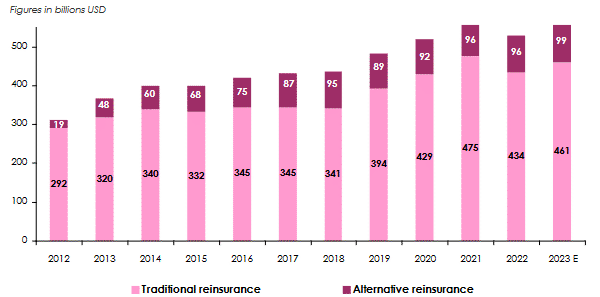

Traditional and alternative reinsurance capacity

Reinsurance market capacity almost doubled between 2012 and 2023, despite the stagnation at 400 billion USD reported in 2015, before picking up again until 2021, a year impacted by Covid-19. For the first time, this growth slowed at 530 billion USD in 2022.

Reinsurance market capacity almost doubled between 2012 and 2023, despite the stagnation at 400 billion USD reported in 2015, before picking up again until 2021, a year impacted by Covid-19. For the first time, this growth slowed at 530 billion USD in 2022.

Forecasts for 2023 point to a recovery, with a return to capacity slightly lower than in 2021.

Reinsurance capacity trends: 2012-2023

Figures in billions USD

| 2012 | 2017 | 2021 | 2022 | 2023 E | 2012-2023 evolution | |

|---|---|---|---|---|---|---|

| Traditional reinsurance capacity | 292 | 345 | 475 | 434 | 461 | 57.87% |

| Alternative reinsurance capacity | 19 | 87 | 96 | 96 | 99 | 421% |

| Alternative reinsurance share | 6% | 20% | 17% | 18% | 18% | 196% |

| Total capacity | 311 | 432 | 571 | 530 | 560 | 80% |

E: estimate

Source : AM Best

Traditional reinsurance capacity

Growing steadily since 2019, traditional capital accounts for more or less the same percentage of total capacity offered by reinsurers over the past five years, at 82%.

Traditional reinsurance had increased by 58% between 2012 and 2023, sustaining only two declines over the same period, the first of 1.2% in 2018 and the second of 8.63% in 2022.

Alternative reinsurance capacity

Alternative capacity, which grew strongly from 2012 to 2018, has stagnated over the past five years before peaking at 96 billion USD in 2021 and 2022, in comparison with the 19 billion USD reported ten years earlier. Its contribution to total capacity tripled between 2013 and 2022, from 6% to 18%.

For many reinsurers, alternative capital is of paramount importance, offering answers to specific coverage needs. Moreover, current market conditions, marked by a decline in traditional capacity by 2022 and strong demand for cover, are of particular interest to reinsurers.

According to AM Best, alternative capacity in 2022, which includes ILS funds and other investment vehicles, is broken down as follows:

- 34.5 billion USD in Cat-Bonds,

- 6 to 7 billion USD of side-cars,

- 5 to 7 billion USD in Industry Loss Warranties (ILW),

- 45 to 50 billion USD in collateralized reinsurance.