The Chinese insurance market: A rising dragon

In this country of old civilisation regulated by a centralized power, the traditional family laws are at the core of the economic system. The capitalist concept of risk sharing is hard to adapt and sell, and insurance operations are not easily integrated in this pattern of collectivist culture.

This explains why, since the opening of the sector ten years ago, the basic problem faced by foreign insurers is attendant rather upon the nature of the Chinese society than on the regulatory barriers. For the time being, setting one's foot on this deposit and banking on the long-term basis should be the priority. All foreign investors admit that the road to expansion is arduous and that the slightest mistake could be fatal.

The Chinese insurance market : the existing features

A market dominated by state-owned companies

Bank of China Headquarters - Beijing © Yoshi Canopus, CC BY 3.0 Bank of China Headquarters - Beijing © Yoshi Canopus, CC BY 3.0 |

While the insurance market is a promising one, it remains nonetheless problematic. Indeed, it is dominated by the state- owned companies endowed with massive distribution potentials.

Town-by-town license granting

Despite the opening process implemented as of 1992 and the country's affiliation in the World Trade Organisation in 2001, foreign investors' participation in China remains limited. Regulatory restrictions are still stiff especially those pertaining to the level of foreign shareholding and to the per-town license granting principle.

A market characterized by vast regional disparities

According to a recent survey, the development of the insurance business remains below that of the national economy where it accounts for a poor proportion. Marked by a region-based disparate level, the insurance market in China is still at its infancy stage.

The structural shortcomings of the Chinese insurance market

Despite the outstanding progress, the insurance sector remains well below the market's enormous potential. One of the major causes behind this weakness is the imperfection of the market system.

- The reforms of public corporate being inadequate, structural problems and the failures in technical mechanisms have not yet been fully resolved.

- The notion of risk remains inadequate in the business. Corporate risks remain high and especially badly evaluated. There is no risk-prevention policy.

- The concentration of insurance companies is weak with reduced capacities in comparison with other countries. For instance, AIG, the American giant alone holds a financial capacity that is equivalent to that of the entire Chinese insurance industry.

The concentration of Chinese insurers: a must

Jin Mao building, Shangai Jin Mao building, Shangai |

The study concludes that the solution consists in accelerating the process of mergers and acquisitions in the Chinese insurance market. A stronger concentration would have the advantage of increasing the insurers' capacities, reducing costs, raising profits and reinforcing competitiveness among stakeholders.

Competition within the sector is likely to promote new services, to stimulate the integration of capital among different financial institutions and to optimize resources.

The Chinese insurance market : a rocketing growth

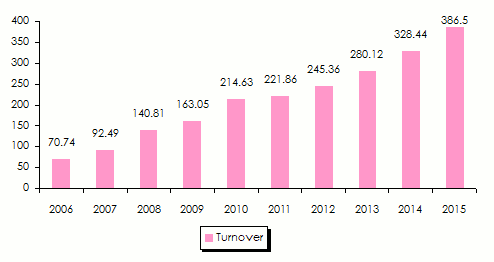

Evolution of turnover of the insurance industry in China

- 2000:Insurance premiums amounted to 160 billion CNY (19.3 billion USD), that is, an average annual increase of 30%.

- 2001:The total premium volume was worth 210,9 billion CNY (25.5 billion USD). The sector accounts for 1.7% of GDP. The total number of staff members in the insurance sector amounts to more than 1.2 million people.

- 2003:The total insurance premiums amounted to 388 billion CNY (46.9 billion USD), that is, an increase of 27.1% over the previous year.

- 2004:The total volume of insurance premiums reached 394.1 billion CNY (47.6 billion USD).

- 2005:The total volume of gross premiums written in the Chinese insurance market amounted to 492.734 billion CNY (61 billion USD), 34.1 billion CNY (4.22 billion USD) of which for the foreign insurance companies which hold 7% of the market shares.

- 2006:The total volume of premiums is likely to reach 600 billion CNY (74.4 billion USD).

- 2010:The total premiums of the Chinese insurance market amounted to 1450 billion CNY (220 billion USD).

- 2012:The China market turnover totaleed 247 billion USD.

- 2014:The chinese industry recorded a turnover of 2.02 trillion CNY (329.08 billion USD). in 2013, it achieved 1.72 trillion CNY (281.35 billion USD).

Turnover evolution of the Chinese insurance market: 2000-2015in billion USD

Evolution in the number of players in the Chinese insurance market

- 2000:40 insurance companies were accounted for, 5 of which were state-owned, 9 were joint-stock companies, 13 with Sino-foreign capital and 13 were branches of foreign companies.

