Special reinsurance, reinsurance in the MENA zone

While some countries like Syria, Iraq or Libya are engulfed in the crisis, others like the Gulf States and Morocco are consolidating their insurance legislative framework, taking full advantage of a starting economic recovery.

According to the generally adopted classification, the MENA zone includes 19 countries: Algeria, Saudi Arabia, Bahrain, Egypt, U.A.E, Iran, Iraq, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Palestine, Qatar, Syria, Turkey, Tunisia and Yemen.

Dubai Financial Center Dubai Financial Center |

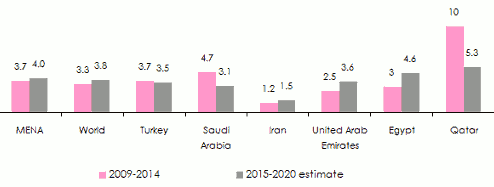

It accounts for a population of 387 million inhabitants. By the end of 2014, the International Monetary Fund estimated the region’s gross domestic product at 3 600 billion USD, that is 5% of the global GDP. For the 2009-2014 period, the average growth of this indicator is set at 3.7% per year for the MENA region compared to 3.3% at the global level.

GDP average growth rate (in %)

Source: IMF, World Economic Outlook, April 2015

Source: IMF, World Economic Outlook, April 2015Insurance market specificities

In 2014, the MENA region, as a whole, posted a gross life and non life premium volume of 51.4 billion USD, compared to 31.9 billion USD in 2009. Turkey, Iran,U.A.E and Saudi Arabia grabbed three quarters (3/4) of this amount. Reinsurance, on its part, accounted for 13 billion USD of non life premiums in 2014, that is 30% of the MENA zone non life insurance premiums and 7% of the global level.

Life and non life premiums of the MENA countries: 2013-2014

in millions USD| 2014 | 2013 | |

|---|---|---|

Algeria | 1597 | 1520 |

Saudi Arabia | 8128 | 6731 |

Bahrain | 743 | 691 |

Egypt | 1968 | 1898 |

United Arab Emirates | 9106 | 8034 |

Iran | 7458 | 6689 |

Iraq | ND | ND |

Jordan | 736 | 694 |

Kuwait | 1007 | 946 |

Lebanon | 1513 | 1417 |

Libya | ND | ND |

Morocco | 3400 | 3180 |

Oman | 1035 | 947 |

Palestine | ND | ND |

Qatar | 2183 | 1994 |

Syria | ND | ND |

Turkey | 11595 | 12460 |

Tunisia | 888 | 860 |

Yemen | 75 | 110 |

Total | 51432 | 48171 |

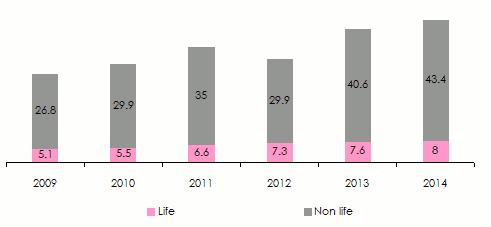

Life and non life premiums’ volume in the MENA region

in billions USD Source: Swiss Re, Sigma

Source: Swiss Re, SigmaSubstantial growth potential

The insurance penetration rate in the MENA region remains poor. With just 1.4% in 2014, it improved less quickly than expected, remaining notably low compared to the high level of per-capita GDP. According to the latest “2015 Reinsurance Barometer”, published by Qatar Financial Center, a lot remains to be done before the level of insurance penetration rate of the region could be brought to that of the other macroeconomic indicators. With regards to reinsurers, this market remains under-exploited but accounts for huge growth potential.

Life insurance accounts for just 15% of the regional market, compared to 55.5% at the global level. It stands as the main factor for insurance development in the region. A young and rapidly-growing population is considered to be a sizable asset in this regard.

The markets of the Middle East, that is Saudi Arabia, theU.A.E, Bahrain, Qatar, Lebanon, Oman, Kuwait, Jordan, and Egypt are undergoing steady growth of their insurance premiums. According to magazine Sigma, underwritings went up from 3.7 billion USD in 2002 to 26.4 billion USD in 2014, a progression of 613% within 12 years. This significant growth of the primary market makes the area attractive for reinsurance companies.

Low loss experience

Apart from growth prospects, the MENA region is benefiting from a low loss experience, which is perceived by reinsurers as an additional asset. Apart from Turkey, Algeria and Iran, this vast region which stretches out over two continents is rarely exposed to large-scale natural catastrophes. A major plus which enables reinsurers to diversify their portfolios without actually covering large risks.

Even if the area is not immune to natural catastrophes triggered by the upsurge of tropical phenomena, the few events such as floods and storms that occur periodically in Oman, Saudi Arabia or in theU.A.E are for the time being easily absorbed by the market.

The highest losses result from accidental events of technical character. Property damage, engineering, marine and energy classes of business are the hardest hit. The fire that broke out in October 2014 in one of the factories of the food industry, “Almarai”, in Jeddah, is regarded as one of the most costly claims with technical nature in recent years even though it amounted to just 790 million SAR (210 million USD).

