Swiss Re: history of the Swiss reinsurance company

In 1861, the city of Glarus, south of Zurich, was ravaged by a terrible blaze. That tragic event unveiled Swiss insurance shortcomings, with the insured being poorly indemnified despite previously signed arrangements.

From the outset to 1900: Laborious start of Swiss Re

On the initiative of M.J. Crossmann, Chief Executive of Helvetia Assurances Incendie and that of Helvetia Assurances Marine based in St-Gall, a pool of companies would act in order to address such disasters.

On the initiative of M.J. Crossmann, Chief Executive of Helvetia Assurances Incendie and that of Helvetia Assurances Marine based in St-Gall, a pool of companies would act in order to address such disasters.

On December 19, 1863, Helvetia Assurances, Crédit Suisse of Zurich and the Basler Handelsbank of Basel established the Schweizerische Ruckversicherungs-Geselleschaft in Zurich with a capital of 6 million Swiss francs (3.7 million USD), 15% of which is paid up. This initiative is so popular that 20% of the insurance premiums have so far been picked up by foreign reinsurers.

Corporate statutes, therefore, enabled it to underwrite marine, fire, and life classes of business, with private or state-owned, Swiss or foreign insurers.

It was in a two-room flat that the company started off. The first marine and fire treaties were signed respectively on January 1, 1864 and May 1, 1864 with the company Helvetia Général and the Helvetia Incendie of St-Gall.

It was in a two-room flat that the company started off. The first marine and fire treaties were signed respectively on January 1, 1864 and May 1, 1864 with the company Helvetia Général and the Helvetia Incendie of St-Gall.

The company was successful and managed to clinch numerous deals. Nevertheless, the first annual report displays extreme caution as regards underwriting. Despite the strict regulations it imposed, the company would end up its first financial year with major losses accounted for mainly by the fire claims.

The business environment is extremely competitive among Swiss insurers resulting in low rates on the market. Unable to cope with the losses of the company he had been running, George Schmidt, Chief Executive, committed suicide.

The first life treaty was concluded on June 1, 1865 with Basle Life. Swiss Re, then, had a total of ten staff members.

At the end of the 19th century, new risks emerged giving birth to new covers. Thanks to growing profits, the company manages to extend the range of its operations to other classes of business. In 1881, the first reinsurance accident treaty was signed with Cologne Accident.

In light of its growing activities, Swiss Re raises its capital to 8 million Swiss Francs (5 million USD) and reports a hundred employees. It manages 473 treaties in 25 different currencies in 1990, versus 84 treaties in 8 currencies in 1864.

1900-1915: First developments of Swiss Re and the first major claims

The advent of the automobile marked the beginning of the 20th century. Swiss Re underwrites its first motor third party liability contracts in 1901. Business development gives birth to the first engineering deals in 1904. Thanks to its expanding activities, the companies' exposure has multiplied in numerous regions.

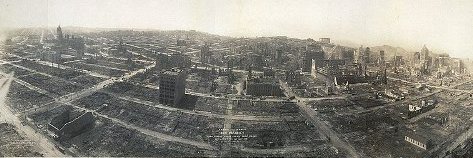

The first major claim the company had to face was the April 4, 1906 San Francisco earthquake which amounted to 4.3 million Swiss francs, (2.69 million USD), that is, more than 43% of the company's capital. As the previous years were lucrative, Swiss Re was hardly affected.

After this disaster, the company shall be working with its peers on the elaboration of the standard wordings so as to avoid the lengthy judicial procedures.

As of 1910, under the pressure of the national supervising authority and for reasons of fiscal policy, branches started to see the light of day. The very first one under the name of Swiss Re was set up in the United States. It is dedicated to fire reinsurance.

In April, 1912, the Swiss reinsurer suffers the second major claim following the tragedy of the Titanic. Nonetheless, it manages to celebrate its 50th anniversary the year after in merrier moods and with the reputation of a growing multi-national company with more than 200 employees, having branches and subsidiaries and investing in both the United States and Great Britain.

In 1915, the company's head office was transferred to Mythenquai in Zurich, opposite to the lake.

Swiss Re between 1915 and 1939: The birth of a leader

On the eve of the First World War, 20% of the company's premiums originated from Switzerland. But war did not stop Swiss Re's expansion. Thanks to its sound financial base and to the good performance of the Swiss franc, the holding acquired in 1916 a strategic and major stake in the British reinsurer Mercantile & General Insurance Company, leader in Great Britain and first-scale international player. Separation occurred only in 1968.

On the eve of the First World War, 20% of the company's premiums originated from Switzerland. But war did not stop Swiss Re's expansion. Thanks to its sound financial base and to the good performance of the Swiss franc, the holding acquired in 1916 a strategic and major stake in the British reinsurer Mercantile & General Insurance Company, leader in Great Britain and first-scale international player. Separation occurred only in 1968.

