Construction insurance

In France, the craft has been completed and formalised by the Napoleon Code according to a model that has been adopted by a number of countries, namely African ones.

Decennial liability insurance: A French exception

The Grand Palais, Paris, 1899 The Grand Palais, Paris, 1899 |

The first contractors' liability schemes date back to the mid XIXth century. In their current pattern, the construction insurance plans had been set up between the two World Wars in relation to the development of concrete building.

The initiative is that of professional pools such as the Mutuelle des Architectes Français (MAF) and the Société Mutuelle d'Assurances du Bâtiment et des Travaux Publics (SMABPTP), the market's main players so far, as well as the oversight firms such as Veritas and Socotec.

The first insurance obligation imposed on contractors building for cheap housing entities dates back to 1928.

The French legislation

- 1804: According to the French civil code, the architects and contractors' liability is subjected to special dispensations to common law. The 1792 article of the civil code then stipulated that “if the erected building should partially or wholly collapse as a result to a faulty construction or even due to a faulty soil, architects and contractors are to be held responsible for the failure for a ten-year period”.

- 1967: The January 3, 1967 law remodels the notion of decennial liability and institutes, along with this liability, a biannual guarantee for petty works.

- 1978: An inter-ministerial commission was set up in order to submit proposals for the reform of the construction insurance. The “Spinetta Report” is at the origin of the January 4, 1978 law, also called the “Spinetta Law”.

The spirit of the law

The law stems from the serious finding established by the Spinetta commission which pointed out to:

- the excessive periods for the claim settlement

- the significant rise in incurred losses

- the serious insurance deficit for the construction sector

The Spinetta law objectives: The institution of a double-spring system

For the Spinetta commission, construction insurance needs to undergo a profound reform. The proposed remedy is simple: to give priority to compensation over the search for responsibility. The law plays out under two aspects:

to institute a pre-funding mechanism allowing a swift compensation for the disorder. A compulsory insurance should, therefore, be imposed on the contracting authority in the form of a property insurance baptised “Damage to the works policy” underwritten by the contracting authority. This work damage policy will be key to the new decennial insurance scheme.

to institute a pre-funding mechanism allowing a swift compensation for the disorder. A compulsory insurance should, therefore, be imposed on the contracting authority in the form of a property insurance baptised “Damage to the works policy” underwritten by the contracting authority. This work damage policy will be key to the new decennial insurance scheme.- to submit the various stakeholders in the building process to the obligation of underwriting “liability insurance” in order to possibly sanction their own mistakes.

The main provisions of the Spinetta reform

- Distinction between construction and equipment functions

The law defines clear-cut distinctions between the function of construction which pertains to decennial liability and that of equipment which relates to the two-year “common law” guarantee.

- The different types of liabilities

- the guarantee of due completion: lasting one year

- decennial guarantee, lasting ten years

- the biannual guarantee of good working order, lasting two years

- Acceptance

The entire system is set around the notion pertaining to the date of acceptance. Acceptance is, therefore, regulated with extreme accuracy. Acceptance is “the act through which the contracting authority acknowledges receipt of the work with or without reservation”.

- The persons bound to construction insurance

Are submitted to the obligation of insurance:

- the proprietor of the work

- the representative officer of the work proprietor

- the vendor of the building to build or the completed one

- the developer

- the natural person that is building the house for personal use or for the benefit of spouse, ascendants or descendants.

- the constructor of individual lodgings

Only the State is exempt from insurance obligation.

- Underwriting date, effective date of construction insurance

Underwriting date: the policy has to be written before the opening of the work site.

Underwriting date: the policy has to be written before the opening of the work site.

The effective date: It differs from the underwriting date. The policy is effective only one year following acceptance, that is, on the expiry of the deadline for the due completion guarantee.

The covered risks by the construction insurance

The insurance guarantees all damage repair works for which contractors are held responsible in conformity with the law (article 1972 of the civil code). Also covered under the same scheme, are works pertaining to demolition, clearing, or possibly needed depositing or dismantling works.

The compulsory legal guarantees regard repair works affecting:

- the solidity of the work

- inaccuracy on destination

- the solidity of indissociable equipment components

- collapse resulting from faulty construction

Facultative guarantees may be granted by insurers. They pertain mainly to:

- the guarantee of good working order: damage regarding equipment elements that can be removed or replaced without deteriorating constituent elements.

- immaterial damage following material damage.

- The amount of the guarantee

The guarantee covers the total cost of the works required for the restoration of the buildings or equipment elements following a loss. For practical reasons, contracts provide for a standard amount that can be derestricted.

- Claim indemnification

Fifteen days is the time allotted to the insurer in order to pay the claim. This period of time starts when the insured acknowledges acceptance of the compensation fee proposed by the insurer.

