Compagnie d’Assurance et de Réassurance Tuniso-Européenne (CARTE)

As for most companies at that time, the establishment of the new company resulted from a partnership between foreign insurers and Tunisian individuals or companies.

It is in this context that the group Doghri persuaded MGFA, a leading French insurers in North Africa in the 60s and Préservatrice Foncière, another French player, to consolidate their portfolio into a joint structure.

This Doghri-MGFA partnership strengthened in 1986 with the rise of the two partners in the capital of the company. Ever since, CARTE leaders have been free to develop with the support of a renowned technical partner.

CARTE is today one of the major market players with a balanced portfolio and a leading position in industrial risks.

In 2011, the group diversified by creating a company specializing in life insurance: CARTE Vie.

|  |

| Hassine Doghri | Afifa Boughzou |

| Chief executive officer CARTE Assurances (non life) | General manager CARTE Vie (life) |

in USD

| The 2012 indicators | CARTE Assurances | CARTE Vie |

| Share capital | 16 139 500 | 3 227 900 |

| Turnover | 49 862 075 | 18 080 684 |

| Total assets | 161 157 538 | 58 661 162 |

| Shareholder’s equity | 55 425 890 | 14 381 355 |

| Technical result | 705 607 | 1 943 165 |

| Net result | 5 855 556 | 1 355 391 |

| Staff members | 161 | 27 |

| Number of branches and agencies1 | Three branches and 50 agencies | |

1 The branches and agencies are common to both companies

CARTE Assurances

Direction

| Chief executive officer | Hassine Doghri |

| Central manager, third party liability, construction | Nebil Zitouni |

| Central manager, motor | Sadok Gmiza |

| Central manager, property and marine | Naceur Chamekh |

| Manager, sales and development | Mehdi Doghri |

| Reinsurance manager | Fairouz Ghanjati |

| Manager, health, pension and travel assistance | Zied Karou |

| Manager, network inspection | Elyes Idir |

| Manager, finance and administration | Salima Ben Mami |

| Assistant manager, IT system | Ahmed Zaibi |

Shareholders

| Hassine Doghri | 49.002% |

| S.E.P.C.M | 26.323% |

| Investment certificates | 10.000% |

| UTP | 9.050% |

| STEC | 5.485% |

| Other shareholders | 0.140% |

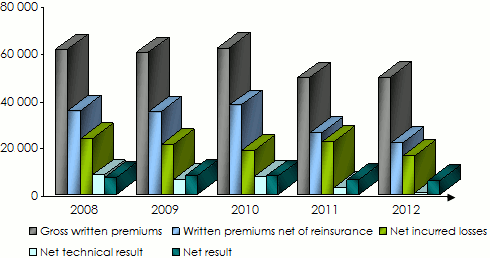

Main technical highlights: 2008-2012

in USD

| 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|

Gross written premiums | 61 242 282 | 59 986 921 | 62 029 402 | 49 464 145 | 49 862 075 |

Written premiums net of reinsurance | 35 545 334 | 34 998 742 | 37 660 608 | 26 272 903 | 21 825 915 |

Net earned premiums | 34 883 279 | 35 137 343 | 36 645 447 | 25 314 155 | 21 202 813 |

Gross incurred losses | 24 647 565 | 39 843 870 | 24 615 220 | 40 762 249 | 21 613 506 |

Net incurred losses | 23 521 957 | 21 136 216 | 18 532 015 | 22 287 560 | 16 399 879 |

Management expenses 1 | 8 059 854 | 8 507 825 | 9 137 650 | 6 980 071 | 7 108 700 |

