The governance of insurance companies*

The major losses caused by these events, oftentimes leading to bankruptcy, have provoked strong reactions from the authorities as well as from the shareholders.

The major losses caused by these events, oftentimes leading to bankruptcy, have provoked strong reactions from the authorities as well as from the shareholders.

The image of failing companies, itself, has been seriously affected.

In the insurance sector, the regulatory authorities are required to protect the insured and the beneficiaries. It is in order to safeguard the latter’s interests that legislation has imposed on insurers increasingly binding management rules. Moreover, the authorities are keen on protecting the economic and social fabric.

Today, the composition, the role and the responsibility of management bodies are strictly encrypted. Governance mechanisms, including oversight systems, internal and external communication, conformity rules, are complying with regulatory provisions to which insurers are bound.

*excluding mutual insurance companiesShort historical overview

The conflicts of interest between shareholders and managers have been identified early. Adam Smith(1) had already noted in the eighteenth century an efficiency loss in corporate management. According to him, this dysfunction is accounted for by the non-separation of the managerial functions from those pertaining to shareholding. Other theories came in support of A. Smith’s arguments. For instance, the studies on managerial management conducted by Adolf Berle(2) and Gardiner Means(3) advocate stiffer control over the managers by the shareholders. For the two American authors, this kind of control is likely to increase share-based corporate efficiency. The strengthening of American legislation, allowing better defense of minority shareholders’ interests, draws inspiration from their works.

Wall Street Wall Street |

More recent studies, known under the name of “the theory of the agency” have analyzed share-based corporate efficiency, testing various organizational mechanisms with a view to assessing their efficiency. They came to the conclusion that the problem lies with the gap between corporate management and shareholders.

In this regard, the disappearance of less profitable mechanisms becomes inevitable. Michael Jensen(4), William Meckling(5) and E.F. Fama(6) are the strongest advocates of this trend.

The early 2000s had been marked by numerous scandals that have shaken public confidence. Employees, shareholders, customers and creditors were the worst hit by the effects of the crisis triggered in particular by Enron (USA, 2001), Arthur Andersen (USA, 2002), Parmalat (Italy, 2003), Société Générale (France, 2008) and AIG (USA, 2008). In the United States, some shareholders, exasperated by the opacity of corporate management, had even threatened to block Wall Street. Henceforth, regaining trust has to go through reform of governance systems.

The conflicts of interests between shareholders and management teams affects mainly listed companies. Even if they are publicly traded, the insurance companies comply with specific governance rules. The particular nature of their business prompts them to follow the principles upon which rest the requirements of the various regulations to which they are subject.

The insurance legislation is built around the concept of protection of the insured and the beneficiaries of contracts. With the introduction of compulsory insurance, legislation and controls are getting more and more stringent. The management of considerable capital generated by life insurance and pension products has also pushed the authorities to be more vigilant. Hence, the regulations pertaining to liabilities of insurance companies, establishment of technical reserves, investments, solvency and corporate governance.

The safety of the insured, and by the same token, the survival of an insurance company depend on two factors: the ability of the regulatory authorities to control the companies and the quality of insurance company management bodies to conduct profitable transactions within the framework of regulations.

(1) Adam Smith (1723-1790): philosopher and British economist of the Enlightenment, author of "The Wealth of Nations," one of the founding texts of economic liberalism.(2) Adolf Augustus Berle (1895-1971): economist, lawyer, teacher and US diplomat, author of "The modern corporation and private property," published in 1932.

(3) Gardiner C. Means (1896–1988): American economist.

(4) Michael Cole Jensen (born in 1939): American economist.

(5) William H. Meckling (1922-1998): American economist.

(6) Eugene Francis Fama (born in 1939): American economist, Nobel Prize of economics in 2013.

Corporate governance, definition

We can define corporate governance as the organization and distribution of powers between the various bodies that make it up.

Corporate governance is about the management of resources and risks but it is also about the creation of values. It sets up incentive, control and sanction mechanisms. These mechanisms or procedures explicitly describe who has the duty and the power to act within the company.

They apply to all staff members and vary depending on the position of each employee. The procedures are designed to guarantee the transparency of operations ensuring good distribution of responsibilities and effective communication. Their implementation depends on several factors:

- the corporate culture,

- the corporate structure (board of directors, senior management, sectoral divisions etc.),

- the status of the company (listed or unlisted insurer, mutual insurer or limited company), its rules of procedure, the responsibilities of different committees, etc.,

- the corporate strategy,

- the procedures and supervisory bodies.

Governance structure

For the insurance sector, good governance involves two distinct organizational levels. The first level includes the internal structures of the insurance company, that is, all entities and / or systems set up by the insurer to manage its business. These internal structures include among others, the board of directors, management, audit and internal control.

In a broader perspective, the second organizational level pertains to external means of control. This primarily involves supervisory authorities and various market regulation mechanisms. The regulatory authorities shall monitor and oversee insurance companies whereas market mechanisms guide insurers.

The board of directors

The board of directors is entrusted with the task of overseeing all components of the company. It determines the objectives and establishes the means to achieve them.

