriting years, along with the deterioration of the reinsurance conditions would quickly weigh down the group's results as of 2001.

With 278 million EUR ( 246 million USD) in losses, the 2001 turnover was heavily compromised. The situation worsened in 2002 with a loss of 455 million EUR (477 million USD) as 2003 ended with a negative result of 314 million EUR (394 million USD). The cumulative loss for the three years totaled 1.047 billion EUR (1.117 billion USD), sinking the entire capital established at the beginning of 2002.

Revaluation of reserves

By the end of 2001, the significant revaluation of existing Technical provisions became unavoidable. This revaluation is presented in the second half of 2002 in the «Back on Track» plan.

The main adjustments focused particularly on:

- 141 million EUR (147.8 million USD) for the business conducted by CRP as regards the1999-2000 underwriting operations

- 159 million EUR (166 million USD) for the so-called Program Business in the United States as regards the 1998-2001 underwriting operations

- a 15 million EUR (17.7 million USD) increase for business involving asbestos and pollution

- a 30 million EUR (31.4 million USD) increase for the credit business and operations in the derivative markets.

The decline of ratings

Equity markets, struggling until 2001, crashed after the nine eleven attacks and completely destroying the revenues generated from investments. In addition, a series of losses, including natural catastrophes related ones, asbestos, the credit class of business and the World Trade Center led to SCOR’s misery, pushing it on a downward spiral. In January 2001, the group issued a profit warning, and a second one in October 2002 after the publication of an investment-related loss of 268 million EUR (281 million USD) on September 30, 2002.

The reinsurer is having difficult times. He has not the capital required to honor its obligations. By the end of 2002, its solvency margin is of 44%.

So far rated “A”, SCOR Group was put on negative watch by A.M Best, while S & P downgraded its rating to “A-”. Share prices collapsed. A few months later, AM Best downgraded the company’s rating to “B++” and in May 2003, S&P granted it a “BBB +” rating.

SCOR’s positioning: a 2000-2003 comparative statement

In 2000, in terms of written premiums, the ratio between SCOR and the world's largest reinsurer, Munich Re, was 1 to 9 (when SCOR accepts a dollar Munich Re accepts 9). By December 31, 2012, this ratio went up from 1 to 2.96.

In just over a decade, SCOR has grown three times faster than the world's largest reinsurer.

SCOR’s market positioning during years of crisis

in billions USD

| Gross written premiums | Net results | |||||||

|---|---|---|---|---|---|---|---|---|

| 2000 | 2001 | 2002 | 2003 | 2000 | 2001 | 2002 | 2003 | |

Munich Re | 29.284 | 31.977 | 41.924 | 50.71 | 1.648 | 0.221 | 0.302 | -0.545 |

Swiss Re1 | 13.701 | 15.072 | 20.943 | 24.744 | 1.84 | -0.099 | -0.066 | 1.37 |

Hannover Re | 7.835 | 10.193 | 13.063 | 14.238 | 0.344 | 0.009 | 0.28 | 0.445 |

SCOR | 3.256 | 4.332 | 5.257 | 4.633 | 0.056 | -0.246 | -0.476 | -0.394 |

1 Earned premiums

Recovery policy

Under pressure from shareholders, Denis Kessler was appointed CEO of the group in November 2002, in replacement of Jacques Blondeau who had been in office for eight years.

This change at the head of the company paves the way for a first capital increase of 380 million EUR (398 million USD), a move quickly started before the end of 2002 and designed to maintain customers’ trust. It was soon followed by a second capital injection in 2003. The cumulative amount of these operations amounted to 1.132 billion EUR (1.421 billion USD).

The «Back on Track» and «Moving Forward» recovery plans

The 2002-2004 recovery plan called "Back on Track" was set up upon the arrival of the new strong man of the group, followed by a second three-year plan called "Moving Forward". These successive plans were designed to:

- restore capital base

- maintain customers’ trust

- define an appropriate amount of reserves

- obtain an “A” rating

The reconquest strategy, the «Back on Track» plan: 2002-2004

The new objectives, consisting mainly of a shift in the non-life underwriting and of an increase in life results, were rapidly implemented with an overhaul of certain structures.

Main lines of the «Back on Track» recovery plan

Rethinking the strategy in non-life insurance

Restore profitability by adopting a new strategy for each underwriting unit:

- Underwriting treaties:

- portfolio rebalancing

- increase in European and Pacific Asia business. Reduction of the business volume in USA and Bermuda

- further development of short-term non-proportional treaties

- Objectives set out: net combined ratio below 96%, a return on equity (ROE ) above 10%

- Underwriting large risks:

- concentration of business around the hubs of Paris, New York, London and Hong Kong

- increasing acceptances in key industry sectors with priority to short-term business development

- drastic reduction in the underwriting of third part liability in the United States

- Alternative credit risk transfer:

- Significant reduction in the portfolio. Certain classes of risks are no longer underwritten (credit and bond derivatives in the United States)

Increasing life insurance results

In branches and offices, whose number is reduced, the teams become polyvalent. Efforts are being made to revive the life business and develop sales in this sector.

The following aspects are emphasized:

- the North American, German-speaking, French, Southern European and Benelux markets

- the development of long-term products

- limiting the exposure of health and disability markets

- setting out technical objectives: average annual premium growth over 10%, operating result ratio on net premiums above 3%, ROE above 15%.

Control over underwriting and cost

The tasks of the Chief Financial Officer (CFO) and the Chief Risk Officer (CRO) are expanded. These managers are in charge of exercising better control over underwriting and business management.

The tasks of the Chief Financial Officer (CFO) and the Chief Risk Officer (CRO) are expanded. These managers are in charge of exercising better control over underwriting and business management.

