Reinsurance market in 2022

The percentage of reinsured direct premiums reached its highest level in 2022, at 5.9%.

| 2013 | 2017 | 2021 | 2022 | |

|---|---|---|---|---|

| Direct insurance premiums | 4 593 632 | 4 957 507 | 6 764 694 | 6 782 235 |

| Reinsurance premiums (1) | 240 000 | 245 000 | 383 753 | 400 487 |

| % reinsurance / insurance | 5.22% | 4.94% | 5.67% | 5.90% |

(1) Source Atlas Magazine study (2020, 2021 and 2022 premiums of 136 reinsurers). Source AM Best and Swiss Re for 2019 and prior years.

Reinsurance market in 2022: breakdown of life and non-life premiums

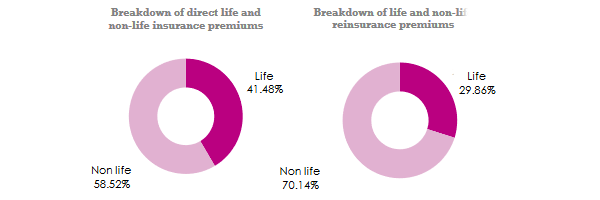

While direct insurance showcases a certain balance between life and non-life premiums, this proportionality disappears in reinsurance, which is largely dominated by non-life underwriting.

With premiums of 280.902 billion USD in 2022, the non-life business accounts for 70.14% of global reinsurance premiums, compared with 58.52% for direct non-life insurance.

Figures in millions USD

| Life insurance | In% | Non-life insurance | In% | Total premiums | In% | |

|---|---|---|---|---|---|---|

| Direct insurance premiums | 2 813 032 | 41.48% | 3 969 203 | 58.52% | 6 782 235 | 100% |

| Reinsurance premiums | 119 585 | 29.86% | 280 902 | 70.14% | 400 487 | 100% |

Reinsurance market concentration

In 2022, the top ten reinsurers accounted for 64% of worldwide premiums, life and non-life combined, or 255.705 billion USD. The top five – Munich Re, Swiss Re, Hannover Re, Canada Life Re and Berkshire Hathaway – accounted for almost 43.56% of total premium income (174.44 billion USD).

Another significant figure is that the top 20 reinsurers accounted for 80.28% of all underwritten business.

Read also | World's largest reinsurers in 2022

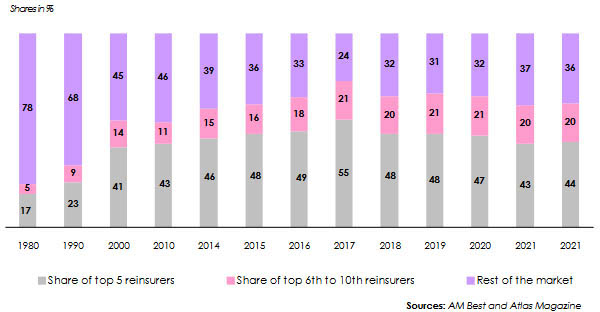

Trends in reinsurance market concentration: 1980-2022

From 22% market share in 1980 to 64% in 2022, the world's top ten reinsurers largely dominate the industry. Concentration peaked in 2017, with the top 10 players accounting for 76% of the market and the top 5 for 55%.

By 2021-2022, a certain stabilization has set in, with rates of 63% and 64% respectively.

Key indicators of reinsurance companies: 2021-2022 (1)

Shareholders’ equity and share capital

In 2022, shareholders' equity for all reinsurers in all zones combined amounted to 926.213 billion USD, down 13.27% on 2021. The share capital of these same players shows a less pronounced decline than shareholders' equity, with a rate of -3.95% reported between 2021 and 2022.

The top 10 reinsurers account for almost 79% of cumulative equity. The rest of the market, some 130 companies, share the remaining 21%.

Berkshire Hathaway alone accounts for almost 52% of the industry's equity. Swiss Re is ranked 13th, well behind Munich Re in 6th place, but ahead of another reinsurance giant, Hannover Re, in 14th place. French reinsurer SCOR is not among the top 20 reinsurers ranked on equity basis.

Net income

In 2022, the reinsurance market has posted a brutal 61.53% drop in net income, going from 52.156 billion USD in 2021 down to 20.062 billion USD in 2022, one of the record years in terms of natural catastrophes. 27 of the top 100 reinsurers in the ranking below have reported losses in 2022, compared with 15 in 2021. Bermuda's Fortitude Re is the reinsurer with the biggest net loss in 2022, at over 7 billion USD.

(1) Atlas Magazine study (Key indicators 2021 and 2022 for 136 reinsurers).

Read also | Reinsurers: ranking per net result

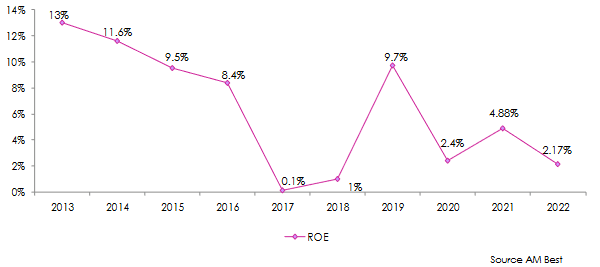

Return on equity (ROE)

Return on equity (ROE) for all reinsurers has reached 2.17% in 2022, the third-lowest rate of return in 20 years. ROE was heavily impacted in 2017 and 2018 by the rise in natural catastrophe claims following the occurrence of three major hurricanes Harvey, Irma and Maria. The market recovered well in 2019 (+9.7%) following the tightening of renewal conditions imposed by reinsurers.

The Covid-19 effect weighed on the fiscal year 2020, which posted a modest ROE of 2.4%.

Read also | Reinsurers: ranking per return on equity

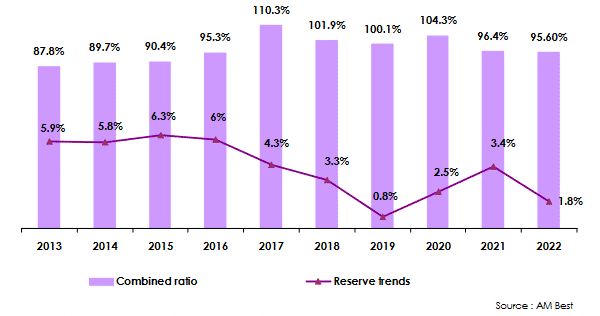

Combined ratio

The combined ratio, which grew steadily from 2013 to 2016 while remaining below 100%, slipped sharply in 2017, the year of hurricanes Harvey, Irma and Maria. This technical indicator remains above 100% for the 2018, 2019 and 2020 financial years. The Covid-19 health crisis weighed on results in 2020, pushing the combined ratio up from 101.9% in 2019 to 104.3% in 2020.

Tariff adjustments made by reinsurers during the 2021 and 2022 renewals contributed to the trend reversal reported over the last two years.

The 2021 financial year ended with a significant improvement in the average combined ratio of 7.9 points, from 104.3% in 2020 to 96.4% in 2021. This downward trend was confirmed in 2022, with a technical profitability gain of 0.8%, despite a high level of natural catastrophe losses exceeding 100 billion USD in 2022.