Ugandan insurance market

Uganda's insurance market features

- Regulatory authority: Insurance Regulatory Authority of Uganda (IRA Uganda)

- Life and non-life premiums: 267 million USD

- Insurance density 2020: 5.8 USD

- Penetration rate 2020: 0.7%

Structure of the Ugandan insurance market in 2020

Market stakeholders | Total |

|---|---|

Non-life insurance companies | 21 |

Life insurance companies | 9 |

Reinsurance companies | 2 |

Insurance brokers | 41 |

Reinsurance brokers | 3 |

Micro-insurance companies | 2 |

Health Maintenance Organizations (HMO) | 5 |

Total | 83 |

Identity

- Surface area (1) : 241 551 Km2

- Population (2) (2020): 45 741 000 inhabitants

- GDP (2) (2020): 37.6 billion USD

- GDP per capita (2020): 822 USD

- GDP growth rate (2) (2020): 3%

- Inflation rate (2) (2020): 3.8%

- Main economic sectors: Agriculture (coffee, wheat, sugar, cotton), energy, oil exploitation and tourism.

Major cities (1)

(per number of inhabitants) (2020)

- Kampala (capital): 3 298 000

- Jinja: 515 000

- Mbarara: 350 000

(1) World Population ReLifew

(2) World Bank

Ugandan insurance market: evolution of premiums per life and non-life insurance

Figures in thousands USD| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Non-life | 121 549 | 136 953 | 153 891 | 167 596 | 179 360 |

| Life | 35 775 | 45 554 | 58 622 | 74 607 | 87 576 |

| Total | 157 324 | 182 507 | 212 513 | 242 203 | 266 936 |

Read also | Ugandan insurance market as of 30 September 2022

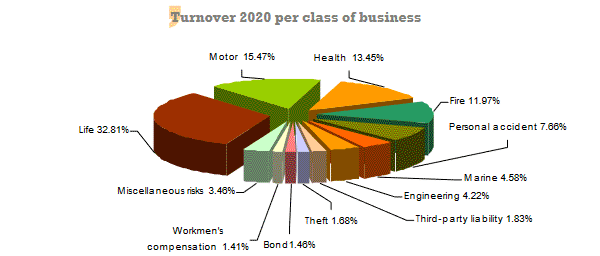

Ugandan insurance market: turnover per class of business

Figures in thousands USD| 2016 | 2017 | 2018 | 2019 | 2020 | 2020 shares | |

|---|---|---|---|---|---|---|

Motor | 32 365 | 34 857 | 38 992 | 40 533 | 41 285 | 15.47% |

Health | 16 821 | 22 779 | 27 732 | 29 169 | 35 916 | 13.45% |

Fire | 21 690 | 22 987 | 25 809 | 30 937 | 31 955 | 11.97% |

Personal accident | 11 274 | 13 720 | 11 595 | 17 569 | 20 439 | 7.66% |

Marine and aviation | 7 694 | 9 041 | 8 962 | 10 739 | 12 224 | 4.58% |

Engineering | 5 638 | 7 842 | 10 789 | 9 811 | 11 265 | 4.22% |

Third-party liability | 2 860 | 3 781 | 4 083 | 4 697 | 4 892 | 1.83% |

Theft | 2 349 | 3 098 | 3 115 | 5 083 | 4 483 | 1.68% |

Bond | 2 405 | 2 456 | 2 923 | 4 865 | 3 885 | 1.46% |

Workmen's compensation | 5 197 | 4 262 | 3 730 | 4 333 | 3 768 | 1.41% |

Miscellaneous accident | 13 256 | 12 130 | 16 161 | 9 860 | 9 248 | 3.46% |

Total non-life | 121 549 | 136 953 | 153 891 | 167 596 | 179 360 | 67.19% |

Life | 35 775 | 45 554 | 58 622 | 74 607 | 87 576 | 32.81% |

Grand total | 157 324 | 182 507 | 212 513 | 242 203 | 266 936 | 100% |

Ugandan insurance market: net 2020 loss ratio per non-life class of business

Figures in thousands| Net incurred losses | Net earned premiums | Net loss ratio | |||

