The CIMA zone insurance market

CIMA in 2020

CIMA in 2020

- Penetration rate: 1%.

- Density: 13.64 USD.

- Life and non-life premiums: 1 369 billion FCFA (2.561 billion USD).

- Life premiums: 484 billion FCFA (905 million USD).

- Non-life premiums: 885 billion FCFA (1.656 billion USD).

- Non-life combined ratio: 80.2%.

- Number of licensed insurance companies: 177.

- Number of reinsurance structures (including regional or foreign subsidiaries and outlets): 19.

- Total number of license withdrawals: 37 (since the establishment of CIMA ).

- Number of employees of insurance and reinsurance companies: 7 558.

- Investments made by all insurers: 2 747.94 billion FCFA (5.138 billion USD).

- Average rate of return on investments: 3.5% in non-life insurance and 2.9% in life insurance.

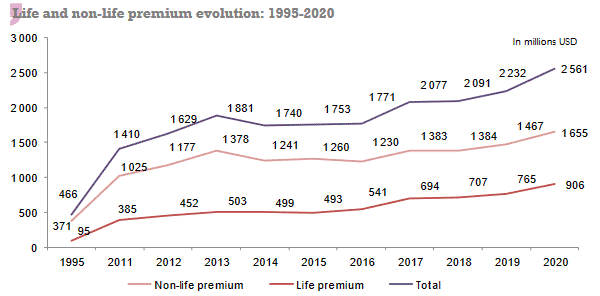

CIMA : premium evolution per life and non-life class of business

From 1995 to 2020, insurance activity in the CIMA zone, all classes of business combined, was multiplied by six. During the same period, life premiums increased ten times, while non-life premiums went up fivefold (1).

The share of life insurance in total premiums has increased by 75% in 26 years, from 20% in 1995 to 35% in 2020, while non-life insurance has declined (80% in 1995 versus 65% in 2020).

| 1995 | 2011 | 2020 | 1995/2020 evolution (2) | 2011/2020 evolution (2) | |

|---|---|---|---|---|---|

| Life premiums | 95 million USD (46.922 billion FCFA) | 384 million USD (199.286 billion FCFA) | 905 million USD (484.192 billion FCFA) | 932% | 143% |

| Non-life premiums | 371 million USD (181.789 billion FCFA) | 1.025 billion USD (531.341 billion FCFA) | 1.656 billion USD (884.892 billion FCFA) | 386.7% | 66.5% |

| Total premiums | 466 million USD (228.711 billion FCFA) | 1.409 billion USD (730.627 billion FCFA) | 2.561 billion USD (1 369.084 billion FCFA) | 498.6% | 87.4% |

| Life insurance shares | 20% | 27% | 35% | - | - |

(1) Evolution in FCFA

Read also | CIMA’s non-life insurance market

CIMA: life and non-life premium evolution per country

With a 30% market share in 2020, Côte d'Ivoire is the undisputed leader in the CIMA zone, with Cameroon and Senegal trailing in second and third place respectively. This top three is followed by Burkina Faso and Gabon. The latter, penalized by the fallout of the economic crisis of recent years, is in fifth position in 2020.

Gabon is even surpassed by Burkina Faso, which, with a growth rate of 181% from 2011 to 2020, is the country in the CIMA zone that has reported the strongest growth in premiums over the past ten years.

In millions USD

| 2011 | 2015 | 2020 | 2011/2020 evolution (1) | 2020 shares | |

|---|---|---|---|---|---|

| Côte d'Ivoire | 351 | 472 | 772 | 127% | 30.2% |

| Cameroon | 272 | 304 | 388 | 47% | 15.2% |

| Senegal | 181 | 201 | 385 | 120% | 15.0% |

| Burkina Faso | 74 | 97 | 203 | 181% | 7.9% |

| Gabon | 179 | 198 | 195 | 12% | 7.6% |

| Togo | 71 | 81 | 128 | 88% | 5.0% |

| Benin | 68 | 78 | 124 | 88% | 4.9% |

| Congo Brazzaville | 75 | 159 | 112 | 54% | 4.4% |

| Mali | 54 | 58 | 106 | 102% | 4.1% |

| Niger | 38 | 49 | 70 | 84% | 2.7% |

| Equatorial Guinea | 23 | 26 | 37 | 68% | 1.4% |

| Chad | 16 | 24 | 28 | 78% | 1.1% |

| Central African Republic | 7 | 5 | 11 | 61% | 0.4% |

| Guinea Bissau | - | - | 2 | - | 0.1% |

| Total | 1 409 | 1 752 | 2 561 | 87% | 100% |

(1) Evolution in FCFA

Read also | CIMA’s life insurance market

Evolution of life and non-life premium evolution: Africa-CIMA comparison

In millions USD

| 2011 | 2015 | 2020 | 2011/2020 evolution | |

|---|---|---|---|---|

| Africa | ||||

| Life premiums | 47 007 | 42 987 | 41 097 | -12.57% |

| Non-life premiums | 22 267 | 20 955 | 19 093 | -14.25% |

| Total premiums | 69 274 | 63 942 | 60 190 | -13.11% |

| CIMA Zone | ||||

| Life premiums | 384 | 492 | 905 | 136% |

| Non-life premiums | 1025 | 1260 | 1656 | 61% |

| Total premiums | 1409 | 1752 | 2561 | 82% |

| CIMA's market share in Africa | 2% | 2.74% | 4.25% | - |

Sources: Sigma 2020 and CIMA annual reports

A comparison of (life and non-life) premiums between the CIMA and Africa zones over the 2011-2020 period shows a significantly higher rate of premium growth for the CIMA zone than for the Africa zone.

Expressed in U.S. dollars, life and non-life premiums reported for the continent as a whole had shrunk by 13% during the period under review, while those in the CIMA zone grew by 82% (1). It is the life class of business, with a growth rate of 136% (2) over the period 2011-2020, that is driving the insurance business in the CIMA zone.

Another striking but modest fact is that CIMA's share of the African premium market continues to grow. Limited to 2% in 2011, it will rise to 4.25% by 2020.

In fact, the CIMA zone countries that use the CFA franc, a currency pegged to the euro, are benefiting from the good performance of the latter currency against the US dollar. At the same time, the main African currencies, in particular the South African Rand, the Nigerian Naira, the Algerian Dinar, the Tunisian Dinar and the Egyptian Pound, are falling heavily against the US currency.

(1) In original currency (FCFA), this same rate increased by 87.4% from 2011 to 2020

(2) In original currency (FCFA), this same rate increased by 143% from 2011 to 2020