Zurich Financial Services

A marine reinsurer

The history of Swiss insurance gathered momentum in the mid 18th century on the eve of industrialization. Switzerland had then emerged slowly as a business center while the financial system started to take shape.

The history of Swiss insurance gathered momentum in the mid 18th century on the eve of industrialization. Switzerland had then emerged slowly as a business center while the financial system started to take shape.

The need for insurance began to play out at a time when two insurance companies were harmoniously operating: One in Basel and the other in St Gall, with both companies trading in marine business. With an ever-increasing volume of exported commodities, experts reckoned that a third insurer based in Zurich had to be introduced. On the initiative of Crédit Suisse, 17 entrepreneurs established a committee advocating its creation in June 1869. In October of the same year, the statutes of Schweiz Transport Versicherungs Gesellschaft (Swiss maritime insurance company) were signed and in May 1870 the company started marketing its first insurance policies. Operating on the local and international markets, the company soon sensed the need of a substantial reinsurance cover that no reinsurer could then provide. That is why Schweiz chose to have its own reinsurer.

It is, thus, that in 1872, an insurance company, Versicherungs Verein, was set up in Zurich with a initial capital of 886 000 Swiss francs. Not only was it the reinsurer of the parent company Schweiz, but it would also develop its own portfolio of direct acceptances in the marine class of business.

It is, thus, that in 1872, an insurance company, Versicherungs Verein, was set up in Zurich with a initial capital of 886 000 Swiss francs. Not only was it the reinsurer of the parent company Schweiz, but it would also develop its own portfolio of direct acceptances in the marine class of business.

In 1875, the company grew bigger widening the scope of its activities to include accident insurance and seizing this opportunity to change its name and become Transport & Unfall Versicherungs Aktien Gesellschaft (Transport and accident insurance company). With the enactment of new German laws instituting employers’ liability in case of accidents of their employees. The newly established company was able to set foot on the market of workmen’s compensation and third party liability insurance in Germany. At the end of 1875, the company was equally present in Austria, Denmark, Sweden and Norway. The growing importance of accident insurance in Switzerland was behind the arrival of another actor on the market: the Winterthur which was set up in 1875. This new class of business enabled Transport & Unfall Versicherungs to grow hand in hand with its parent company and even becoming the company’s major activity.

In 1877, new offices were opened in Brussels and one year later in Paris and Netherlands. As of 1875, the company embarked on the marketing of new products designed to the middle and upper classes.

A change of course

In 1880, a major marine loss led to a drastic change in the company’s strategy. Chairman Heinrich Müller, who had just taken over Wilhem Berend Witt in this position, decided to give up underwriting this class of business and to focus only on accident insurance. The gross premiums volume attained for the first time 1 million Swiss francs, confirming thus the company’s successful restructuring. Operations are scattered around Germany which accounted for 53%, France 21% and Switzerland 19%.

In 1881, agencies were opened in Milan then in Moscow, Saint Petersburg, Helsinki and four years later in Spain. However, the results achieved by the Russian subsidiaries were disappointing, which led to their closure in 1887.

© Sidonius (modified picture), CC BY-SA 3.0 © Sidonius (modified picture), CC BY-SA 3.0 |

The development of Transport & Unfall Versicherungs was particularly intense in France and Switzerland, which made it possible, as of 1886, to offset the losses of the workmen’s compensation portfolio in Germany a year ago following the nationalization of this class of business in this country. In 1885, the loss of this portfolio resulted in shrinking profits for the first time since the group’s inception.

As of 1887, the company embarked on new niches by insuring soldiers against accidents that may occur during their annual drills, a move which brought the company under the spotlights.

In 1892, the company made recourse for the first time to a broker in order to gain market shares in Belgium. Three years later, the company, which no longer marketed marine policies for 15 years, had its name changed into Zurich Allgemeine Unfall und Haftlich Versicherung Aktiengesellschaft (Zurich Accident and third party liability insurance). This new name reflected quite well its engagement in accident and third party liability insurance, with both classes standing as its major activity. In 1898, France, whose legislation made workmen's compensation coverage compulsory, enabled the insurer to consolidate its positions on this territory, becoming its biggest accident insurer on the eve of the First World War.

