Trust Re

Rebaptized Trust Re as of February 28, 2008, the reinsurance company may be considered today as one of the Group's most elaborate piece of work.

Rebaptized Trust Re as of February 28, 2008, the reinsurance company may be considered today as one of the Group's most elaborate piece of work.

Despite the positive results reported in recent years, it was only at the start of 2005 that the company reached its cruising pace. For a capital worth 100 million USD, the 2007 turnover amounted to 184 million USD, net result to 35.9 million USD and return on equity to 19.85%. A performance at the reach of no other reinsurer in the region.

From a purely family business, run by a respected and enlightened patriarch, Trust Re has gradually been turned into a genuine professional reinsurer which excelled at attracting the region's best human potentialities.

|

| Ghazi Abu Nahl |

| Founder of Trust Group |

Specialised from the outset in oil risks for the Arab countries, the company is expanding its scope of operation year after year. In order to develop its portfolio in the East and set foot on the Asian markets, Trust Re opened, as of 2003, an underwriting office in Kuala Lumpur. Westward, it was Africa that the company turned to.

Highly rated by international rating agencies, the Bahrain-based reinsurer may rely on its new generation of underwriters to build its portfolio and consolidate its foundation, under the ever watchful eye of Ghazi Abu Nahl.

Trust Re in 2007

| Capital | 100 million USD |

| Turnover | 184.10 million USD |

| Net result | 35.9 million USD |

| Shareholders' equity | 183.3 million USD |

| Total assets | 462 million USD |

| Return on equity (R.O.E) | 19.85% |

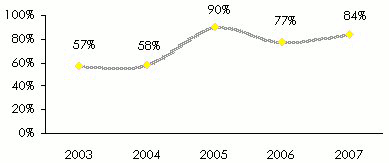

| Combined ratio | 84% |

| Number of employees | 80 |

Management

| Chairman | Kamel Abu Nahl |

| CEO | Fadi Abu Nahl |

| Chief operating officer | Nabil Cotran |

| Deputy chief operating officer | Samir Shaman |

| Chief underwriter | Gunnar Maltegard |

| Head of finance | Yousif Anzawi |

| Group actuary and risk manager | Said Younsi |

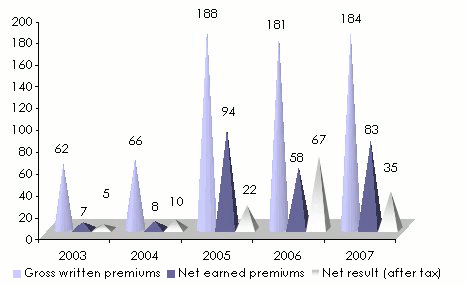

Main financial highlights: 2003-2007

in thousands USD| 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|

Gross written premiums | 62 636 | 66 527 | 188 360 | 181 408 | 184 101 |

Net written premiums | 7 617 | 9 168 | 96 915 | 62 189 | 96 080 |

Net earned premiums | 7 095 | 8 043 | 94 418 | 58 883 | 83 835 |

Net incurred losses | 3 117 | 3 636 | 61 735 | 33 552 | 50 372 |

Net acqusition costs | (3 672) | (3 654) | 15 506 | 4 978 | 13 290 |

Management expenses | 4 591 | 4 688 | 8 102 | 6 578 | 6 995 |

Investment income | 2 066 | 6 807 | 10 833 | 52 297 | 18 611 |

Other financial costs | 951 | 1 978 | 4 097 | 2 628 | 5 880 |

Net result (after tax) | 5 262 | 10 837 | 22 840 | 67 929 | 35 932 |

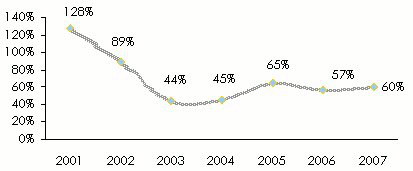

Net loss ratio: 2003-2007

Combined ratio: 2003-2007

Contact

| Head office | P.O Box 10002, Manama, Bahrain |

| Phone | (+973) 17 532425 |

| Fax | (+973) 17 531586 |

| Website | |

mail [at] bahrain [dot] trustgroup [dot] net |