The CFO has to reduce costs for all of the group's activity. The financial managers of each entity are submitted to a double reporting system, under the authority of the CFO and the manager of the concerned entity.

The CRO is henceforth required to take part in the underwriting strategy of treaties and facultative risks. He is also responsible for overseeing technical reserves level.

Redefining tasks in both life and non-life classes of business

A redistribution of duties within the group has been achieved. Life and non-life entities will be focusing on operational dimension. Activities that are not directly related to underwriting and marketing are centralized within the group: calculating reserves, retrocession, internal audit, human resources, IT systems, etc.

Optimizing asset management

The aim is to increase the share of revenues from asset management operations. And to do so, the following measures have been taken:

- strengthening control over ALM (Asset-Liability Management) operations

- restructuring of financial management operations

- cash pooling whose performance is maximized

- monthly meetings for monitoring the company’s financial policy,

Strengthening human resources management

SCOR is endeavoring to reduce the management costs of the entire group. With the anticipated decline in premium income, the top executives are compelled to decrease management costs in order to maintain the company’s competitiveness. This resizing is, according to various scenarios, likely to trigger lower costs of 20 to 41 million EUR (27 to 56 million USD). Savings are projected at the level of payroll and organization of the reinsurer worldwide.

SCOR’s operating costs are higher than those of most reinsurers. By the end of 2004, they were higher than in 2002. The premium-per-employee is lower for the French reinsurer than that of its main competitors. A restructuring plan was designed to shed hundreds of jobs.

The «Moving Forward» plan which takes over the «Back on Track» scheme for the 2004-2007 period, was aimed at reducing costs. In early 2008, the forecast were revised and the management expenses ratio was lowered to 5 % of the premiums.

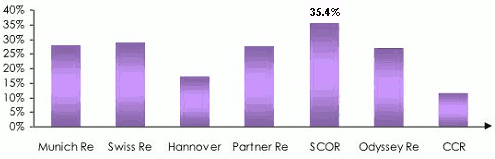

Management and acquisition costs in % of net premiums for the main reinsurers in 2004

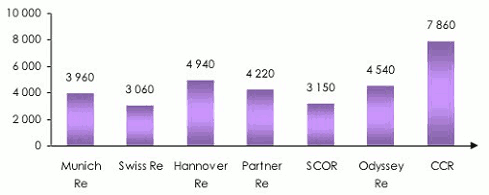

Written premiums per employee in 2004

in thousands USD

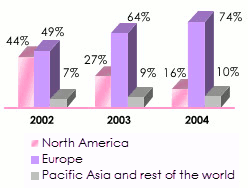

Reducing the scope of activity

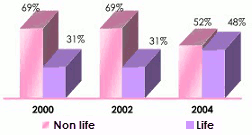

In order to meet solvency requirements, SCOR adopted a strict underwriting policy and reduction of its operations in the United States. Between 2002 and 2004, the volume of collected premiums was divided by two. The non-life portfolio was heavily cut unlike the life portfolio which performed better. In 2002, 30% of business came from life insurance compared to 70% for non-life. In 2005, the non-life sector accounted for only 52% of the total business underwritten. Redeployment was gradually carried out towards the emerging markets endowed with strong potential.

The «Back on Track» assessment

By the end of 2004, the main objectives of the «Back on Track» project were met. Reserves were brought to acceptable levels while capital was reinjected, with the company’s portfolio being reduced and redirected and the group restructured.

«Back on Track» in figures

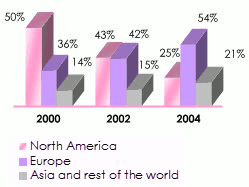

Breakdown of life and non life written premiums: 2000–2004

| Breakdown of life and non life written premiums per geographic area | Geographic breakdown of non life premiums |

|  |

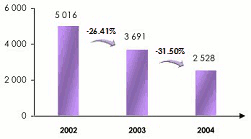

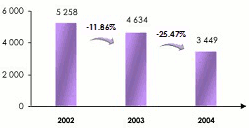

Turnover: 2002-2004

| in millions EUR | in millions USD |

|  |

Consolidation stage: the 2004-2007 «Moving Forward» plan

To consolidate the results achieved, further efforts were exerted. The «Moving Forward» plan was revealed in late 2003, outlining SCOR’s objectives by 2007:

- increasing the turnover, Asia became a priority

- maintaining the underwriting strategy as described in the «Back on Track» plan

- stiffer sales control especially in the United States

- new capital distribution per class of business and per market

- increasing shareholders’ profitability

- developing regional hubs

- improving the group’s rating to “A”

To achieve these objectives, SCOR had to lower its costs and endeavor to stay the course set out by the «Back on Track » plan.

Operating costs

In an effort to bounce back quickly, SCOR had maintained a significant number of employees . The staff cuts made during the adoption of the «Back on Track» scheme turned out to be inadequate which made the target cost ratio set out in the strategic plan «Moving Forward» difficult to achieve by 2007.

In order to get as close to the estimates as possible, a new series of measures was announced including a reduction in overheads from 12% to over 20%, depending on the future level of activity.

The trigger: the “A-“ rating by Standard & Poor's

Despite a drastic decline in premium volume, Standard & Poor's upgraded on August 1, 2005 SCOR’s rating to “A-” .

The 2005 turnover amounted to 2 407 million EUR (2 851 million USD), that is half the one achieved in 2002 (5 016 million EUR or 5 258 million USD).

The group finally reached one of its major objectives: return of the rating to class A, paving the way for a fresh start.

The two successive plans allowed the French reinsurer to pull out of the crisis and to consider acquisitions which were last made in 2001 after the purchase of Sorema (France). In 2006, the last year of the «Moving Forward» plan, the life reinsurer Revios Rückversicherung AG came within the Group’s sphere. It is during this same year that Scor Global Life was established.