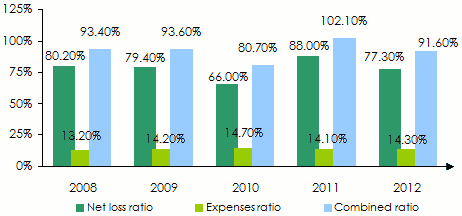

Net loss ratio 2 | 80.2% | 79.4% | 66.0% | 88.0% | 77.3% |

Expenses ratio 2 | 13.2% | 14.2% | 14.7% | 14.1% | 14.3% |

Combined ratio 1 | 93.4% | 93.6% | 80.7% | 102.1% | 91.6% |

Net technical result | 8 220 917 | 6 325 852 | 7 518 966 | 2 897 050 | 705 607 |

Financial income | 7 702 447 | 7 897 213 | 6 655 969 | 2 370 346 | 3 088 054 |

Net result | 7 260 973 | 8 176 652 | 7 777 198 | 6 348 206 | 5 855 556 |

1 Including administration and acquisition costs

2 Relating to non life insurance only

Evolution of premiums, losses and results: 2008-2012

in thousands USD

Evolution of ratios: 2008-2012

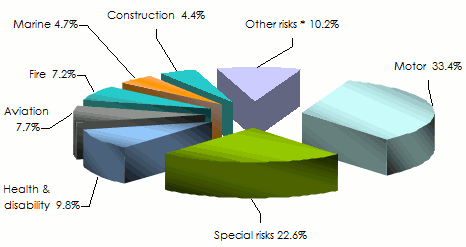

Turnover’s breakdown per class of business: 2008-2012

in USD

| 2008 | 2009 | 2010 | 2011 | 2012 | 2012 shares | |

|---|---|---|---|---|---|---|

| Non life | ||||||

Motor | 16 323 488 | 16 036 780 | 16 473 580 | 16 651 704 | 16 671 575 | 33.4% |

Third party liability | 1 116 603 | 1 287 895 | 1 348 610 | 1 441 814 | 2 038 641 | 4.1% |

Fire | 3 365 646 | 3 234 227 | 3 255 110 | 3 808 825 | 3 606 706 | 7.2% |

personal accident | 1 057 184 | 1 089 789 | 1 188 360 | 1 249 740 | 768 717 | 1.6% |

Special risks | 14 682 326 | 11 306 499 | 13 273 378 | 11 546 893 | 11 285 920 | 22.6% |

Aviation | 3 278 105 | 3 806 562 | 3 204 354 | 3 533 647 | 3 825 694 | 7.7% |

Marine | 2 592 402 | 2 293 440 | 2 411 387 | 2 342 871 | 2 354 663 | 4.7% |

Health & disability | 4 731 378 | 4 306 644 | 3 969 485 | 4 523 107 | 4 868 618 | 9.8% |

Assistance | 2 114 181 | 1 838 069 | 2 009 520 | 2 132 376 | 2 179 159 | 4.4% |

Construction | 3 715 662 | 2 508 915 | 1 900 403 | 1 829 945 | 2 204 030 | 4.4% |

Other risks | 69 882 | 131 566 | 74 857 | 70 719 | 52 719 | 0.1% |

Acceptances | - | - | 37 294 | 332 504 | 5 633 | 0.0% |

Total non life | 53 046 998 | 47 840 386 | 49 146 338 | 49 464 145 | 49 862 075 | - |

| Life | ||||||

Total life | 8 195 284 | 12 146 535 | 12 883 064 | - | - | - |

Total | 61 242 282 | 59 986 921 | 62 029 402 | 49 464 145 | 49 862 075 | 100% |

Turnover’s breakdown per class of business in 2012

* Including third party liability, personal accident, assistance and acceptances

* Including third party liability, personal accident, assistance and acceptances

CARTE Vie (Life)

Management

| Chairman of the board | Hassine Doghri |

| General manager | Afifa Boughzou |

Shareholders

| CARTE Assurances | 96.76% |

| Hassine Doghri | 2.00% |

| COFITE SICAF | 1.00% |

| Other shareholders | 0.24% |

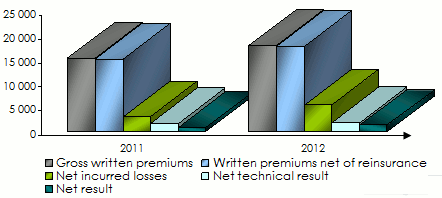

Main technical highlights: 2011-2012

in USD

| 2011 | 2012 | |

|---|---|---|

Gross written premiums | 15 450 248 | 18 080 684 |

Written premiums net of reinsurance | 15 262 003 | 17 861 874 |

Gross incurred losses | 3 216 699 | 5 786 605 |

Net incurred losses | 3 093 919 | 5 662 006 |

Management expenses 1 | 5 600 717 | 5 962 793 |

Expenses ratio 1 | 36.3% | 33% |

Net technical result | 1 679 392 | 1 943 165 |

Financial income | 1 992 582 | 2 335 094 |

Net result | 854 564 | 1 355 391 |

1 Including administration and acquisition costs in thousands USD

Exchange rate TND/USD as at 31/12 | 2008 | 2009 | 2010 | 2011 | 2012 |

0.78412 | 0.76309 | 0.7009 | 0.66896 | 0.64558 |

CARTE Assurances

| Head office | Immeuble CARTE-Lot BC4 Centre Urbain Nord 1082 Tunis |

| Phone | (+216) 71 184 000 |

| Fax | (+216) 71 184 184 |

contact [at] carte [dot] com [dot] tn | |

| Website |

CARTE Vie

| Head office | Entrée B, immeuble CARTE Lot BC4 Centre Urbain Nord 1082 Tunis |

| Phone | (+216)71 184 154 |

| Fax | (+216) 71 184 170 |

contact [at] carte [dot] com [dot] tn | |

| Website |