African reinsurance market has wind in its sails

African insurance: characteristics

Cape Town, South Africa Cape Town, South Africa |

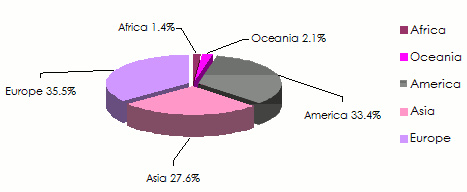

In direct insurance, the premiums written for the entire continent amounted to 68.9 billion USD in 2014. Africa accounts for just 1.4% of the global insurance turnover.

With 49.2 billion USD in premiums, South Africa has a leading position, accounting for 71% of the overall continental underwritings, well ahead of Morocco and Nigeria.

Africa within the global insurance market in 2014

Source: Sigma, Swiss Re

Source: Sigma, Swiss ReThe Main indicators

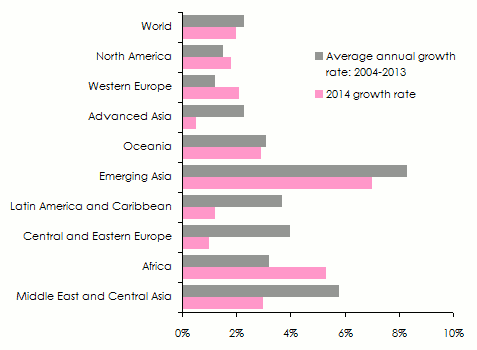

Growth rate

Expressed in dollars, insurance premium growth in Africa has slowed down for life and non life classes of business. According to Sigma, this indicator witnessed a sharp decline in life insurance going from 6% in 2013 down to 1.6% in 2014. Non life insurance reported the same trend, going from 4.4% in 2013 to 1.8% in 2014.

This slowdown is accounted for by a decrease in South Africa's economic activity where life insurance, the cornerstone of the South African market, has posted a growth rate of just 0.9% compared to 6.2% in 2013. Apart from South Africa, growth in the other countries of the continent has been maintained at relatively high levels.

Gross Domestic Product (GDP)

On the economic level, Africa is regarded as one of the most dynamic continents, with a gross domestic product set at roughly 2 trillion USD. According to the forecasts of the rating agency AM Best, this figure is likely to rise to 2.6 trillion USD in 2020.

Since the start of the 2000s, the real GDP has posted an average annual increase of 5% in Africa and 5.6% in sub-Saharan Africa. This rate is well above the one reported for global growth.

Real GDP growth per region

Source: Oxford Economics, WIIW, Swiss Re Economic Reseach & Consulting

Source: Oxford Economics, WIIW, Swiss Re Economic Reseach & ConsultingPenetration rate

Insurance penetration rate in Africa is of 2.8% (0.9% South Africa excluded). It is of 1.85% for the life class of business (0.28% South Africa excluded). As for the non life class, the penetration rate is only of 0.94% (0.65% South Africa excluded).

Only South Africa, Morocco and to a lesser extent Kenya exhibit penetration rates similar to the ones displayed by some developed markets. Insurance demand remains poor in other African countries despite the improvement noted.

In the long run, the proliferation of investments in basic infrastructure, the improvement of GDP and the growth of the middle class should increase the insurance penetration rate: a development asset for the African insurance and reinsurance markets.

According to Sigma, even South Africa which benefits from a very high penetration rate, especially in life insurance (11.4%) can further improve this index through the development of products adapted to some population categories that are deprived of coverage.

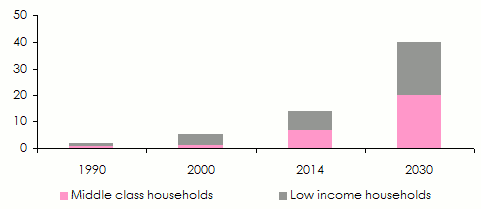

The development of the middle class

While the growth of African GDPs continues at the current pace, the World Bank estimates that most countries on the continent will attain the ”middle income” status by 2025.

