AXA group: history and growth

The tremendous rise that will ensue coincides with the arrival of Claude Bébéar, the charismatic head of the company. AXA, headquartered in Paris, which has since become one of the undisputed leaders in the sector with a presence throughout the world. Nevertheless, it was in Normandy that the group kick started.

The tremendous rise that will ensue coincides with the arrival of Claude Bébéar, the charismatic head of the company. AXA, headquartered in Paris, which has since become one of the undisputed leaders in the sector with a presence throughout the world. Nevertheless, it was in Normandy that the group kick started.

The AXA group genesis

Group AXA’s founding company was built in 1816. At that time, Theodore Jacques le Carpentier along with 17 other shareholders, established a mutual insurance company headquartered in Rouen. AXA would inherit both features until 1970. Specializing in non-life insurance, the company was named Compagnie d’Assurances Mutuelles contre l’Incendie (mutual insurance company against fire) in the departments of Seine and Eure. As with any mutual company, policyholders become members, but only for five years. A plate marked with the letters P.A.C.L. (property insured against fire) was then attached to the properties covered by the new insurer.The first major event the company had to face occurred in 1820. The partial destruction of the Rouen Cathedral by fire was a major loss for the young company.

The industrial revolution of the early nineteenth century has profoundly changed the European economic environment. New companies, such as Providence (1838) and la Paternelle (1843), entered the market and embarked on a competition that the insurer had to cope with as a reality in Rouen. Adolphe Lanne, the group’s manager on duty since 1832, decided to set up two new companies: Mutualité Immobilière(1847) and Mutualité Mobilière specializing in movable estate.

During the following decade, the management extended mutuals’ territoriality throughout France while Mutualité Mobilière set foot on the fire market. In 1881 under the management of Masselin, both companies merged under the name of Ancienne Mutuelle and the new life entity, Mutuelle Vie, came into being. Ancienne Mutuelle’s name would remain unchanged until 1977.

The AXA group at the period of European wars

In 1902, all of the offices were gathered in Rouen. Twenty years later, the group embarked on motor insurance through Ancienne Mutuelle Accidents. Its success was immediate and considerably contributed to the profits realized thereafter.

In 1902, all of the offices were gathered in Rouen. Twenty years later, the group embarked on motor insurance through Ancienne Mutuelle Accidents. Its success was immediate and considerably contributed to the profits realized thereafter.

In 1944, Gaston Payenneville, the company’s chairman since 1913, died in his office after a bombing carried out by the Allies. When the war ended, Ancienne Mutuelle was struggling even though Life and Accidents’ entities were less affected.

The arrival in 1946 of André Sahut d’Izarn will mark the beginning of a revival. The group was dotted with a new structure. Its stable and steady progress had lasted until the 1970s. Meanwhile, a succession of mergers with other mutuals would increase the number of policyholders. Ancienne Mutuelle of Calvados (in 1946), Mutuelle d’Orléans (in 1950), Mutualité Générale Vie, the Participation (in 1954) were pooled under its name. In the mid-1950s, the group Ancienne Mutuelle was made up of eight mutual insurance companies and a few commercial insurance companies, all of which subsidiary at 100%.

The internationalization of the AXA group

Under the leadership of André Sahut d’ Izarn, the group will, as of 1955, extend to Canada where it primarily targeted the Quebec market.

On the recommendation of a friend, son of the group’s chairman, Claude Bébéar joined the company in 1958 as executive assistant. A few years later, he left France for Canada, where he joined the insurer Provinces-Unis, a subsidiary company of Ancienne Mutuellel where he developed life business. His mandate ended in 1968.

On the recommendation of a friend, son of the group’s chairman, Claude Bébéar joined the company in 1958 as executive assistant. A few years later, he left France for Canada, where he joined the insurer Provinces-Unis, a subsidiary company of Ancienne Mutuellel where he developed life business. His mandate ended in 1968.

André Sahut d’Izarn passed away in June 1972. In April 1974, a strike hit the entire insurance market for two months. Ancienne Mutuelle was, therefore, paralyzed and a new social policy seemed inevitable. The response came with Claude Bébéar, appointed general manager in 1975. From that date onwards, the history of the group and that of its ambitious leader, known as the insurance "Cowboy" became one. The Nouvel Economiste magazine characterized him as the "avantgardist insurer" in 1988.