In 1898, Zurich embarked on motor third party liability insurance, a class of business which became dominating as of the mid 1930s.

Starting from 1900, the company was provided with a new perspective. Under the reign of Fritz Meyer, who took over Heinrich Müller as CEO, Zurich’s financial soundness was enhanced, enabling the company to earn 15.4 million Swiss francs in premium income. France was its most important market followed by Germany, each accounting for approximately one third of the portfolio. In 1909, reserve to premium ratio attained 150%. It was under the management of F. Meyer that the company set up its headquarters in 2 Mythenquai in Zurich, the head office still in use today.

Entering the American market

The start of the 20th century marked a turning point for the group : in December 1912 Zurich obtained license to get established in New York as the company had until then been operating in the United States in association with German Fire Insurance Company via a branch in Chicago. In America, the company’s development was unexpectedly intense. At the end of the first year of operation, 9% of the turnover was made on the American territory. But this expansion triggered higher costs and provisions. In order to raise the reserves required by the authorities, the company invested substantial sums in the capital of the New York entity. Such reserves would then be used for the future expansion on the American territory after the First World War. In 1920, the United States became the group’s second market.

The start of the 20th century marked a turning point for the group : in December 1912 Zurich obtained license to get established in New York as the company had until then been operating in the United States in association with German Fire Insurance Company via a branch in Chicago. In America, the company’s development was unexpectedly intense. At the end of the first year of operation, 9% of the turnover was made on the American territory. But this expansion triggered higher costs and provisions. In order to raise the reserves required by the authorities, the company invested substantial sums in the capital of the New York entity. Such reserves would then be used for the future expansion on the American territory after the First World War. In 1920, the United States became the group’s second market.

Meanwhile, the company, led by Leonhard Tobler since 1918 extended over the main markets, taking over competitors most of the time: Spain (acquisition of Hispania Compania General de Seguros, 1915), Canada (establishment of a branch, 1923), Great Britain (establishment of a branch in London in 1922, followed by the acquisition of Lancashire and Cheshire Insurance Company in 1924), Austria (acquisition of Kosmos Insurance Company, 1928), in Germany (the partial acquisition of Deutsche Allgemeine Versicherungs AG, Berlin 1928).

In 1922, the company extended the scope of its activities to life insurance by setting up Vita Lebensversicherungs AG (Vita Life Insurance Ltd.), a Swiss subsidiary which swallowed the Swiss portfolio of German companies undermined by post-war hyper inflation and driven out of the Swiss market. Vita, therefore, made use of the parent house network to extend rapidly. In 1926, the company went modernized by introducing regular medical check-ups. In 1930, the life insurance subsidiary was dotted with branches in Belgium, Germany, Netherlands, France and Spain. Vita would keep its name until 1993 when it was renamed Zurich Life.

New strategy: multi-class diversification and new acquisitions

The Great Depression of 1929 which hit the economic and social world had also had its toll on Zurich assurance. The collection of premiums went down but the company’s specialization in workmen’s compensation and third party liability insurance allowed to slow down the crisis’ impact. The company had still enough capital to pursue its acquisitions: Merkur Insurance Company, (Czechoslovakia, 1933), Belford Insurance Company (Great Britain, 1935), Holmia Insurance Company (Sweden, 1933), the Nation Vie et Non Vie (France, 1938). A reinsurance subsidiary was established in Switzerland (Turegum Insurance, 1938) and another in direct insurance in the United States (American Guarantee and Liability in New York, 1939).

The Second World War would trigger the loss of all the Group’s business in Central and Eastern Europe. The presence of the company on the major markets, especially in North America enabled it to get a good positioning by the end of the war and a solid foundation to restart its operations. Reconstruction commenced with the reestablishment of the network in Germany around Düsseldorf and Frankfurt’s offices.

After the scourge of war, the company’s business stopped in France during the nationalization of workmen’s compensation insurance. Until then, this segment accounted for 74% of the premiums in France.

