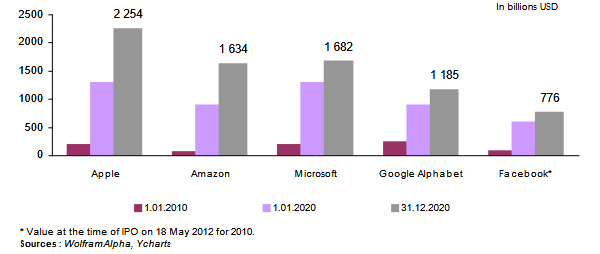

GAFAMs' market capitalization

The market capitalization of the five companies united under the acronym GAFAM exceeds the GDP of a country like Japan.

Compared to insurers, Berkshire Hathaway, a conglomerate that includes an insurance entity, has the largest market capitalization as of 31 December 2020 with about 537 billion USD, four times less than Apple.

Market capitalization of GAFAMs and leading insurers and reinsurers

In billions USD| Company | Country | Creation date | Capitalization * | |

|---|---|---|---|---|

| 2019 | 2020 | |||

| GAFAMs | ||||

Apple | United States, California | 1976 | 1305 | 2254 |

Microsoft | United States, New Mexico | 1975 | 1203 | 1682 |

Amazon | United States, Seattle | 1994 | 916.150 | 1634 |

Google/Alphabet | United States, California | 2015 | 922.130 | 1185 |

Facebook | United States, Massachusetts | 2004 | 585.320 | 776.590 |

| Leading insurers | ||||

UnitedHealth Group | United States | 1977 | 279.322 | 329.355 |

Ping An Insurance Group | China | 1988 | 221.486 | 225.275 |

Allianz | Germany | 1890 | 109.507 | 98.652 |

Anthem | United States | 2004 | 76.242 | 79.998 |

Axa Group | France | 1816 | 66.824 | 56.894 |

| Leading reinsurers | ||||

Berkshire Hathaway | United States | 1962 | 552.721 | 537.519 |

Munich Re | Germany | 1880 | 41.666 | 41.780 |

Swiss Re | Switzerland | 1863 | 34.073 | 24.410 |

Hannover Re | Germany | 1966 | 23.279 | 19.383 |

Scor | France | 1970 | 7.786 | 6.089 |

* Capitalization as at 31 December

Source : Atlas

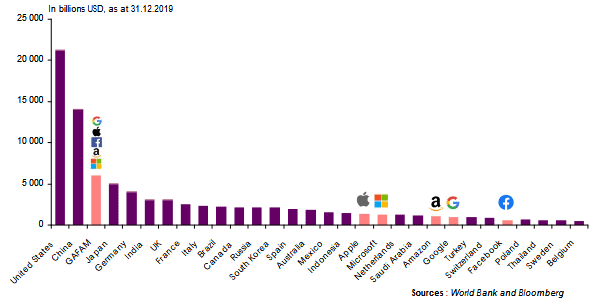

Comparison of 2019 GDP and GAFAMs’ market valuation

At the end of 2019, the cumulative valuation of the five GAFAMs makes this group the third largest economic power in the world after the United States and China and ahead of Japan, Germany and India.

Apple, the first of the GAFAMs, is in the 17th position, followed by Microsoft. The two Internet giants are ahead of countries like the Netherlands and Saudi Arabia.

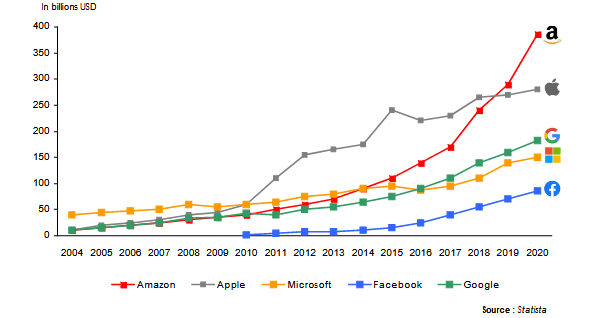

Evolution of the GAFAMs' turnover

GAFAMs owe their success to the free services they offer to users. In fact, their wealth comes from their customer relationships and the advertising revenues they generate.

This illusion of free services, a real magic trick, is put forward by these giants of the digital economy who don't seem to sell new products and only seem to play an interface role. Yet their annual turnover amounts to hundreds of billions USD.

From 2010 to 2020, that is, over 10 years, GAFAMs' premiums have increased by 455%. Over one year, from 2019 to 2020, these web giants’ turnover increased by 19%. At the same time and during the same period, the turnover of insurers has increased by 7.52% and that of reinsurers by 13.46%.

Evolution of GAFAMs’ turnover

In billions USD| 2010 | 2019 | 2020 | 2019-2020 evolution | |

|---|---|---|---|---|

Amazon | 34.2 | 280.52 | 386.06 | 37.62% |

Apple | 65.2 | 260.174 | 274.52 | 5.51% |

Google | 29.3 | 160.47 | 181.69 | 13.22% |

Microsoft | 62.48 | 125.84 | 143.02 | 13.65% |

Facebook | 2 | 70.697 | 85.965 | 21.60% |

| Total | 193.18 | 897.701 | 1071.255 | 19.33% |

Source : Statista

Turnover evolution of the leading insurers and reinsurers

In billions USD| 2019 | 2020 | 2019-2020 evolution | |

|---|---|---|---|

| Leading insurers | |||

UnitedHealth Group | 189.699 | 201.478 | 6.21% |

Ping An Insurance Group | 113.774 | 122.243 | 7.44% |

Axa Group | 112.093 | 118.799 | 5.98% |

Anthem | 94.775 | 104.109 | 9.85% |

Allianz | 92.858 | 101.927 | 9.77% |

| Total | 603.199 | 648.556 | 7.52% |

| Leading reinsurers | |||

Munich Re | 37.859 | 45.839 | 21.08% |

Swiss Re | 36.164 | 36.579 | 1.15% |

Hannover Re | 25.306 | 30.417 | 20.20% |

Scor | 18.300 | 20.104 | 9.86% |

Berkshire Hathaway | 16.952 | 19.761 | 16.57% |

| Total | 134.581 | 152.7 | 13.46% |

Source : Atlas

Faced with this new world of the net which is shaking them up and imposing itself on them, insurers seem to be taken by surprise. Despite their age, some of them more than a hundred years old, the leaders of the profession have never been able to exploit and deepen the customer relationship in the same way as the insurtechs did at first and as the GAFAMs are currently doing, with only twenty years on the block.

Static and hardly innovative, insurers have suffered a first shock with the arrival of insurtechs, young companies whose strategy is fundamentally opposed to theirs. These vibrant and creative companies, often of modest size, base their approach on the complete use of customer relationship, building tools that match the profiles of the insured.

The arrival of the GAFAMs with their colossal financial means and their gigantic databases is finally knocking out the insurers. The first named represent a more significant threat than the insurtechs.

The net giants have capital, a perfect mastery of the internet chain and distribution platforms; three levers that facilitate their penetration in the insurance sphere.