A young population

According to an Ernst & Young report, Africa, with a median age of 20 years, is the youngest continent. Its population amounted to 1.138 billion people in 2014 but it is poised to double in the course of the next 40 years to reach nearly 2 billion people, that is 20% of the global population in 2050.

African labor is therefore poised to reach 1.1 billion people by 2040, a figure above labor projections for China and India.A young and a working age population along with a fast urbanization are two ingredients traditionally associated to economic growth and insurance market development.

Evolution of the middle class in Africa

Source: Standard Bank, Understanding Africa’s middle class

Source: Standard Bank, Understanding Africa’s middle classAfrican reinsurance

The growth perspectives of direct market combined with low loss experience have pushed some foreign reinsurers to set foot on the continent. New players, such as Brazilian IRB and Canadian Fairfax, have already acquired stakes in the local reinsurance companies where they are shouldering traditional companies like Scor, Munich Re, Swiss Re,…

Historical background

African reinsurance market is relatively recent. Apart from South Africa, the industry is marked by State volunteerism. The first national reinsurance companies were born after independence, that is, during the 1960s and 1970s.

Back then, only the State was able to mobilize the funds required for the establishment of such companies. Moreover, this move used to be regarded as an act of reconquest of national sovereignty.

The current market

Nearly 35 reinsurance companies are domiciled in Africa, and their number is steadily growing. Privately-owned companies are being established there. African reinsurers, public or private, found themselves competing with major global reinsurance companies which not only have subsidiaries or representation offices established in Africa but also businesses developed there from their head offices.

In terms of turnover, Africa Re is largely dominating the market thanks to its geographical network and to the relocation of its underwriting teams. It is the only one to be endowed with a geographically diversified portfolio. South African reinsurers, subsidiaries of major international groups and state-owned Maghreb reinsurance companies remain concentrated on their respective markets from which they derive most of their resources.

List of African reinsurers: ranking per date of creation

in USD| Company | Country | Date of creation | Class of business | Share capital as at 31/12/2014 |

|---|---|---|---|---|

Swiss Re Life & Health Africa | South Africa | 1950 | Life | 172 380 |

Société Centrale de Réassurance | Morocco | 1960 | Life and non life | 166 382 000 |

General Reinsurance Africa | South Africa | 1966 | Life and non life | 345 000 |

Munich Reinsurance of Africa | South Africa | 1968 | Life and non life | 3 009 000 |

Kenya Re | Kenya | 1970 | Life and non life | 19 651 000 |

Compagnie Centrale de Réassurance | Algeria | 1973 | Non life | 217 360 000 |

Africa Re | Nigeria | 1976 | Life and non life | 293 731 000 |

Tunis Re | Tunisia | 1981 | Life and non life | 51 101 000 |

Hannover Reinsurance Africa | South Africa | 1981 | Non life | 6 273 000 |

Hannover Life Reinsurance Africa | South Africa | 1981 | Life | 9 696 000 |

CICA-Re | Togo | 1981 | Life and non life | 37 037 000 |

Continental Re | Nigeria | 1985 | Life and non life | 28 655 000 |

Sen Re | Senegal | 1988 | Life and non life | 11 353 000 |

Zep Re (ex PTA Re) | Kenya | 1990 | Life and non life | 42 268 000 |

East Africa Re | Kenya | 1993 | Life and non life | 11 230 000 |

Ghana Re | Ghana | 1995 | Life and non life | 11 893 000 |

FBC Re | Zimbabwe | 1995 | Non life | 600 000 |

RGA Reinsurance Company of South Africa | South Africa | 1998 | Life | 4 480 000 |