Claude Bébéar founded the Ancienne Mutuelle de Réassurance (AM Re) in 1977, itself sprung from Ancienne Mutuelle Transport du Bétail, which was founded in 1939. AM Re became AXA Re in 1989 and was then acquired by Paris Re in 2006.

In 1978, the Compagnie Parisienne de Garantie along with Mutuelle de l’Ouest came under the tutelage of Ancienne Mutuelle. The first will be renamed Mutuelle Parisienne de Garantie, while Ancienne Mutuelle group became Mutuelles Unies. The pool reported a turnover of 160 million EUR in 1980 with 1850 employees worldwide. The overall turnover was then achieved in France.

The AXA group and the global boom of the 1980s

In 1981 the Left came to power with the election of François Mitterrand. Fearing nationalization then in full swing, Bébéar seized the opportunity of controlling the Drouot Group in 1982. This spectacular acquisition dramatically boosted Mutuelle Unies in the forefront of French private insurers with Claude Bébéar becoming chairman of the group.

In July 1985, the group is officially named AXA, more commonly known "group Bébéar." Its president became CEO, quitting the operational department. In April 1986, AXA purchased the company Présence made up of the companies Providence and Secours The latter, then newly merged, operated respectively in life and non life insurance, owning a large network in Europe and France.

In July 1985, the group is officially named AXA, more commonly known "group Bébéar." Its president became CEO, quitting the operational department. In April 1986, AXA purchased the company Présence made up of the companies Providence and Secours The latter, then newly merged, operated respectively in life and non life insurance, owning a large network in Europe and France.

In 1988, AXA group merged with the Compagnie du Midi, whose general manager is Bernard Pagézy. Bernard Pagézy was behind the initiative of fostering cooperation as a move to prevent a takeover by the Italian insurer Generali. Cooperation was shortlived as Claude Bébéar decided to take control of the Compagnie du Midi the following year with the help of Generali itself. AXA became the second French insurer behind Union des Assurances de Paris (UAP). The integration of operations of the Compagnie du Midi, the holding company of Assurances Générales de Paris (AGP), enabled Bébéar to take possession of its enormous international network including Equity & Law, the sixth British insurer.

In February 1989, the group had 42 companies and 16 000 employees. In France, AXA structure shielded it from any threat of hostile takeover thanks to the mutual companies in control of the group. In 1989, Claude Bébéar was the first representative in the world of finance to be distinguished Manager of the Year.

The AXA group: restructuring of the 1990s and external development

The 1990s was marked by a restructuring move affecting operations in France. Claude Bébéar chose a horizontal organization by merging all its group companies into three units, each of which having its own distribution network. The result was a specialization in three areas: AXA Insurance which includes general agents, Uni Europe comprising insurance brokers and Franklin Assurance which covers other retail operations.

The 1990s was marked by a restructuring move affecting operations in France. Claude Bébéar chose a horizontal organization by merging all its group companies into three units, each of which having its own distribution network. The result was a specialization in three areas: AXA Insurance which includes general agents, Uni Europe comprising insurance brokers and Franklin Assurance which covers other retail operations.

In 1990, 27% of the collected premiums were achieved in France. The group was then well established in Europe but had no presence in U.S.A, the largest market in the world. It was in 1991 that the French insurer set foot there by acquiring a majority stake in American The Equitable, just after its demutualization. This occurred after the failure of AXA to buy Farmers in 1990. The Equitable was then a major life insurer that AXA recapitalized and renamed AXA Equitable in 1997.

In 1995, officials in National Mutual Life Insurance Company, the second life insurance company in Australia and Hong Kong, came into contact with Claude Bébéar to help in the process of demutualization. Their goal was to submit a recovery plan identical to that achieved with The Equitable. An agreement was reached. It allowed AXA to recapitalize the company and take its reins. The French group then got introduced in Asia and Oceania, especially as AXA Life became operational in Japan the same year. In 1999, National Mutual changed its name to AXA Asia Pacific.

The year 1996 stands as a major turning point for the group AXA which launched a takeover bid of UAP, the first French insurance company, whose turnover is twice as important. An exchange offer was signed, making AXA the number one insurer in France and worldwide. This position will nevertheless return a year later to Allianz which purchased AGF. AXA, therefore, doubled its size in France and surpassed critical size in Great Britain, Belgium and Germany. The takeover of UAP allowed it to consolidate its presence in other countries. In 1996 the group entered Morocco with the acquisition of Al Amane.

