The Bahraini insurance market

Insurance market features

- Regulatory authority: Central Bank of Bahrain

- Premiums (2006): 307.9 million USD

- Insurance density (2006): 441 USD

- Penetration rate (2006): 1.8%

Market structure in 2006

- National companies: 10

- Foreign companies: 9

Identity

- Area: 665 Km2

- Population (2006): 698 585 inhabitants

- GDP (2006 est.): 17.03 billion USD

- GDP per capita (2006 est.): 24 377 USD

- GDP growth rate (2006): 7.8 %

- Inflation rate (2006 est.): 3.5 %

- Main economic sectors: aluminium, ship mending, services and tourism

Main cities

(by number of inhabitants)

- Al Manama (capital): 150 000

- Al-Muharrak: 75 000

- Al-Rifaa: 50 000

- Jidhafs: 44 750

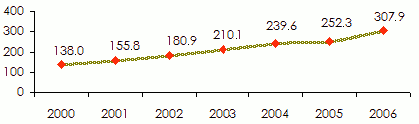

Turnover evolution: 2001-2006

in millions USD| Gross premiums | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2006/05 growth rate |

|---|---|---|---|---|---|---|---|---|

Non life | 102.9 | 120.0 | 142.8 | 168 | 190.1 | 208.2 | 243.2 | +22% |

Life | 35.1 | 35.8 | 38.1 | 42.1 | 49.4 | 44.1 | 64.7 | |

Total | 138 | 155.8 | 180.9 | 210.1 | 239.5 | 252.3 | 307.9 |

Premiums split by class of business: 2001-2006

in millions USD| Classes | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

|---|---|---|---|---|---|---|---|

| Non life | |||||||

Motor | 55 | 61 | 68.3 | 81 | 90.4 | 98 | 111 |

Property & misc. accident | 40.9 | 47.9 | 62.5 | 73.8 | 84 | 94.6 | 113.4 |

Marine | 7 | 11.1 | 12 | 13.2 | 15.7 | 15.6 | 18.8 |

Non life total | 102.9 | 120 | 142.8 | 168 | 190.1 | 208.2 | 243.2 |

| Life | |||||||

Life | 35.1 | 35.8 | 38.1 | 42.1 | 49.4 | 44.1 | 64.7 |

Grand total | 138 | 155.8 | 180.9 | 210.1 | 239.5 | 252.3 | 307.9 |

Turnover split by company: 2001-2006

in thousands USD| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|

| National companies | ||||||

Gulf Union Ins. & Reins. Co. | 20 456 | 23 134 | 27 444 | 26 664 | 25 120 | 101 280 |

Bahrain National Holding1 | 29 058 | 44 480 | 50 736 | 60 618 | 62 915 | 74 145 |

Bahrain Kuwait Ins.Co. | 17 544 | 22 038 | 25 933 | 24 747 | 29 876 | 71 240 |

Al-Ahlia Insurance Company | 9 907 | 13 406 | 14 643 | 17 956 | 18 903 | 23 970 |

Solidarity Insurance Company | NA | NA | NA | 909 | 6 996 | 18 540 |

Takaful International Ins.Co. | 5 036 | 9 666 | 10 963 | 13 580 | 13 791 | 15 250 |

United Insurance Company | 6 036 | 6 690 | 7 841 | 9 128 | 10 269 | NA |

Norwich Union Ins. (Gulf) Co2 | 17 268 | 8 946 | 10 296 | 11 984 | - | - |

Mediterranean & Gulf Ins.& Re | NA | NA | NA | 4 066 | 7 031 | NA |

| Foreign companies | ||||||

American Life Insurance Company | 15 196 | 16 524 | 17 605 | 19 895 | 20 032 | NA |

New India Insurance Company | 3 906 | 5 559 | 6 916 | 7 318 | 7 730 | NA |

Arabia Insurance Company | 2 930 | 3 203 | 3 244 | 3 090 | 3 110 | NA |

Iran Insurance Company | 3 526 | 4 288 | 4 911 | 4 970 | 4 490 | NA |

Northern Assurance Co. | 3 276 | 2 969 | 3 465 | 3 728 | NA | NA |

AXA Insurance Company(Gulf) | 1 369 | 649 | NA | 11 984 | 13 730 | NA |

Al-Nisr Insurance Co. | 1 018 | 1 551 | 2 287 | 2 414 | 2 422 | NA |

Royal & Sun Alliance Ins. PLC | 1 231 | NA | NA | 3 728 | 5 742 | NA |

Zurich International Life Ltd. | 18 039 | 17 875 | 23 777 | 28 467 | 17 531 | NA |

New Hampshire Ins. Co. | NA | NA | NA | NA | 2 589 | NA |

Total | 155 796 | 180 978 | 210 061 | 239 533 | 252 277 | 307 900 |

Insurance Co. 2 Merger with AXA Gulf in 2004NA: Non available

Exchange rate BHD/USD as at 31/12 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

2.659 | 2.659 | 2.66 | 2.659 | 2.659 | 2.658 | 2.657 |

0

Your rating: None

Thu, 16/05/2013 - 12:01

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news