|---|---|---|---|---|---|

| In UGX | In USD | In UGX | In USD | ||

Motor | 44 966 978 | 12 141 | 138 072 740 | 37 280 | 32.57% |

Health | 60 333 567 | 16 290 | 79 740 183 | 21 530 | 75.66% |

Fire | 5 584 914 | 1 508 | 25 185 451 | 6 800 | 22.18% |

Personal accident | 19 570 351 | 5 284 | 52 061 301 | 14 057 | 37.59% |

Marine and aviation | 2 991 795 | 808 | 12 786 028 | 3 452 | 23.40% |

Engineering | 3 258 714 | 880 | 6 357 586 | 1 716 | 51.26% |

Third-party liability | 2 668 351 | 720 | 5 881 439 | 1 588 | 45.37% |

Theft | 4 575 980 | 1 236 | 10 632 937 | 2 871 | 43.04% |

Bond | -1 034 230 | -279 | 671 504 | 181 | -154.02% |

Workmen's compensation | 5 812 770 | 1 569 | 10 311 160 | 2 784 | 56.37% |

Miscellaneous accident | 1 934 451 | 522 | 7 659 947 | 2 068 | 25.25% |

Total non-life | 150 663 641 | 40 679 | 349 360 276 | 94 327 | 43.13% |

Ugandan insurance market: net 2020 management expenses ratio per non-life class of business

Figures in thousands| Management expenses (1) | Net written premiums | Management expenses ratio | |||

|---|---|---|---|---|---|

| In UGX | In USD | In UGX | In USD | ||

Motor | 70 145 135 | 18 939 | 137 376 962 | 37 092 | 51.06% |

Health | 23 571 732 | 6 364 | 85 375 743 | 23 051 | 27.61% |

Fire | 41 667 006 | 11 250 | 27 272 530 | 7 364 | 152.78% |

Personal accident | 40 044 802 | 10 812 | 52 448 750 | 14 161 | 76.35% |

Marine and aviation | 11 195 947 | 3 023 | 12 239 684 | 3 305 | 91.47% |

Engineering | 12 248 352 | 3 307 | 6 268 133 | 1 692 | 195.41% |

Third-party liability | 7 745 102 | 2 091 | 6 154 467 | 1 662 | 125.85% |

Theft | 8 487 976 | 2 292 | 10 768 970 | 2 908 | 78.82% |

Bond | 5 123 999 | 1 384 | 1 674 254 | 452 | 306.05% |

Workmen's compensation | 7 845 040 | 2 118 | 10 462 728 | 2 825 | 74.98% |

Miscellaneous accident | 15 677 718 | 4 233 | 8 530 629 | 2 303 | 183.78% |

Total non-life | 243 752 809 | 65 813 | 358 572 850 | 96 815 | 67.98% |

(1) Including net commissions

Ugandan insurance market: net 2020 combined ratio per non-life class of business

Figures in thousands USD| Net loss ratio | Net management expenses ratio | Net combined ratio | |

|---|---|---|---|

Motor | 32.57% | 51.06% | 83.63% |

Health | 75.66% | 27.61% | 103.27% |

Fire | 22.18% | 152.78% | 174.96% |

Personal accident | 37.59% | 76.35% | 113.94% |

Marine and aviation | 23.40% | 91.47% | 114.87% |

Engineering | 51.26% | 195.41% | 246.67% |

Third-party liability | 45.37% | 125.85% | 171.22% |

Theft | 43.04% | 78.82% | 121.86% |

Bond | -154.02% | 306.05% | 152.03% |

Workmen's compensation | 56.37% | 74.98% | 131.35% |

Miscellaneous accident | 25.25% | 183.78% | 209.03% |

Total non-life | 43.13% | 67.98% | 111.11% |

Source : IRA (Uganda)

Exchange rate as at 31/12/2020: 1 UGX = 0.00027 USD at 31/12/2019: 1 UGX = 0.00027 USD ; at 31/12/2018: 1 UGX = 0.00027 USD ; at 31/12/2017: 1 UGX = 0.00027 USD ; at 31/12/2016: 1 UGX = 0.00027 USD

Read also | Insurance companies in Uganda

0

Your rating: None

Mon, 25/04/2022 - 10:16

The online magazine

Live coverage

04/17

04/17

04/17

04/17

04/16

Latest news