Other acquisitions occurred in subsequent years: In the UK, Guardian Royal Exchange came into the possession of the French group. Taking advantage of Japan's economic difficulties, AXA set foot in the country’s 13th life company, Nippon Dantai. Other Asian companies were then bought out in China (AXA Minmetals), in Turkey (AXA Oyak), in Lebanon (AXA Middle East).

The AXA group in the 2000s, post-Claude Bébéar era

As he had announced, Claude Bébéar yielded his position as president of the management board to Henri de Castries in 2000. He then became chairman of the supervisory board. The beginnings of the new man at the head of the company were marked by the New York attacks whose losses reached 650 million EUR (612 million USD). The consolidation of the group's positions in this market was, nonetheless, pursued with further acquisitions including that of the Mutual of New York in 2004. In 2002, 87% of turnover was generated abroad.

Meanwhile, development in emerging countries became a priority, particularly in Asia:

- opening of an entity in Canton (2004)

- establishment of a joint venture with bank Mandiri in Indonesia (2004) and acquisition of MLC Indonesia (2005). Following these transactions, AXA became the third insurer in the country

- association with local banks in the Philippines and Thailand (2004)

- establishment of AXA Tech in India (2005)

- establishment in Saudi Arabia with AXA Gulf (2005)

The group's strategy was somewhat different in South America:

- withdrawal from the Chilean market in 2002

- withdrawal from Uruguay in 2005

- presence limited to assistance insurance only in Argentina and Brazil

- acquisition of the largest insurer in the Mexican market ING Seguros in 2008

In Europe, AXA took control of the Portuguese company Seguro Directo (2005) and withdrew from the Netherlands in 2007. Switzerland remained a prime target with the acquisition of Winterthur in 2006 and Nationale Suisse Assurance in 2007.

The group announced in early June 2011 its withdrawal from the Canadian market with the sale of its subsidiary company AXA Canada to Intact Financial for 2.7 billion USD.

AXA group's financial strength rating as at 31.12.2010

| Agency | Rating | Outlook |

|---|---|---|

Standard & Poor’s | AA- (very strong) | Stable |

Moody’s | Aa3 (very strong) | Stable |

Fitch | AA- (very strong) | Stable |

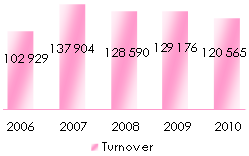

Main technical highlights of the AXA group: 2006-2010

in millions USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

Global turnover of the group | 102 929 | 137 904 | 128 590 | 129 176 | 120 565 |

- Life and savings - Property and casualty - Other operations* | 65 950 25 758 11 221 | 88 143 36 845 12 916 | 81 732 36 708 10 150 | 82 588 37 516 9 072 | 75 441 36 332 8 792 |

Shareholders’ equity | 62 317 | 67 162 | 52 724 | 66 220 | 65 867 |

Solvency margin | 186% | 154% | 127% | 171% | 182% |

Non life combined ratio | 97.70% | 96.90% | 97.60% | 95.50% | 99% |

* Including international insurance, asset management and banking

Exchange rate EUR/USD as at 31/12 | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1.32027 | 1.47285 | 1.40974 | 1.43333 | 1.32530 |

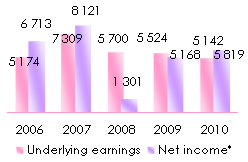

Turnover’s evolution: 2006-2010 in millions USD | Results’ evolution: 2006-2010 in millions USD |

|  |

* For 2010, the net income excludes the exceptional charge of 2.1 billion USD related to the sale of some traditional life and savings business in the United Kingdom.

