SCOR : The build-up race

Chronology of facts

- In January 2007:SCOR buys on the financial markets the bulk of 12 200 000 shares, that is, 8.3% of Converium's capital at the average price of 18.96 Swiss francs. This deal, achieved most certainly thanks to purchases made via various companies more or less linked to SCOR, has gone unnoticed until Friday, February 16.

- On February 16:SCOR acquires an additional bulk of 24.6%, 20% of which from the company Patinex AG belonging to Martin Ebner. Martin Ebner entered Converium's capital in 2004 when the share's value was close to 8 Swiss francs. The SCOR offer enables him to realise a substantial profit three years later.

- In the evening of February 16:SCOR was in possession of 32.9% of Converium's capital, that is a little less than the 33.3% required in Switzerland to trigger a takeover bid.

- On February 26:SCOR publicly announced its takeover bid of Converium as regards the remaining 67.1% shares.

SCOR's offer

© AlfvanBeem, CC0 1.0 © AlfvanBeem, CC0 1.0 |

Initially presented as a friendly bid, SCOR's offer was immediately rejected by Converium. By offering 21.1 Swiss francs per share, SCOR has valued Converium at 1.93 billion euros (2.5 billion USD).

As far as the shareholders are concerned, this offer shall allow a 27% profit in relation to the 4th of January price, the last reference price that is not affected by transactions.

Converium takeover shall be funded at 80% by SCOR shares and at 20% in cash. SCOR shall then proceed to a new capital increase of 400 million euros (525 millions USD), the fifth in four years.

SCOR's strategy

The creation of group of worldwide stature

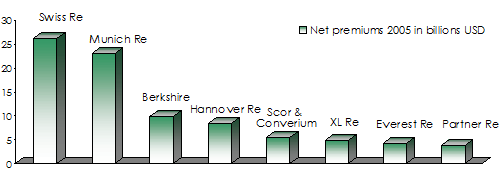

If the rapprochement between SCOR and Converium materializes, it shall give birth to the world's fifth reinsurer.

The geographical balance

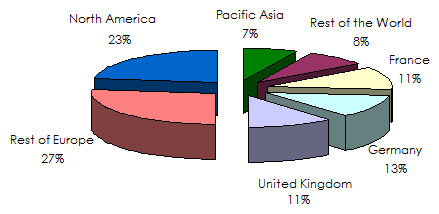

The accrued portfolio (SCOR + Converium) would be geographically better balanced as this set is less exposed to natural disasters particularly in North Europe.

Geographic portfolio break down SCOR + Converium

The USA portfolio would be contained at less than 25%. The two partners seem to be equally cautious on the American market where both companies have sustained considerable losses in the past.

In Europe, the major balance regards the three major markets: Great Britain, Germany and France whose shares are located between 11% and 13%.

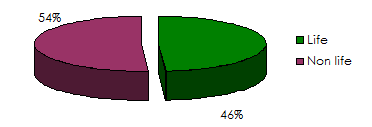

The balance of life and non-life activities

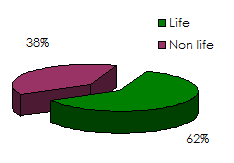

Revios' takeover has made SCOR a predominantly life reinsurer with an overall 62% of premiums in 2006.

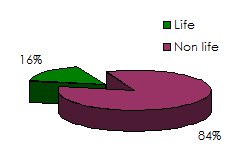

On the opposite, Converium, 84% of whose activities are made in the property and third party liability classes, stands as a suitable non-life reinsurer.

The merger of both companies should give birth to a better balance between non-life (54%) and life (46%) classes of business.

SCOR | Converium |

SCOR & Converium  |

The technical complementarities

According to the plan elaborated by SCOR, each partner is supposed to bring in its expertise in its favourite classes of business. The whole set would stand as a truly multi-class group able to provide a top-level global service to its customers.

| SCOR's specificities | Converium's specificities1 |

|---|---|

|

|

1 According to SCOR's documents

Financial elements

For the shareholders, SCOR's offer targets:

- A return on equity (ROE) of 13%

- A stock market capitalisation of 3.9 billion euros (5.1 billion USD)

- Productivity gains of 38 000 000 euros in 2008 and 65 000 000 euros in 2009 and 2010

- An “A+” rating by 2010

Obstacles to SCOR's strategy

The strategy's lack of visibility

The takeover bid launched on Converium has initiated a new U-turn in SCOR's strategy. With Revios takeover, the French reinsurer has clearly out worded its preference for life reinsurance. By setting its heart on Converium today, SCOR is coming back on the non-life market.

The takeover bid launched on Converium has initiated a new U-turn in SCOR's strategy. With Revios takeover, the French reinsurer has clearly out worded its preference for life reinsurance. By setting its heart on Converium today, SCOR is coming back on the non-life market.

This reluctant positioning and the financial risks in which SCOR is venturing are causing concern in the stock markets and are likely to jeopardise or at least upset takeover operations.

Financial markets

SCOR's takeover bid comes at a time when financial markets are undergoing a clear fallback. Converium's takeover having to be made partly in SCOR shares, the share price of the French reinsurer shall determine Converium's value.

February 26, the day when SCOR's strategy was introduced, the French index, CAC 40, reached a record high level of 5771 points. On this date, SCOR's share amounted to 20.65 euros while Converium's valuation reached 1.885 billion euros (2.47 billion USD).