Tan Re | Tanzania | 2001 | Life and non life | 16 466 000 |

Namibre | Namibia | 2001 | Non life | 1 892 000 |

Aveni Re | Côte d’Ivoire | 2004 | Life and non life | 14 824 000 |

Prima Re | Zambia | 2006 | Non life | 4 726 200 |

Tropical Re | Zimbabwe | 2007 | Non life | - |

Scor Africa | South Africa | 2009 | Life and non life | 12 928 000 |

First Re | Botswana | 2009 | - | - |

Globus Re | Burkina Faso | 2010 | Non life | 4000 000 |

Waica Re | Sierra Leone | 2011 | Non life | 25 000 000 |

SCG Ré | Gabon | 2012 | Life and non life | 9 265 000 |

NCA Re | Côte d’Ivoire | 2012 | Life and non life | 12 727 000 |

Emeritus Reinsurance Company | South Africa | 2012 | Non life | 6 368 000 |

Uganda Re | Uganda | 2013 | Life and non life | 3 553 000 |

GIC Re South Africa Ltd (1) | South Africa | 2014 | Non life | 1 783 000 |

GN Reinsurance Company Limited (GN Re) | Ghana | 2014 | Non life | 25 000 000 |

Mamda Re | Morocco | 2015 | Non life | 111 030 000 |

Ethiopian Reinsurance | Ethiopia | 2015 | - | 50 000 000 |

Capacity

Despite the influx of new investors, the capacities provided by African reinsurers remain inadequate. The shareholder’s equity of existing companies is hardly enough to face the needs of a market where construction and energy risks are mobilizing substantial funds.

Furthermore, the capacities of some African reinsurers of respectable size remain underused outside their national market.

Shortage of qualified staff

Apart from the poor capacities of regional players, the shortage of competent staff in the fields of underwriting and risk management stands as an impediment to the growth of continental reinsurance. Few African companies lead the cession programs of major insurers or quote large risks.

Protectionist measures

In order to protect their national market, many countries limit access to reinsurance for foreign companies. A compulsory cession to the national reinsurer is oftentimes imposed on insurers. Moreover, equally compulsory cessions are added to other reinsurers or entities (specialized pools) in which the State possesses interests. For instance, in Senegal, local insurance companies are required to cede to the national reinsurer a fixed percentage over all policies written nationwide. To this “baseline” or on ground-up basis cession another cession on reinsurance treaties is added. Besides, regional reinsurer CICA-Re and continental reinsurer Africa Re also benefit from compulsory cessions. The same scheme, with some variables (ground up cessions+ reinsurance cession or reinsurance cession only) exists in Ghana, Nigeria, Kenya, Gabon, Algeria, Morocco , Egypt,…

New reinsurance companies

One of the current trends for numerous African countries is to endow the national market with reinsurers that are able to increase local capacities and to spare the country, as much as possible, foreign currency exits abroad.

This kind of pattern is generally advocated and supported by public authorities which oftentimes make new companies benefit from legal cession. That is how in Ghana a third national reinsurer, GN Reinsurance Company, was set up in 2015. As a reminder, Ghanaian insurance companies are not allowed to place their reinsurance on international market unless local capacities have been exhausted.

In Uganda local insurers are required to cede 15% of their treaties to Uganda National Reinsurance (Uganda Re) set up in 2013. In Gabon, the Société Commerciale Gabonaise de Réassurance (SCG-Re) which was established in 2012, benefits from a compulsory cession of 15% of direct insurance policies (excluding health and assistance) and of 10% of the ones pertaining to the life insurance policies (excluding capitalisation).

In Ethiopia, a national reinsurance company, “Ethiopian Re” is about to be established. Endowed with 50 million USD in seed capital, the new company's objective is to increase market capacities.

Alongside these transactions encouraged by public authorities, many other reinsurers have entered the scene. Introduced by the private sector, these new structures are usually endowed with inadequate seed capital. NamibRe (Namibia), a non life insurance company, set up in 2001, has 1.9 million USD in capital, Prima Re started out its operations in 2006 with a capital of 4.7 million USD.

Finally, the national Indian reinsurer, GIC Re, acquired in 2014 the South African Saxum which was renamed GIC Re South Africa. The latter is endowed with a capital of 1.78 million USD.