In 1917, its capital rose to 20 million Swiss francs (12.5 million USD), and in 1918, due to reasons of legal provisions, it established in the United States, the Reinsurance Company Zurich (renamed General Re in 1924 and then European General Re in 1929).

The 1920s enabled air transportation to evolve beyond all expectations. In 1924, Swiss Re decided, then, to cover aircraft hull risks. The reinsurer was, then, present in 11 European countries, owned shares in 31 groups and set up the life North American Reinsurance Company which would quickly become the leading American insurer in this field. But the 1929 crisis badly hurt the company which sustained heavy losses. A few months earlier, its capital was, nonetheless, posted at 50 million Swiss francs (31.3 million USD).

In 1938, Swiss Re was the world's first reinsurer with premiums amounting to 297 million Swiss francs (186 million USD) generated by 546 clients, and with over 400 staff members operating in it. In the same year, Neue Holding AG, which would be baptised Schweizer Ruck Holding AG in 1970, was founded including all the group's activities in Germany.

1939-1959: An overall growth of Swiss Re

After the First World War, Swiss Re was better prepared when the second one broke out. Nonetheless, depreciation and the economic downturn affected the premium incomes which went down. Restrictions on foreign insurers operating on the American territory obliged Swiss Re to reorganise its branches already established there.

In Germany, thanks to the acquisition of Bayerische Ruckversicherung AG in Munich in 1911, Swiss Re gets hold of the German market which was banned to foreign insurers during the big war.

As of 1943, the group, however, benefited from Switzerland's impartiality. As a result, very few contracts were lost outside East Europe by the company which was gradually getting back to business as usual.

In 1946, its relationship with the Eastern European customers started deteriorating while the emergence of new countries in Asia and Africa reshaped the trend of business ties. Such upheaval required a new strategy.

Therefore, a new development policy has emerged. It would lead to the development of the company's presence abroad: Insurance and reinsurance network enhancement in Western Germany as of 1948, the launching in 1950 of the Swiss-South African Reinsurance Company in Johannesburg, followed by Australia in 1955, Hong Kong in 1956 and Toronto in 1959. For the first time the turnover climbs above one billion Swiss francs (627 million USD) in 1959.

1960-1980: Consolidation of Swiss Re's assets

The group's underwriters have always been keen on new risks and Swiss Re has always been there to take full advantage of it. The requirements of modern life resulting in the growing need of diversified covers stand as a challenge for the reinsurer who regards the fact as a window of opportunities, especially when it comes to the development of the life class of business.

The group's underwriters have always been keen on new risks and Swiss Re has always been there to take full advantage of it. The requirements of modern life resulting in the growing need of diversified covers stand as a challenge for the reinsurer who regards the fact as a window of opportunities, especially when it comes to the development of the life class of business.

Its growing diversity, its experience at the international level in all business fields incite the group to establish the Swiss Re Academy, an insurance training body dedicated in the first place to the company's clients and still operational today.

Ever since, training, the various technical publications along with the multiple schemes of collaboration with a wide range of specialized entities have reinforced the company's brand image which it has always diffuse on the market. In 1968, the review Sigma, specializing in analysis, insurance technique and information was launched. It would contribute considerably to the reinsurer's renown. Throughout the years, this review would become a reference for the market.

Three years later, the company celebrated its hundredth anniversary. Henceforth, it shall be dealing with a 1000 clients scattered around 75 countries, posting a turnover of 1.4 billion Swiss francs (900 million USD) and employing 500 staff members. To mark the event, a logo was created to be replaced only in 1995 by the new one.

In 1964, the company underwent some restructuring giving up the per-class of business pattern of organisation for the benefit of the market approach. The geographical territorial division was adopted for the sake of better business management.

In 1970, the London contact office got extended to become a full-fledged branch underwriting all classes of business starting from 1975.

In 1970, the London contact office got extended to become a full-fledged branch underwriting all classes of business starting from 1975.

By the end of the 1970s, the company also manages to consolidate its presence abroad. It is, indeed, represented in all continents through branches or contact offices. 90% of premiums are generated from foreign operations, with the United States and Germany as main markets. Particular attention has, so far, been granted to the activity of direct insurance and the number of employees has doubled in the last twenty years reaching 900.

Swiss Re between 1980 and 2006: Strategic choices, external growth and focus on core reinsurance business

The start of the 1980s marked the beginning of a new era for the company. The latter is more and more directed towards related services deemed indispensable for stronger ties with clients. Swiss Re, therefore, invests and develops its capacity to assess, analyse and manage risks and claims by training and coaching specialists in all fields of insurance and reinsurance.

New establishments and insurance and reinsurance companies' takeovers have progressed throughout the 1980s and 1990s, especially in 1992 in Estonia, where, for the first time, it had business in the Baltic countries. Consolidating direct insurance remains a crucial priority for the company while most significant acquisitions are made in Germany and in the United States as regards life and non-life classes of business.

In 1994, the reinsurer's strategy takes a U-turn. The company's leaders, including the newly-arrived board of directors' chairman, Ulrich Bremi, estimates that it is wiser for Swiss Re to focus its activities on the company's original craft. So, the company parts way with most of its direct insurance operations.