Several types of governance coexist in the insurance market (excluding mutual companies).

Several types of governance coexist in the insurance market (excluding mutual companies).

Their implementation depends on the jurisdiction to which insurers are subject. These modes of governance are organized around two main functions that can be conducted by a single body or attributed to several entities within the company:

- Strategic commitments and control: in most jurisdictions this function is the responsibility of the board of directors,

- The implementation of guiding and management measures: this function designed for the management of day-to-day business is entrusted by the board of directors to the general management.

The powers of the board of directors are defined by law, the statutes and the internal regulations of the insurance company. The statutes largely focus on the legal provisions, giving details on the organization of the insurer, the functions of the board of directors, its duties, obligations and powers.

The jurisdiction to which the insurer is subject plays a crucial role in defining the powers and responsibilities of the board of directors. Finally, the pattern of the insurance company also stands as an important parameter in the definition of the scope of jurisdiction of the board. The powers and components of the board of directors vary depending on the enterprise’s status: limited company, mutual company with or without intermediary, listed joined stock company.

Dualistic structures

Some legislations require insurance companies to divide the tasks of the board of directors between a supervisory board and a management board. The presence of these two management bodies reflects the dual structure of power in the company.

The supervisory board is the ultimate body in charge of the company, the one that defines the strategy. The task of management and implementation of decisions is then attributed to the management board whose president is the general manager/ CEO.

Monistic structures

Monistic systems are characterized by the fact that all responsibilities within the company are entrusted to the board of directors which appoints a president or a general manger/CEO or a governing body comprising several members.

Whatever the structure adopted, the management remains accountable to the board of directors or the supervisory board to which it shall submit regular reports. The latter spell out the strategy along with the resources deployed to achieve the objectives and the results obtained.

The statutes and other internal documents provide specific guidance on the duties and functions of all of the company's management bodies.

For the board of directors, the statutes make reference to a number of provisions including:

- the number of directors,

- the procedures for the selection of directors,

- the number of annual meetings held by the board of directors,

- the methodology of decision making.

The directors

The members of the board of directors are called administrators or directors.

The members of the board of directors are called administrators or directors.

The administrators are individuals, designated by the owners and shareholders of the insurance company. The president of the board of directors shall be elected by all administrators. To ensure good governance, administrators should be experienced and skilled in areas that are not necessarily related to the insurance field.

It is sometimes advisable for administrators to be from different areas of expertise (finance, legal business, banking, etc.). This diversity allows insurance companies to better tackle the various challenges that modern companies have to face.

The boards of directors may include two kinds of administrators:

- in-house administrators, that is, employees or executives of the insurance company,

- outside administrators. They are individuals who are independent of the insurance company or of the group to which the insurer belongs. Their independence offers greater impartiality as to the decision making process.

Administrators are expected to make decisions in the interest of the owners and shareholders. They shall proceed to perform their duties in compliance with the law and shall not, under any circumstances, seek any personal interest. They are therefore required to:

- have a perfectly objective judgment, devoid of any personal interest, be the guarantors of the independence of the decision-making mechanism within the board of directors.

The chairman of the board of directors

The chairman of the board of directors is broadly in charge of the following (not exhaustive) tasks:

- guide and lead the board of directors,

- take part in the selection of administrators. According to a study conducted by Gérard Charreaux(1) and Jean Pierre Pitol-Belin(2) (1990), the majority of nomination proposals are made by the chairman of the board. The proposals of other administrators are adopted only in 30% of the cases. A majority shareholder may also intervene in these choices,

- ensure the successful integration of board members as well as their training and development,

- ensure a succession plan within the board of directors,

- set an agenda for the meetings to be held by the board of directors,

- ensure the proper conduct of meetings in accordance with the law,

- ensure that the decision-making process is done in the interest of stakeholders.

(1) Gérard Charreaux (born in1950): professor and researcher in management science.

(2) Jean-Pierre Pitol-Belin(1948 - August 2015): French professor at the advanced school of commerce, Dijon (France).

The influence of the board of directors on the management

Power relations between the administrators and the management team of an insurance company are often difficult. In 1990, Gérard Charreaux and Jean Pierre Pitol-Belin, two French university professors, studied the power of the board of directors on the chairman and the general manager, according to the type of company. The authors came to the conclusion that the influence of the board of directors varies according to the nature of the company.

It is in the family business where, oftentimes, the main shareholder is also chairman of the board that the power of administrators is at its lowest. In such cases, administrators play a marginal role and the board appears more like a decision-reporting chamber of the major shareholder rather than a collegial decision-making body.

In contrast, in companies where the shareholding is spread out, the board of directors plays its role perfectly, being the real holder of power. Managers, therefore, follow the recommendations of the administrators.