Reinsurance takes advantage from major infrastructure projects

For the Gulf Cooperation Council States, (GCC), dependence on oil has often been invoked among the factors that, in the past, slowed down long-term growth for the insurance and reinsurance business. The important oil price fluctuations since the 2008 crisis incited GCC States to diversify their investments apart from hydrocarbons and to launch major construction projects.

For A.M. Best, the high level of commercial risks and the recent rise in infrastructure expenditure are henceforth highly coveted assets for reinsurers. The value of the ongoing construction projects in the region amounts to 1.4 trillion USD. The building in Qatar of nine new stadiums designed to host the 2022 soccer world cup is among the major projects noted.

The proliferation of insurance hubs

The establishment of several business centers has accelerated the opening of the market, thus, encouraging both international reinsurers and major brokers to manage their regional underwritings from local offices.

During the recent decade, four hubs have been set up in the MENA region. In 2004, Dubai International Financial Center, (DIFC), started operating. One year later, it was imitated by Qatar Financial Center (QFC) in Doha. In 2013, Abu Dhabi announced the start of its own business center called the “Global Marketplace Abu Dhabi”, (GMAD). Finally in 2014, a new financial hub, “Casablanca Finance City”, (CFC) was set up in Morocco with the objective of conquering African markets.

In March 2015, the opening of a regional office for the Lloyd’s in Dubai International Financial Center triggered an important turning point for the insurance and reinsurance business in the region.

This establishment in Dubai of such a prestigious player like the Lloyd’s has opened the doors to nine major syndicates in the London market: Amlin, Argo Re, Beazley, Catlin, Liberty, Markel, Talbot, Visionary and Watkins.

Several insurers and reinsurers of international renown have today direct presence in the most active markets of the region, such as Qatar,U.A.E and Morocco.

Improved regulations

These attempts of all kinds have pushed local authorities to start regulatory reforms in order to ensure a decent legislative framework and an enabling business environment for both local and foreign players. Many regional countries have recently imposed new legislative provisions and introduced a set of insurance obligations, especially for motor, health and third party liability classes of business.

Challenges facing reinsurers

Reinsurers in the MENA region, especially those in the Gulf States, are faced with several sizable challenges including competition and overcapacity.

Competition weighs heavily on profitability

The number of reinsurance companies in the MENA zone is ever-increasing. Between 2003 and 2010, ten new players set foot on the market, three of which domiciled in theU.A.E. There are now 21 reinsurers having their head office set up in the region. In addition to these local entities, there are reinsurers that underwrite from other zones (Europe, United States, Asia,…), attracting a flow of capacity. According to the "2015 MENA Reinsurance Barometer", the establishment of the Lloyd’s in Dubai is likely to increase substantially the shareholding of western countries in most complex risks: renewable energy, cyber risks, terrorism,…

This high number of operators on a small-size market has given rise to exacerbated competition, additional pressure on tariffs and loss-making technical results during the three recent years.

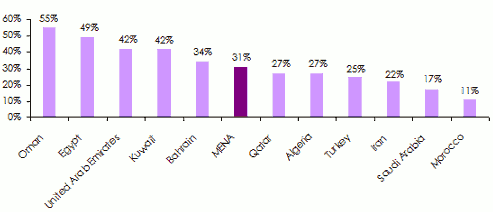

Retention increase

Overcapacity, tariff reduction, the increase in the retention of ceding companies are additional sources of concern for reinsurers. The improvement of shareholder’s equity of direct insurers and merger-acquisition transactions have consolidated the financial foundation of the companies that are in a position to retain more premiums. The reduction of reinsurance cessions is notable, while in 2004, 50% of direct non life premiums were ceded to reinsurers, the cession rate was only of 31% in 2014, that is a loss of about 20 points in 10 years.

Moreover, some countries of the zone are implementing a protectionist reinsurance policy, increasing retention of the market and dwindling the available premiums to international reinsurers.

The rise in retention also reflects a change in the structure of the insured portfolios. Health and motor insurance have become major components of the market. The former generating little or no reinsurance while the latter is ceded in non-proportional reinsurance at low premium rates. For instance, the health risk accounted for 51.5% of the overall underwritings of the Saudi market in 2014.

Percentage of premiums ceded to reinsurance in 2014

Source: 2015 Reinsurance Barometer, Qatar Financial Center

Source: 2015 Reinsurance Barometer, Qatar Financial Center Renewal under pressure

With the situation remaining fundamentally unchanged during the recent 12 months, reinsurers will always be on the defensive during the upcoming 1 st of January 2016 treaty renewal. The pressure on the terms and conditions will remain quite high. There is an abundance of capacity for little premium. This situation will inevitably serve the interest of insurers. With the exception of some segments and markets affected by losses, premium rates are poised to undergo a decline.