In 1994, the reinsurer's strategy takes a U-turn. The company's leaders, including the newly-arrived board of directors' chairman, Ulrich Bremi, estimates that it is wiser for Swiss Re to focus its activities on the company's original craft. So, the company parts way with most of its direct insurance operations.

The Holding Vereinte, Magdeburger, Lloyd Adriatico, Trieste and Alvia Group are ceded to Allianz. Winterthur retakes Schweiz Seguros, Barcelona, Schweiz Italia and Equitavita Group.

One year later, a 53% increase of the premiums collection consolidates the group's new strategy while a special effort for acquisitions has been agreed so as to enter the life market.

On January 1, 1997, B. Kielholz becomes Chief Executive Officer succeeding to Lukas Muhlemann. He also becomes member of the board of directors. He decides to strengthen the reinsurer's position in the life and health classes of business by purchasing Mercantile & General whose head office is in London. The acquisition of this group of 1300 employees spread out over 27 branches throughout the world has boosted Swiss Re as the world's number one in life reinsurance.

Since the mid 1990s, consistent external growth moves have been adopted throughout the world and were designed to fulfil two objectives: proximity to clients and specialisation in peak fields, namely capital and risk management, which prompted the group toward financial reinsurance activities. As a matter of fact, Swiss Re proceeded to several acquisitions of this kind.

The group's willingness to underwrite deals with the main European markets from local or regional branches has been reaffirmed: Swiss Re Italia was established following the purchase of the reinsurer Unione Italiana di Riassicurazione in 1977.

Swiss Re's German entity Bayerische Réassurance AG was baptised Swiss Re Germany following its full integration into the Swiss group in 2001. It carried out underwritings on the German, Austrian, Scandinavian and East European markets. Madrid, Paris and London, obviously, stand among the major European bases. Only the Swiss, Belgian, Luxembourgian, (non-life) Dutch, Greek, Cypriote, Maltese, (non-life) Israeli and Maghreb markets may be underwritten from Zurich.

Similarly, the strategic areas of America and Asia, where a number of branches are operational, fall within the responsibility of the main offices of Armonk (New York's outskirts), Mexico and Hong Kong.

Similarly, the strategic areas of America and Asia, where a number of branches are operational, fall within the responsibility of the main offices of Armonk (New York's outskirts), Mexico and Hong Kong.

Africa has remained for fifty years Johannesburg's and Cape Town's field of establishments while the official opening of representations in China in 2003 and Japan in 2004 are counted among the most recent ones. In total, Swiss Re is represented by 79 entities over more than 30 countries.

During the start of the 2000s, the group improved its operational structure, so far divided into departments (regions, specialities), by creating as of 2001 three poles of management.

Apart from the traditional Life-health and Non-life poles, a third pole, Finance, has been added. It was only in 2005 when Swiss Re, coming out of a restructuring plan required by its strategic objectives, managed to take the shape that characterizes it today. Ever since, its organisation has turned on products, clients, financial markets & services. A global pole is entrusted with the simultaneous management of the entire structure's efficiency and transparency. This type of organisation resulted from the acquisition at the end of 2005 of GE Insurance Solution, the world's fifth reinsurer.

Swiss Re in 2007

The takeover of GE Insurance Solution boosted Swiss Re at the top of reinsurance companies in terms of premiums with a 2007 collection of 31.7 billion Swiss francs (20 billion USD), broken down into 45% for Life and 55% for Non-Life.

The profits posted for the same period amount to 4.2 billion Swiss francs (2.6 billion USD) for shareholders' equity amounting today to 31.9 billion Swiss francs (20 billion USD) while its S&P rating is AA-, behind that of Berkshire Hathaway (AAA).

Finally, by December 31, 2007, Swiss Re has made business deals with 160 countries throughout 79 representations (offices, branches, subsidiaries). The number of its staff members is 11 702.

Read also | Swiss Re today

Major dates

- 2005:Acquisition of GE Insurance Solution (United States)

- 2004:Representation in Japan

- 2003:First representation in China

- 1997:Acquisition of Unione Italiana Di Riassicurazione (Italia)

- 1997:Acquisition of Merchantile & General (England)

- 1968:Creation of the review Sigma

- 1950:Creation of Swiss-South African Reinsurance Company in Johannesburg (South Africa)

- 1929:World economic crisis

- 1916:Majority stakeholder in Merchantile & General (England)

- 1915:Moving the company to its new head office in Mythenquai, Zurich

- April 1912:Wreck of the Titanic

- 1911:Acquisition of the Bayerische Rückversicherung in Munich (Germany)

- April 14, 1906:San Francisco earthquake

- 1904:Underwriting the first engineering deals

- 1901:Underwriting the first motor third party liability contracts

- January 1, 1864:Acceptance of the first reinsurance treaty

- December 19, 1863:Establishment of Swiss Re in Zurich