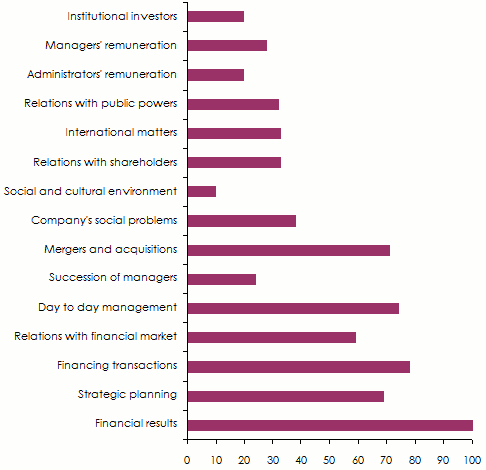

Gérard Charreaux and Jean Pierre Pitol-Belin also reviewed the main topics discussed by the boards of directors and their analyses enabled them to find out that the financial issues always prevailed in the discussions.

Among the six most important concerns on the mind of the boards, four themes of financial nature were listed: financial results, financing operations, mergers and acquisitions, and relations with financial markets. The review of current management is only the third concern for the directors. Moreover, it seems that the topics most regularly addressed by the boards of directors relate to short-term issues.

Questions addressed by the board of directors

Source: Gérard Charreaux and Jean Pierre Pitol-Belin 1990

Source: Gérard Charreaux and Jean Pierre Pitol-Belin 1990

The foundations for effective governance

Good governance requires substantial delegation of power. Delegating means distributing the workload among the best qualified people to perform a task. This delegation of functions is defined by the procedures manuals of each insurer. The procedures are sometimes provided for in the statutes of the companies.

The board of directors may itself delegate certain functions to specific committees partially made up of some administrators to whom assignments or tasks are then allocated. Some legislations require the establishment of specific committees, namely those related to internal audit or to investments. Meanwhile, recourse to independent auditors external to the company is often required. The committees mentioned below are those that are found most often among insurance companies:

- Audit committee,

- Investment committee,

- Risk management committee,

- Asset-liability management committee,

- Policyholders’ protection committee,

- Ethics committee,

- Nomination and remuneration committee.

Other committees can also be set up:

- Human resources committee,

- Strategic monitoring committee,

- Information and communication committee,

- Compliance committee.

Each committee oversees the functions attached to its area: strategy development, implementation of decision-making process, coordination, control, reporting, etc.

Oversight mechanisms

Efficient governance requires effective control exerted in two main directions: internal and external. Internally, the company is required to establish a monitoring and audit system conducted by trained personnel. Externally, the company is required to ensure the adoption of a set of safeguards allowing it to establish relations with external partners in keeping with the regulations.

Internal control

It is essential for the insurer to be fully knowledgeable about the risks he faces and the obligations he is required to fulfill towards his policyholders. He is, therefore, obligated to understand the legislative framework, discern the operational and financial risks related to the nature of his activity. He must have qualified personnel upgraded with advanced technology. There has to be enough staff, endowed with enough experience to:

- build systems of identification, appraisal, rectification, control, risk monitoring and stress tests. Strict risk management methods are imposed by law,

- write procedures, establish a compliance function. Devise strategies, in accordance with the laws in force in order to achieve the desired objectives and ultimately crisis exit plans,

- establish effective internal control systems independent of the operational bodies. Insurers reinforce this independence by appealing to various qualifications and experts within the internal audit function: actuary, loss adjuster, etc.

- establish an effective internal audit system,

- create warning systems in case anomalies came to be spotted.

External measures

Supervisory authorities require insurers to comply with some management standards. The management of technical provisions, assets, resources, liabilities and solvency margin are particularly monitored.

Strict regulations have been developed to enable compliance with insurers’ commitments towards all stakeholders:

- The regulatory authorities. Insurers are required to submit to their supervisors a set of internal and confidential information. The regulatory body has the power to withdraw the license granted to an insurer in the event of serious breach of regulatory and prudential measures. Insurers are required to comply with prudential rules, for instance, Solvency II.

- The auditors. The balance sheets and accounting documents shall be validated by certified auditors.

- The external auditors. Insurers may outsource certain functions, particularly those pertaining to control with independent external auditors.

- Rating agencies. Rating agencies inform the public and the market about the financial health of the processed company. Information and documents must be periodically sent to the agencies entrusted with insurers’ rating.

- Experts. As with the external auditors, insurers can hire licensed experts to carry out certain activities: actuaries, medical experts, financial tasks, etc.

Communication

Today, transparency has been established as a standard. Publishing information is of strategic importance.

Today, transparency has been established as a standard. Publishing information is of strategic importance.

This crucial task is entrusted to specialists. Communication provides the market and customers with a way to compare insurers among themselves, allowing to draw parallels between different governances, compare the quality of insurers and their practices.

The stock market authorities, for listed insurers, and control authorities for the entire market determine minimum disclosure requirements that insurers are required to comply with. In addition to the legal communication obligations, insurers are required to provide information regarding:

- the composition of the shareholding,

- the composition of the board of directors, special committees, senior management and key executives,

- the financial and operating results. This information must be provided periodically,

- the company's strategy, its social policy, the remuneration policy,

- the risk management policy including internal controls, compliance.

The dissemination of information and data is carried out through different channels including:

- The shareholders’ general assembly,

- Quarterly, semi-annual, annual reports,

- The balance sheet and social reports,

- Rating agencies,

- The reports submitted to stock market authorities,

- The websites of insurance companies.