The new regulations

The international trend is toward the consolidation of the reinsurance industry, considered to be systematic. The new legislative provisions highlight prudential standards that are getting stricter and stricter.

The international trend is toward the consolidation of the reinsurance industry, considered to be systematic. The new legislative provisions highlight prudential standards that are getting stricter and stricter.

Africa is not immune to this regulatory endeavor. The Inter-African Conference on Insurance Market (CIMA) enacted on April 9, 2015 a new provision exclusively dedicated to reinsurance. The regulation spells out the terms for the establishment and operation of reinsurance companies within the CIMA area.

The minimum share capital required for the establishment of a reinsurance company amounts to 16.55 million USD. Everywhere else on the continent, the supervisory authorities are introducing new legislations on a regular basis. In Morocco, the arrival of a second reinsurer, Mamda Re, has pushed the insurance department to publish new prudential rules in October 2015.

Perspectives

The influx of new capacities on a relatively restricted market, apart from South Africa, has triggered more and more exacerbated competition among reinsurers. Moreover, the establishment of major direct African insurance groups such as Sanlam, Saham, NSIA or Jubilee, to which the Anglo-South African Old Mutual and foreign groups Allianz and Axa can be added, has seriously strained African reinsurers. A sizable portion of continental premiums generated by these groups is placed outside Africa.

Some analysts believe that in the long run the current competitive environment is likely to jeopardize growth perspectives of the African reinsurance market. This situation is attributed to the reduced level of business available on the market.

African local reinsurers are, henceforth, required to count on new expansion strategies across their borders. The objective is to strengthen their shareholder’s equity and achieve the critical mass required for the underwriting of more important risks outside their national territory.

Some African reinsurers have already started this cross-border expansion strategy: SCR and Tunis Re set up their branch offices in Abidjan. Continental Re is offering reinsurance services from Tunisia, Nairobi, Abidjan, Gaborone and Douala. CICA-Re has three regional offices in Douala, Abidjan and Tunisia.

Some African reinsurers have already started this cross-border expansion strategy: SCR and Tunis Re set up their branch offices in Abidjan. Continental Re is offering reinsurance services from Tunisia, Nairobi, Abidjan, Gaborone and Douala. CICA-Re has three regional offices in Douala, Abidjan and Tunisia.

In the medium term, the new legislative requirements are going to consolidate the African reinsurance market which, for the time being, remains dominated by five companies: Africa Re (Nigeria), Munich Re Africa (South Africa), SCR (Morocco), Hannover Re Africa (South Africa) and CCR (Algeria). These five companies together underwrite nearly 60% of the reinsurance premiums accounted by the 30 African reinsurers.

It is also worth noting that among the ten top African reinsurers, four have an entirely, partly or semi-public shareholding (Africa Re, SCR, CCR and Kenya Re) whereas the other six are subsidiaries of major international groups (Munich Re, Hannover Re, Hannover Life Re, General Re, Swiss Re and RGA).

Major transactions of cross-border expansion

| Name | Country of origin | Transaction type | Country of residence | Date |

|---|---|---|---|---|

SCOR | France | Opening a representation office | Kenya | July 2015 |

WAICA Re | Sierra Leone | Opening a representation office | Côte d’Ivoire | July 2015 |

Trust Re | Bahrain | Opening a representation office | Morocco | June 2015 |

CICA-Re | Togo | Opening a regional office | Tunisia | May 2015 |

Continental Re | Nigeria | Opening a subsidiary | South Africa | April 2015 |

SCR | Morocco | Opening a representation office | Côte d’Ivoire | February 2015 |

Continental Re | Nigeria | Opening a regional office | Tunisia | April 2014 |

Continental Re | Nigeria | License for a subsidiary | Botswana | July 2014 |

Continental Re | Nigeria | Opening a regional office | Botswana | July 2014 |

Continental Re | Nigeria | Opening a regional office | Tunisia | April 2014 |

Tunis Re | Tunisia | Opening a regional office | Côte d’Ivoire | 2012 |