MENA reinsurance market: 2023's renewal

Even if the reinsurers in the MENA region are evolving in different economic environments, they are nevertheless tapping into interesting business opportunities. The weight of the world leaders, Swiss Re, Munich Re, SCOR is very important, hence the maintenance of a certain underwriting discipline.

Even if the reinsurers in the MENA region are evolving in different economic environments, they are nevertheless tapping into interesting business opportunities. The weight of the world leaders, Swiss Re, Munich Re, SCOR is very important, hence the maintenance of a certain underwriting discipline.

These leaders are very selective, providing their capital according to their underwriting mood. This strategy has helped support local reinsurance markets and rate increases during recent renewals. However, pressure from international reinsurers and, to a lesser extent, African and Asian reinsurers, is resulting in a continuous evolution of the capacities offered.

For the 2023 renewals, cedants from oil and gas exporting countries should be favored. Rising export values should boost economies and attract capacity.

Read also | MENA reinsurance companies rating

Reinsurance in the MENA zone: evolution of premiums and retention rate

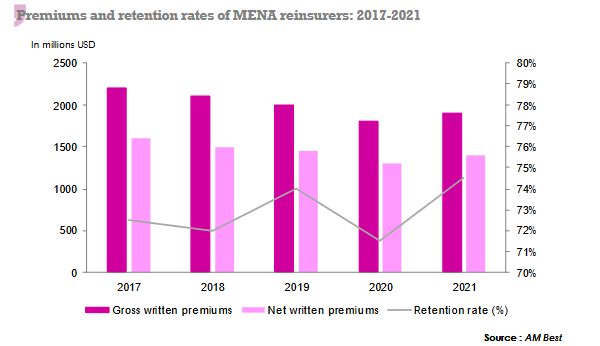

Since 2017, the gross premium volume written by all MENA reinsurers has been declining, a trend accounted for by:

- the disruption and/or slowdown in economic activities during the pandemic period which particularly impacted the 2019-2020 years,

- the increase in cedant retentions,

- the cessation of underwriting by several relatively large local reinsurers as Best Re and the transfer of Qatar Re's headquarters outside the MENA zone.

Moreover, it is interesting to note that in this zone, many local insurers are regaining interest in reinsurance acceptances, an attraction for reinsurance that is particularly exercised in the field of facultative risks, notwithstanding the very bad results reported in the past.

As local insurers do not have the same underwriting discipline as reinsurers, this practice is poised to develop in the short term.

Reinsurance in the MENA zone: combined ratio and return on equity

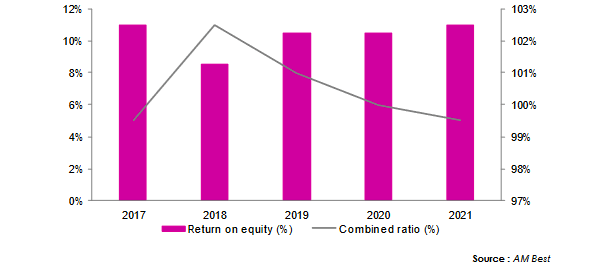

After years of soft markets, local insurers have had great difficulty in achieving good operating results. Continuous improvement in terms and conditions coupled with better discipline have helped to adjust the situation.

The chart below shows that MENA insurers have significantly reduced their combined ratio since 2018 while maintaining a strong return on equity.

Technical ratios of MENA reinsurers: 2019-2021

With the exception of Milli Re and Trust Re, the analysis of technical performance shows relatively low premium loss ratios over three years. However, the imbalance of the portfolios, dominated by large risks, in particular energy risks, leads to heterogeneous results.

This heterogeneity is even more pronounced when it comes to the combined ratio.

| Company | Country | Non-life loss ratio in % | Non-life combined ratio in % | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2019 | 2020 | 2021 | 3-year average | 2019 | 2020 | 2021 | 3-year average | ||

| International General Insurance (IGI) | Jordan | 54.8 | 53.5 | 51 | 53.1 | 94.1 | 88 | 89 | 90.4 |

Société Centrale de Réassurance | Morocco | 35.1 | 45.1 | 46.3 | 42.2 | 81.8 | 92.5 | 88.4 | 87.6 |

Compagnie Centrale de Réassurance | Algeria | 59.4 | 52.7 | 51.4 | 54.5 | 84.3 | 82.2 | 77.8 | 81.4 |

To discover | MENA zone reinsurers: technical ratios 2019-2021