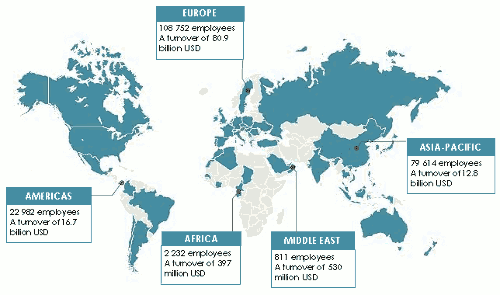

Breakdown of employees and the 2010 turnover per geographic zone *

* The property-casualty and life insurance turnover excludes international insurance, asset management, and banking

* The property-casualty and life insurance turnover excludes international insurance, asset management, and banking By December 31, 2010, AXA had 95 million customers worldwide and managing 214 391 employees and exclusive distributors (60% of whom are based in Europe). The 2010 turnover reached 91 billion EUR (120 billion USD), 63% of which in life-retirement savings and 30% in the non life insurance. The remaining turnover is split between asset management, banking and other insurance operations. Operating results amounted to 3.88 billion EUR (5.14 billion USD) with a non-life combined ratio of 99.1%.

The capitalization of the company was at the end of 2010 up to 27.4 billion EUR (36.3 billion USD), mainly distributed among institutional investors in North America (18.8%), France (16.5%), Great Britain and Ireland (11.5%), Germany (3.6%) and the Benelux countries (3%). BNP-Paribas owns 5.4% of the capital. Employees, all shareholders, hold 6.5% of the company.

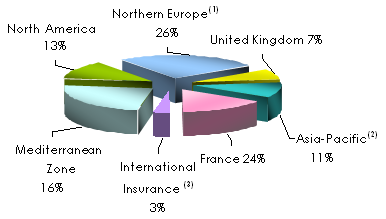

Breakdown in % of the 2010 insurance activities per geographic zone

1 Including Central and Eastern Europe 2 Including Japan 3 Excluding AXA Re

1 Including Central and Eastern Europe 2 Including Japan 3 Excluding AXA Re Main technical highlights of the AXA group: 2010-2017

in millions USD| Year | Turnover | Net result | Shareholder's equity | Non life combined ratio |

|---|---|---|---|---|

2017 | 118 066 | 7 439 | 83 384 | 96.30% |

2016 | 105 576 | 6 142 | 74 393 | 96.50% |

2015 | 107 233 | 6 138 | 74 850 | 96.20% |

2014 | 111 823 | 6 107 | 79 259 | 96.90% |

2013 | 125 592 | 6 171 | 72 832 | 96,60% |

2012 | 119 129 | 5 363 | 68 998 | 97.70% |

2011 | 111 509 | 5 426 | 60 088 | 97.90% |

2010 | 118 498 | 3 643 | 65 865 | 99.50% |

The major acquisitions made by the AXA Group since its creation

| Year | Country | Company name |

|---|---|---|

1946 | France | Ancienne Mutuelle du Calvados |

1950 | France | Mutuelle d'Orléans |

1954 | France | La Participation |

1968 | Canada | Provinces-Unies |

1978 | France | Compagnie Parisienne de Garantie |

1978 | France | Mutuelle de l'Ouest |

1982 | France | Groupe Drouot |

1986 | France | La société Présence |

1988 | France | La Compagnie du Midi |

1982 | United Kingdom | London & Hull |

1987 | United Kingdom | Equity & Law |

1991 | United States | The Equitable |

1994 | Canada | Boréal Assurances |

1994 | Belgium | Victoire Belgium |

1995 | Australia | National Mutual |

1996 | France | Union des Assurances de Paris (UAP) |

1996 | Morocco | Al Amane |

1999 | United Kingdom | Guardian Royal Exchange |

1999 | Japan | Nippon Dantai |

2000 | United Kingdom | Sun Life & Provincial Holdings |

2004 | United States | MONY: Mutual of New York |

2004 | Indonesia | MLC |

2005 | Portugal | Seguro Directo |

2006 | Switzerland | Winterthur Group |

2007 | Switzerland | Nationale Suisse assurance |

2007 | United Kingdom | Swiftcover.com (direct insurance) |

2007 | South Korea | Kyobo Auto |

2007 | Ukraine | Vesko |

2008 | Mexico | ING Seguros |

2013 | Germany | Several international subsidiaries of Global Reinsurance |

| 2014 | China | Tian Ping Auto Insurance Company |

| 2015 | Philippine | Charter Ping An Insurance |

| 2015 | Nigeria | 7.15% of Africa Re |

| 2015 | India | Bharti Group |

| 2015 | Brazil | SulAmérica Companhia de Seguros Gerais |

| 2018 | Bermuda | XL Group |