The London Market

There are two facets to the activities of the London market: the British risks and the risks of the London market, among which are the marine and aviation insurance and reinsurance and the direct insuring of the risks abroad.

Although the turnover of premiums plummeted during the last decade, marine insurance has remained one of the major sectors of the London market. It was the sector in which Lloyd's started its activities more than three centuries ago.

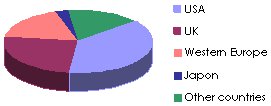

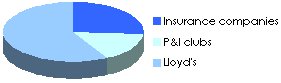

| London market business by country in 2000 | Apportionment of business in the marine and aviation sectors |

|---|---|

|  |

The global turnover of the premiums on the London market reached 26 782 million USD in 2000. It breaks down as follows:

- Marine and aviation : 6 426 million USD, or 24% of the total turnover.

- Direct non-marine insurance and optional reinsurance: 9 280 million USD, or 34,6% of the total turnover.

- Non-marine standard reinsurance: 11 076 million USD, or 41.4% of the total turnover.

The major part of the activities on the London market comes from the United States that represents 38% of Lloyd's activities.

The market structure

Source: The London Insurance Market, July 1997

Source: The London Insurance Market, July 1997

The actors

The brokers

Their role is to place insurance and reinsurance risks on the market.

Les clients

Clients are the British and foreign leading enterprises and insurance and reinsurance companies. They seek to place their risks on the market through brokers.

The International Underwriting Association of London (IUA)

The IUA was created in 1999 out of the merger of the Institute of London Underwriters (ILU) and the London Insurance and Reinsurance Market association (LIRMA).

IUA's role is to protect the interest of its members on the insurance markets and to supervise underwriting processes.

IUA counts 66 members, out of which 9 are affiliate members, mainly located in London or the European Union.

In addition, IUA welcomes 35 associate members from 20 non-European countries, and 8 affiliate associations.

P&I clubs

P&I clubs P&I clubs are specialized in maritime transport. They are insurance mutual associations of shipowners and charterers. They play an important role in marine insurance.

They are organized around the International Group of P&I Clubs, whose head office is in London, and which includes 19 P&I Clubs. In 2000 it represented 90% of the total P&I premium turnover.

The Lloyd's of London

Introduction

Lloyd's headquarters |

It is an insurance market, not a company. It offers specialized services to enterprises and companies in over 120 countries. Lloyd's was initially created in the 17th century around the maritime insurance business. Nowadays it deals with all categories of risk coverage, with the exception of life insurance.

Lloyd's operates through brokers. Brokers wishing to participate in Lloyd's activities must get its approval and become members of the General Insurance Standards Council (GISC).

In the early 1990's, Lloyd's went through a crisis that resulted in a tremendous decrease in its capacity and the collapse of many of the "names."

The Lloyd's : Facts and figures

- In 2003, 71 syndicates were registered to the Lloyd's.

- The number of London syndicates underwriting marine risks went down from 120 in 1990 to 2025 in 2002 (12 were exclusively marine, other were mixed).

- Results in 2002: 1 345 million USD following pro forma annual accounting.

- Rating: A (strong) by Standard & Poor's and A- (excellent) by AM Best.

Organization

Contracts are underwritten by the "names" grouped together in syndicates.

Each syndicate is an insurer that has its own capital assets. Capital assets may come from its members, that are either physical persons with unlimited responsibility, or moral persons with limited responsibility.

Syndicates are headed by the Managing Agents, whose task is to design business plans, determine the syndicates' line of action and supervise the underwriting process, but they do not participate directly to it; they appoint an underwriter that operates on behalf of its clients.

All the risks are placed through a Lloyd's broker in London; the broker is the link between the underwriters and the clients (insurers and reinsurers).

Lloyd's Future Perspectives

- Replace the present control and management units by a new system that would improve the profitability of the underwriting and Lloyd's rating.

- Acquire a totally integrated structure with permanent assets, starting from 2005.

- End the tri-annual account closure and return to a more conventional accounting system.

- End the status of unlimited responsibility for the Lloyd's members time insurance.