The main reinsurance market stakeholders

Major non-life reinsurers

Major non-life reinsurers

According to the figures communicated by AM Best, the two non-life reinsurers remain Munich Re and Munich Re with, however, a reversal of the leading position. Swiss Re, which came in second place in 2018, passes in front of the Bavarian giant in 2019.

During the past year, the Swiss reinsurer reported 26.095 billion USD in gross reinsurance premiums while Munich Re’s totaled 24.742 billion USD.

This duo is well ahead of its traditional followers Hannover Re (16.555 billion USD), Lloyd's (14.978 billion USD), Berkshire Hathaway (11.112 billion USD) and Scor (8 billion USD).

The top ten reinsurers were still the same in 2018 and 2019 with slight changes at the top of the ranking, with Swiss Re passing ahead of Munich Re.

In 2019, the top ten reinsurers will account for 73.7% of the total global reinsurance market premiums which is practically the same percentage as in 2018 at the rate of 73.16%. The only notable change is that the total premiums reported by the 10 reinsurers amounted to 123.591 billion USD in 2019 compared to the 109.774 billion USD in 2018, an increase of 12.58% over one year.

It is worth noting that the best combined ratio is achieved by the Bermudan company Everest Re (95.3%). Another interesting observation is that Swiss Re has one of the highest combined ratios on the list (111.4%), 10 points higher than its immediate competitor Munich Re and nearly 12 points higher than Hannover Re and Scor.

Top 10 non-life reinsurers

In billions USD| Rank 2019 | Company | Gross non-life written premiums | Shareholder's equity | Combined ratio in % |

|---|---|---|---|---|

| 1 | Swiss Re | 26.095 | 31.037 | 111.4 |

| 2 | Munich Re | 24.742 | 34.245 | 101.1 |

| 3 | Hannover Re | 16.555 | 12.718 | 98.5 |

Discover the full table | Top 10 non-life reinsurers

Major life reinsurers

Still according to AM Best, the world leader in the life insurance sector is Swiss Re, a regular at the pole position. In 2019, Munich Re will drop one place, from second place in 2018 to third in 2019.

Among the top 10 life reinsurers, Great West Lifeco is making a huge leap, practically doubling its 2018 turnover. The increase in Great West Lifeco's premiums is accounted for by external growth through mergers and acquisitions.

Top 10 life reinsurers

In billions USD| Rank | Company | Gross life written premiums | Shareholder’s equity |

|---|---|---|---|

| 1 | Swiss Re | 16.133 | 31.037 |

| 2 | Great West Lifeco | 13.26 | 19.549 |

| 3 | Munich Re | 13.122 | 34.245 |

Discover the full table | Top 10 life reinsurers

Top 50 life and non-life reinsurers

In terms of group, life and non-life activities combined, Swiss Re is the world leader in both life and non-life classes of business. Scor stands 4th in the ranking, well behind Hannover Re.

Among the "composite" world leaders, the French reinsurer is the only one to generate more premiums in life than in non-life business. For all the other leaders, the non-life business is clearly dominating the scene.

Top 50 global reinsurers

In millions USD| Rank | Company | 2019 turnover | Shareholder’s equity | Ratio in % (1) | ||||

|---|---|---|---|---|---|---|---|---|

| Total | Non-life | Life | Loss | Management expenses | Combined | |||

| 1 | Swiss Re | 42.228 | 26.095 | 16.133 | 31.037 | 79.7 | 31.7 | 111.4 |

| 2 | Munich Re | 37.864 | 24.742 | 13.122 | 34.245 | 66.7 | 34.4 | 101.1 |

| 3 | Hannover Re | 25.309 | 16.555 | 8.754 | 12.718 | 69 | 29.5 | 98.5 |

Discover the full table | Top 50 global reinsurers

Among the most noteworthy movements, Valdius has jumped to 28th place, following an increase of nearly 40% in gross written premiums, particularly in non-life lines.

On the other hand, Qatar Re is in 43rd place after a 17-place drop compared to the previous year. Africa Re, the only African reinsurer in the list, gains one place, moving from 42nd position in 2018 to 41st in 2019.

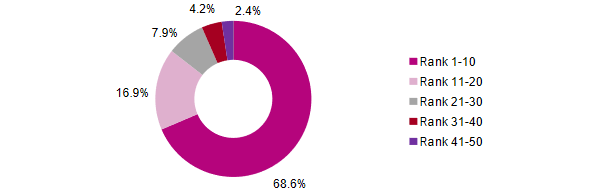

Market shares in 2019

Out of total reinsurance premiums (life and non-life) estimated at 280 billion USD in 2019, the top two reinsurers together account for 28%, while the top 10 account for nearly 70%.