Zurich Financial Services, Hamburg © Staro1, CC BY-SA 3.0 Zurich Financial Services, Hamburg © Staro1, CC BY-SA 3.0 |

After these difficult years, Zurich decided to market insurance policies in all classes of business. This diversification became a priority as much important as the restart of expansion worldwide. This change of strategy was inaugurated by a change of name in 1955: Zurich Versicherungs Gesllschaft (Zurich Insurance).

The acquisitions, initiated by the CEO Robert Matthias Naef (Morocco 1951) would go on under the leadership of Fritz Gerber: the opening of an office in India (1962), the purchase of Alpina Versicherungs Gesellschaft in Switzerland, entry on the South American market with the acquisition of Iguazù Compania de Seguros in Argentina (1965), the acquisition of Agrippina Versicherung AG in Germany (1969). The takeover of Agrippina, whose marine activity is important, enabled Zurich Insurance to make up with this class of business which had been for so long abandoned.

Until the beginning of the 1970s, the Asian continent, whose development started to pick up, was hardly represented in the Swiss insurer’s portfolio. Only a representation office in Hong Kong beard witness of the presence in this region since 1973. In 1980, the group expanded there by taking a minority stake in Malayan, a Filipino company which opened the door for the insurer to spread its wings over the entire region. The first marketing operation in Japan occurred in 1986, though.

In 1989, a large-scale acquisition was made in the United States with the takeover of Maryland Casualty Group whose head office was in Baltimore, the biggest takeover ever realized by Zurich Insurance. It did consolidate the group’s positioning on the continent, enabling it to double its turnover in the United States.

Between 1972 and 1990, the premiums written by the parent company in Switzerland rose from 2.3 billion CHF to 6.1 billion CHF. Those of Zurich Insurance soared from 4 billion CHF to 17.1 billion CHF with operations in almost 80 countries around the world. The main markets then were Switzerland, United States and Germany. The reinforcement of the European spirit and the birth of the Common Market incited the company to adjust to this new policy, by establishing subsidiaries in major Western European countries which were dotted with the computer system Zurinet, enabling data sharing within the different entities.

The birth of Zurich Financial services during Rolf Hüppi’s era

The arrival of Rolf Hüppi at the top of Zurich Insurance would impose a new vision for the company. In view of competition and the growing globalization of the economy, he set as an objective in the countries where Zurich is operational, to focus on the most profitable segments of insurance. Less profitable classes or those off their core business were then ceded for the benefit of targeted markets including that of life insurance in Switzerland. That is exactly what he did in 1991 by acquiring Geneva Insurance then by joining the Swiss bank SBC in a partnership designed to sell life insurance policies throughout its network.

Zurich Financial Services, Corporate Center, Zurich © Jürg-Peter Hug, CC BY-SA 3.0 Zurich Financial Services, Corporate Center, Zurich © Jürg-Peter Hug, CC BY-SA 3.0 |

In the mid 1990s Hüppi consolidated operations across the Atlantic. In 1993, he established Zurich Reinsurance Center Holdings which quickly became a major player of the American reinsurance. The swift consolidation of financial services pushed the group to embark on other major transactions on the continent. In 1996, Zurich disbursed 2 billion USD to acquire 97% of Kemper Financial Services (a company of asset management) and 80% of Kemper Corporation (detaining two life insurance companies). Zurich, whose life insurance became a priority objective, took, for the first time, a huge step forward on the American continent in terms of life insurance. Kemper Financial services, which was later renamed Zurich kemper Investment, also enabled Zurich to set foot on asset management in the United States. Kemper was then running a 42 billion USD portfolio in assets which would be reinforced in 1997 by majority participation in Scudder, Stevens & Clark Inc., a company whose activity is similar, but whose management portfolio is three times as important. Both companies later merged under the name of Scudder Kemper Investments.