Construction insurance: Decennial liability in the Maghreb and in French-speaking Africa

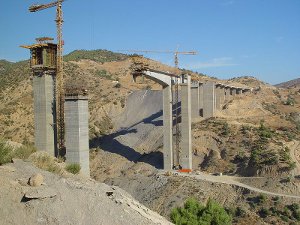

A highway bridge near Aïn Turk, Algeria A highway bridge near Aïn Turk, Algeria |

The Maghreb insurers along with their counterparts in many French-speaking countries in sub-Saharan Africa do write decennial liability risks, which is often mandatory. The guarantees offered, however, are more restricted than in France. In most cases, such guarantees are confined to collapse or the threat of collapse.

Construction insurance: Problems and shortcomings of Decennial Liability

- Monitoring insurance obligation

Even when rendered compulsory, decennial insurance remains well below the expected level. Many works are not insured, and the authorities cannot manage to impose compliance to the insurance obligation.

- The market organisation

Green Point Stadium, Capetown, South Africa © Alex@Eddi , CC BY SA-3.0 Green Point Stadium, Capetown, South Africa © Alex@Eddi , CC BY SA-3.0 |

The environment of the construction insurance remains hardly favourable to the underwriting of decennial liability risks. Quite often, the market organisation does not allow the monitoring of construction operations as required by insurers: non-registered oversight offices, absence of procedures and standards governing construction.

- Problems of capacity

The development of decennial liability insurance is often hindered by a serious problem of capacity. Very few insurers are willing to write such risks. The market is monopolised by a few reinsurers such as SCOR, Swiss Re and XL Re which, in the absence of a structured construction market and thorough statistics, remain reluctant in terms of getting engaged on markets showing guarantees well below their criteria.

- Pool creation

To make up for this lack of capacity at the international level, the local insurers are often bound to get organised in pools like Tunisia where Tunis Re is running the Tunisian decennial liability pool. This pool grants an automatic underwriting capacity to its members and mobilises the local market retention. Recourse to foreign reinsurance is resorted to only after local capacities have been exhausted.

The current situation of decennial liability insurance on the French market

Following the years of stagnation and deficit, construction insurance has started to recover in 2005. This recovery is accounted for by the stabilisation of the loss ratio, tariff increases and the growth reported by the housing market.

Following the years of stagnation and deficit, construction insurance has started to recover in 2005. This recovery is accounted for by the stabilisation of the loss ratio, tariff increases and the growth reported by the housing market.

In 2005, the construction insurance sector reported a 20% increase in its turnover with 2 billion EUR (2.4 billion USD) premiums received, and 231 million EUR (273.60 million USD) profits. In 2006, the turnover has amounted to 2.3 billion EUR (3.03 billion USD), that is, 5.3% of the total insurance sector.

The market is characterized by the frequency of non-insurance and by a deficit in risk mutualisation, which is at the origin of the high tariffs.

It is estimated that one third of the 250 000 individual houses on site are not covered by the compulsory Damage to the Works insurance mainly because of the premium's high cost (4000 to 5000 EUR i.e 5806 to 7258 USD), and the regulation in force which requires recourse to an architect only for lodgings whose area is above 170 m2.

Costly claims

Terminal 2E of the Roissy Charles de Gaulle Airport (modified picture) © Christoph Mendt , CC BY 2.0 Terminal 2E of the Roissy Charles de Gaulle Airport (modified picture) © Christoph Mendt , CC BY 2.0 |

Claims are setting the insurance business back 1 billion EUR (1.4 billion USD) a year. Among the most important losses of recent years stands the collapse of Terminal 2E of the Roissy Charles de Gaulle Airport in May 2004. The reconstruction of the terminal roofing is set to cost insurers 150 million EUR (217 million USD).

Huge but difficult projects to insure

In view of the Business' precarious balance, most of the big projects whose cost rises above50 million EUR (70 million USD) cannot find insurers or reinsurers to cover the whole system. The projects which have recently experienced difficulties in finding decennial liability insurance are:

- the Museum of the Arts Premiers, Quai Branly in Paris

- the Generali Tower in the district of La Défense (estimated cost between 500 and 700 million EUR i.e 725 million and 1 billion USD)

- the Museum of Confluences in Lyon

Profile of a leader

Set up in 1859, the SMABTP Group, the Société Mutuelle d'Assurances Bâtiment et des Travaux Publics), (the Mutual Company of Construction and Public Works Insurance) accounts for 30% of the construction insurance market and has over 100 000 members: firms, craftsmen, project managers, contractors and all those who are involved in the construction business.

In 2006, the SMABTP Group represented:

- 115 300 insured

- 1 836 million EUR (2 665 million USD) turnover

- 13.02 billion EUR (18.90 billion) of current assets

- it gathers 2 057 collaborators spread out throughout the entire French territory.

News: One of the world leaders in construction insurance, the Bermudan XL Insurance has announced in September 2007 the increase of its underwriting capacity from 40 million USD to 100 million USD per project.