Market players

The market is characterized by the presence of two categories of operators: reinsurers said to be traditional, that is, those who have been present in the area for more than 20 years and the new entrants. The poor results have pushed some traditional reinsurers to quit the region or cut down their operations there. This slowdown has been largely offset by the new comers whose number has been steadily growing with the establishment of new hubs.

Traditional reinsurers, including in the first place national reinsurers Milli Re, SCR Casablanca, Bimeh Markazi, CCR Algiers, Kuwait Re, Tunis Re, etc benefit from State support. Their establishment, encouraged by public authorities, meets a clear objective; retaining maximum premium on the local market. It is among this category that the best combined ratios of the region are found.

In addition to these national reinsurers, there are major reinsurance companies such as Munich Re, Swiss Re, Hannover Re and SCOR.

The new comers are mainly detained by local, regional, or foreign private investors. These companies set up since the 2000s have often benefited from the support and expertise of the foreign partners. Takaful Re, Saudi Re and Qatar Re are in the forefront of this category.

The reinsurers of the MENA region(1)

| Traditional reinsurers | ||

|---|---|---|

| Date of creation | Reinsurer | Country |

| 1929 | Milli Re | Turkey |

| 1960 | SCR | Morocco |

| 1971 | Bimeh Markazi | Iran |

| 1972 | Kuwait Re | Kuwait |

| 1972 | Arab Re | Lebanon |

| 1973 | CCR | Algeria |

| 1974 | Arab Union Re | Syria |

| 1980 | ARIG | Bahrain |

| 1981 | Tunis Re | Tunisia |

| 1989 | Trust Re | Bahrain |

| New entrants | ||

| Date of creation | Reinsurer | Country |

| 2003 | Amin Re | Iran |

| 2005 | Takaful Re | U.A.E |

| 2006 | Hannover ReTakaful | Bahrain |

| 2008 | Saudi Re | Saudi Arabia |

| 2008 | Emirates Re | U.A.E |

| 2008 | Gulf Re | U.A.E |

| 2008 | ACR ReTakaful | Bahrain |

| 2009 | Qatar Re | Qatar |

| 2009 | Oman Re | Oman |

| 2010 | Iranian Re | Iran |

| 2015 | Mamda Re | Morocco |

The technical performance

Solidly founded and relying on a stable local market, traditional reinsurers are exhibiting better technical performance than the new comers. On the average period of the five recent years, CCR Algiers reported a loss ratio of 44% followed by SCR with 57%. For the same period and for the same reinsurers, the combined ratio is of 75% for the first and 88% for the second.

In terms of combined ratio (the average value over the recent five years), only three reinsurers among the 13 are under the threshold of 100%. To the first reinsurers mentioned, we add Trust Re with a combined ratio of 94%. It is ACR Retakaful (Bahrain) that exhibited the highest combined ratio of 133%.

Evolution of loss ratios and combined ratios of non life reinsurance

| Loss ratio | Combined ratio | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Company | Country | 2012 | 2013 | 2014 | The last 5-year average | 2012 | 2013 | 2014 | The last 5-year average | ||

Qatar Re | Qatar | 87% | 82% | 84% | 82% | 114% | 111% | 103% | 106% | ||

Trust Re | Bahrain | 66% | 64% | 67% | 66% | 95% | 95% | 97% | 94% | ||

Milli Re | Turkey | 70% | 79% | 83% | 84% | 99% | 113% | 116% | 108% | ||

ARIG | Bahrain | 59% | 63% | 67% | 65% | 97% | 99% | 104% | 102% | ||

CCR | Algeria | 47% | 47% | 40% | 44% | 78% | 76% | 72% | 75% | ||

SCR | Morocco | 50% | 28% | 77% | 57% | 84% | 67% | 90% | 88% | ||

Saudi Re | Saudi Arabia | 59% | 119% | 75% | 87% | 84% | 154% | 109% | 120% | ||

Kuwait Re | Kuwait | 68% | 70% | 68% | 71% | 94% | 97% | 106% | 101% | ||

Arab Re | Lebanon | 65% | 72% | 78% | 71% | 97% | 105% | 113% | 104% | ||

Emirates Re | U.A.E | 59% | 62% | 65% | 67% | 96% | 98% | 92% | 100% | ||

Gulf Re | U.A.E | 72% | 86% | 128% | 83% | 104% | 121% | 258% | 125% | ||

Tunis Re | Tunisia | 55% | 50% | 58% | 57% | 100% | 98% | 100% | 100% | ||

ACR ReTakaful | Bahrain | 77% | 28% | 21% | 90% | 178% | 177% | 39% | 133% | ||

Average | 64% | 66% | 72% | 71% | 96% | 100% | 103% | 101% | |||

Low loss experience, improved legislative framework, booming urbanization, infrastructure development and the presence of major groups are equally enabling factors for reinsurers in the MENA zone. These upsides are unfortunately counter-balanced by overcapacity, stiff competition, lack of tariff discipline, rising retentions, and most importantly by the lack of visibility of insurance and reinsurance companies.