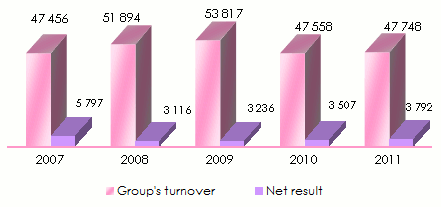

Evolution of the group’s turnover and net result : 2007-2011 in millions USD

In 1998, a major move would give the group a look quite close to that of its present configuration. The merger, worth 38 billion USD, with British American Financial Services (B.A.F.S.) gave birth to the group Zurich Financial services. This new company was then detained at 55% by Zurich Allied AG, which was listed on Zurich’s stock market, and at 45% by Allied Zurich p.l.c, which was listed on London’s stock market. B.A.F.S’s contribution raised premiums volume which grew from 23.7 billion USD to 40 billion USD. B.A.F.S. indeed made it possible to take control over large companies dealing with insurance in the United States and Great Britain: Farmers Group Inc (one of the leaders of American non-life insurance), Allied Dunbar Assurance (one of the leading life insurers in Britain), Eagle Star Holdings (one of the key multiple-line insurers across the Channel). Zurich Financial Services became the world’s fifth insurance group with the United States, Great Britain and Switzerland being the major markets.

This new group focused its development on four segments: non-life insurance, life insurance, reinsurance and asset management.

The gloomy years

At the start of the year 2000, Zurich Financial Services began simplifying its structure by unifying all of its activities under the Swiss holding “Zurich Financial Services”, listed mainly in Zurich stock market.

At the same time, the group posted stagnant results due to major difficulties faced by its asset management subsidiary Scudder, in addition to problems pertaining to the merger between Scudder and Kemper units.

At the beginning of the year 2001, Zurich Financial Services sustained some difficulties and was bound to leave the reinsurance market. The group had to focus on the remaining three pillars: non life insurance, life insurance and asset management. Zurich Re, therefore, emerged and became Converium Holding AG in December 2001. Other cessions ensued: important asset management units, including Scudder, were bought back by Deutsche Bank in 2002 for 2.5 billion USD. In return, Zurich obtained a majority stake in the insurer German Life and entered the life operations of the bank in Italy, Spain and Portugal. The group restructuring into five geographic units was started, while a control of costs was carried out at the headquarters with a view making 200 million USD in savings.

Main technical highlights of the group: 2007-2011 in millions USD| 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|

Group’s turnover | 47 456 | 51 894 | 53 817 | 47 558 | 47 748 |

-Non life insurance | 35 650 | 37 151 | 34 157 | 33 066 | 34 572 |

-Life insurance | 9 623 | 10 794 | 12 440 | 10 113 | 9 432 |

-Farmers 1 | - | 3 381 | 6 615 | 4 194 | 3 529 |

-Other activities | 2 183 | 568 | 605 | 185 | 215 |

Operating profit | 6 707 | 5 186 | 5 593 | 4870 | 4 261 |

After tax profit | 5 797 | 3 116 | 3 236 | 3 507 | 3 792 |

Shareholder’s equity | 28 945 | 22 103 | 29 304 | 31 905 | 31 636 |

Solvency margin | 187% | 160% | 195% | 232% | 242% |

Non life combined ratio | 95.6% | 98.1% | 96.8% | 97.9% | 98.8% |

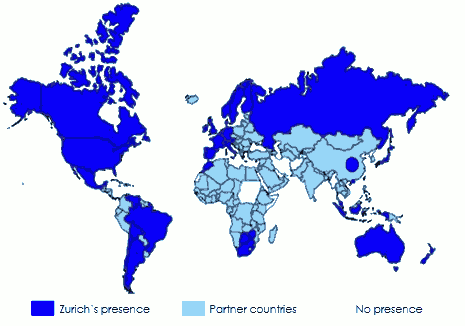

Zurich’s presence worldwide

These cessions were not sufficient to adjust the group’s accounts for the year 2001, which also sustained the fallout of the 9/11 attacks in the United States and which amount to 900 million USD. Zurich Financial Services then posted net losses amounting to 387 million USD. Under pressure, Rolf Hüppi had to step down and James J. Schiro took over as CEO in May 2002.