- 2001:52 insurance companies were accounted for, 5 of which were state owned companies, 15 were joint-stock companies, 19 joint-ventures and 13 companies with foreign capital.

- 2005:93 insurance institutions were accounted for among which 6 groups and 82 insurance companies (40 of which are foreign), 5 investment and insurance service companies.

- 2006:47 foreign companies have been accounted for and which opened 121 subsidiary companies while 135 other companies have opened 200 representation offices.

- 2007:107 insurance companies were accounted for, 62 of which were Chinese capital, and 45 companies with foreign capital.

The Chinese insurance market: time to open up

|

China, which achieved in 2006 the five-year transition phase required within the framework of its affiliation to the WTO, is engaging in a new stage which will lead the insurance industry to a complete opening of the market.

From the outset of the process, the mission of the supervising and regulatory authority, China Insurance Regulatory Committee (CIRC), consists in ensuring compliance with WTO rules, reinforcing the control on insurance companies, improving the market's transparency and creating a suitable environment for a sound development of the insurance business in China.

Expected effects of the opening of the Chinese insurance market

- Acceleration of foreign capital inflow and the introduction of new technologies which will prompt the upgrading of the Chinese traditional industries as well as their restructuring.

- Development of insurance operations volume, the reinforcement of competition and the dismantlement of state monopoly, the prerequisite to meet an ever-growing demand.

- Enhancement of reforms towards a modern corporate system characterized by its adequacy to market competition, protection of copyrights and the interests of stakeholders, the separation between administration and corporate business as well as the transparency of the management and accounting rules.

The Chinese insurance market : new provisions

The 2006 year has allowed the adequacy of the Chinese insurance market with the World Trade Organisation's provisions.

- Full freedom for foreign capital

Henceforth, foreign investors may own the whole of insurance companies' capital. This, however, does not apply to life insurance companies where their participation shall remain confined to 50%. This step will also witness the liberalization of the activity of insurance agent and brokerage.

- New role for banks and local insurance companies

Bank of China Tower, Shangai © Baycrest, CC BY-SA 2.5 Bank of China Tower, Shangai © Baycrest, CC BY-SA 2.5 |

Banks will be allowed to invest in the Chinese insurance industry and to set up insurance companies. Likewise, insurance companies will be authorized to invest in other sectors. China Life Insurance has recently acquired a 32% stake in the state owned power company's capital for the amount of 4.5 billion USD.

- Upgrading and development of the Chinese insurance market

The guidelines to the reform program have been announced by way of a memorandum published in June 2006 and entitled “Ten proposals for the reform and the development of the insurance business”.

They call for :

- An improvement of the standard pertaining to services and corporate management.

- Priority for the promotion of non-life insurance, life insurance, reinsurance and insurance intermediaries.

- The reinforcement of insurance funds management and the enlargement of their investment.

- The consolidation of regulation and supervision of the insurance business so as to prevent and reduce risks and to protect the interests of the insured.

- The introduction of insurance courses in primary school curriculum.

The Chinese insurance market : a huge potential

Shanghai, Pudong Shanghai, Pudong |

Experts believe that thanks to its large population and to the dismantlement of former welfare systems, China could, in the long run, become the world's largest insurance market. The development of a market economy has created a flexible environment furthering the recourse to insurance systems.

This trend is accounted for by the rapid rise in the standard of living of the middle class and its accession to individual property (lodging, cars) and its aspiration to further services. The demand has been enhanced by that of the Chinese returning from abroad, consumers who have been accustomed to western standards and services.

Out of a total population that has reached 1.3 billion people, only 4% have insurance policies. The first ten insurers are controlling 10% of the market shares. The insurance market is poised to grow at an annual rate of 13% as of 2006.

The substantial rise of motor insurance is due to the increase of car sales. The motor business is likely to reach 60% of the total volume of non-life insurance premiums.

Given the rural population which amounts to about 900 million people, it is estimated that the annual increase in the volume of insurance premiums for agricultural risks should be at 50%.

Read also :

- China, booming life insurance in 2015

- China becomes the third largest insurance market

- China will be the world’s number two insurance market by 2025

Fabulous contracts

- May 2005: The broker Aon Re China Limited placed all the agricultural reinsurance contracts with Shangai Anxin Agricultural Insurance Co. (AAIC), the first agricultural insurance company in China set up in 2004 with a capital of 200 million CNY (24.8 million USD).

- The British broker Willis and its French partner Gras Savoye have clinched the important insurance contract for the 2008 Beijing Olympic Games.

- Willis has also obtained the contract for the insurance of the 2010 Shangai's universal exhibition.

Discover also :