Between February 26 and March 1, SCOR's share lost 9.1%, that is, almost 4% more than the CAC 40. Converium's valuation was then falling by almost 20% at 1.514 billion euros (1.98 billion USD). This stock market fallback alone cuts by 15% the extra premium initially promised by SCOR to its Converium shareholders.

In view of the recent improvement in Converium rating (A-) by Standard & Poor's, it is no longer certain for the Swiss reinsurer's shareholders to accept the proposed exchange if the rate of SCOR's share does not pick up before the official launch of the takeover bid next April 18.

The rise of SCOR's offer

If upon the opening of the takeover bid SCOR's shares remained at such a low level, the French reinsurer will be compelled to revise its offer upwards even if that meant the downgrading of its Standard & Poor's rating (“A-”).

Consolidation

Taking into account the Swiss legislation, and in order for the takeover bid to fully succeed, it has to allow the buyout of 2/3 of Converium's capital.

If the Swiss reinsurer manages to persuade 1/3 of the shareholders to reject the takeover bid, SCOR shall find itself in a more awkward situation. The expected synergies would be lost or postponed to a later date. The current move will consequently turn out to be disastrous.

Portfolio losses

Portfolio mergers are often behind the significant losses in market shares, a fact that SCOR's strategy seems to underestimate. Redundancies among portfolios shall definitely emerge and some clients will abstain from renewing accrued shares for the sake of their placements diversification.

Staff

The staff merger (1 259 employees at SCOR and 482 at Converium) could trigger the departure of experienced underwriters, dissatisfied with the conditions offered by the new group.

Furthermore, in order to cut down the two reinsurers' already high operational costs, a merger will inevitably result in a profound restructuring.

Limitations to portfolio synergies

In its project, SCOR has highlighted the complementarities between the two groups. No one denies, though, Converium's decline in the highly-coveted classes of business such as aviation, marine, credit and engineering. The BBB+ rating has seriously restricted the Swiss reinsurer's room to manoeuvre, the latter having even retreated from the underwriting of some classes.

In its project, SCOR has highlighted the complementarities between the two groups. No one denies, though, Converium's decline in the highly-coveted classes of business such as aviation, marine, credit and engineering. The BBB+ rating has seriously restricted the Swiss reinsurer's room to manoeuvre, the latter having even retreated from the underwriting of some classes.

SCOR is also likely to review its strategy regarding the diversification in terms of proportional/non-proportional businesses. Its current policy favours proportional treaty underwriting. In case of merger, it will have to decide whether or not it should preserve Converium's specificities in terms of non-proportional treaties.

In addition, the group led by Inga Beale has become an important player in the placement of retrocession covers especially in emerging countries. This business area has been ceded for a long time by SCOR which is apparently not keen on it.

Converium's position

The 2006 figures

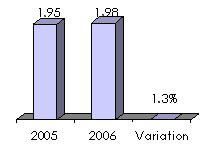

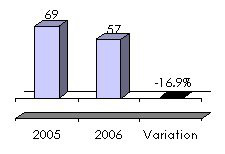

On February 28, 2007, Converium reported its 2006 results.

| Turnover in billion USD  | Net result in million USD  |

The turnover has reached 1.98 billion dollars in 2006, that is, an increase of 1.3% in comparison with 2005. The 57.1 million-dollar net profit is above the group's forecast made before the end of the year (43 million USD). This net profit amounted to 69 million USD in 2005.

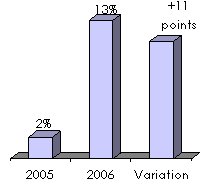

Shareholders' equity profitability  | Combined ratio in % (loss ratio)  |

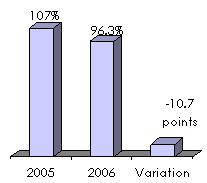

Converium has managed to take full advantage of the market's general upturn to considerably improve its combined ratio reducing it from 107% in 2005 to 96.3% in 2006.

Finally, shareholders' equity profitability has risen from 2% in 2005 to 13% in 2006.

It is therefore on the basis of the 2006 excellent performance and its improved rating (A-) by Standard & Poor's that Coverium's general management has rejected SCOR's takeover bid.

Converium's defensive line

For Converium's leaders, it is only a matter of convincing shareholders to remain loyal to the company. However, a scattered shareholding shall not allow a simple traceability. In Switzerland, only shareholders possessing a minimum of 5% capital are required to come forward.

For Converium's leaders, it is only a matter of convincing shareholders to remain loyal to the company. However, a scattered shareholding shall not allow a simple traceability. In Switzerland, only shareholders possessing a minimum of 5% capital are required to come forward.

In an effort to persuade shareholders to remain loyal to the group, Converium's management has equally unveiled its 2009 strategy. The standard has been set too high despite the entry of reinsurers in a less favourable cycle:

- adoption, as of 2006, of a generous distribution of dividends, doubling them in comparison with 2005.

- 300 million dollars in capital shall be returned to shareholders in order to remunerate the remaining capital up from 25% to 35%.

- increase of the premiums volume at 3 billion dollars, that is, a 50% increase in comparison with 2006.

- a 14% return on equity

SCOR's appetite is ferocious. Following the 2006 acquisition of Revios, the first European life reinsurer, for the sum of 675 million euros, the French group has unveiled its takeover plan of the Swiss reinsurer Converium.

SCOR's appetite is ferocious. Following the 2006 acquisition of Revios, the first European life reinsurer, for the sum of 675 million euros, the French group has unveiled its takeover plan of the Swiss reinsurer Converium.