Painful decisions had to be made in order to rescue the group: A 2.4 billion USD capital increase, 4500 employees were dismissed and significant cuts affected operational costs. In 2002, the loss reserves increased by 1.9 billion USD and asset depreciation up to 1.75 billion USD ensued. Schiro further refocused its group on its core business, splitting away from other units not related to insurance and loss-making units or units deemed too small: the American division of Swiss Life is ceded. These moves were, nonetheless, insufficient since Zurich financial Services posted losses worth 3.43 billion USD in 2002.

Financial soundess rating of the group’s main companies| Standard & Poor’s | Moody’s | A.M. Best | |

|---|---|---|---|

Zurich Insurance Company Ltd | AA-/stable | Aa3/stable | A+/stable |

Zurich American Insurance Company | AA-/stable | - | A+/stable |

Zurich Insurance Public Limited Company | AA-/stable | - | - |

Zurich Deutscher Herold Lebensversicherung AG | - | A1/stable | - |

Zurich Assurance Ltd | - | A1/stable | - |

Recovery

The following three years, nevertheless, enabled the group to return to profits, and difficult years were, then, forgotten.

The following three years, nevertheless, enabled the group to return to profits, and difficult years were, then, forgotten.

Schiro relaunched the group’s international expansion. In May 2006, Zurich was the first foreign insurer to obtain license for the opening of an office in Beijing in order to sell fire and accident policies. Other minor acquisitions had been carried out until 2007 when the group realized major operations.

It acquired the Spanish credit-bond insurer ACC Seguros y Reaseguros de Danos, then got hold of 66% of the Russian insurer Nasta Insurance Company. Zurich then became the first foreign actor in Russian insurance.

In an effort to take full advantage of Asian growth, the group took control, in the same year, of an important Chinese broker then decided to set up a new unit in Hong Kong so it could better serve the companies of the whole region including Japan and Oceania. Eventually, in December 2007, the group’s market share was strengthened in Italy with a more substantial participation in Italian DWA Vita for the sums of 140 million USD.

Despite the disruption triggered by the crisis that started in 2008, a rigorous risk management allowed Zurich Financial Services to overcome this difficulty and to report good results. The group even managed to pursue its expansionist policy by acquiring TEB Sigorta (Turkey) in 2008 and then 21st Century (United States) in 2009.

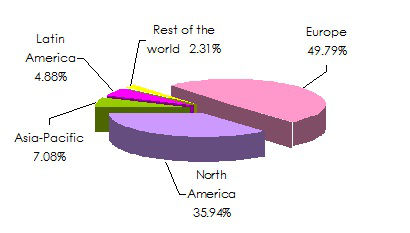

Zurich Financial Services has today 60 000 employees spread out in 170 countries and reported, in 2011, a written premiums volume of 47.748 billion USD. Its biggest life and non life insurance market remains Europe where almost 39% of the written premiums are made, followed by North America with 29%. The group achieved 72.41% of turnover in non-life insurance against 19.75% in life insurance. The network banking activities, reinsurance and asset management account for just 7.84% of the turnover. In 2011, the operating result amounted to 4.26 billion USD compared to 4.87 billion USD in 2010. The equity funds amount to 31.636 billion USD, while its S&P ratings for financial soundness and credit quality are set at AA-.

Breakdown in % of the 2011 turnover per activity

Zurich Financial Services, is in 2011

- a turnover of 47.784 billion USD

- a net profit of 3.792 billion USD

- a shareholder’s equity of 31.636 billion USD

- a combined ratio of 98.8%

- 60 000 staff members

- a presence in 170 countries

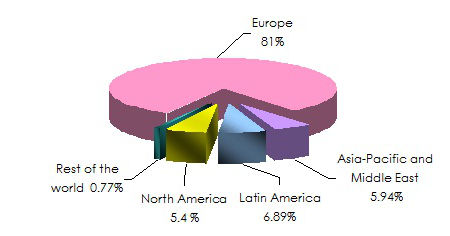

Breakdown in % of the 2011 non life insurance turnover per geographic zone

Breakdown in % of the 2011 life insurance turnover per geographic zone