Gulf States, is it Gold Rush, Act II ?

Burj Khalifa © Imre Solt , CC BY-SA 3.0

Burj Khalifa © Imre Solt , CC BY-SA 3.0 It is the oil discovery by British companies as of the 1940s which boosted on the international scene these costal Gulf States which used to rely on land and maritime trade, fishing and cultured pearl for their livelihoods.

Within this set of small-scale principalities, Saudi Arabia, which possesses a shore endowed with an outlet on the Gulf and the Red Sea, stands as a colossus in terms of its area, population as well as of its status as the world's number one oil exporter.

With the growing energy needs of the world economy and the runaway prices of black oil, the region, being endowed with substantial hydrocarbon stocks, is henceforth confirmed as a prime financial market and as a very attractive business hub.

The United Arab Emirates

Having been under British mandate since the 19th century, several small countries have first merged into an entity called the Truce States' Council, which became in 1971, the United Arab Emirates, a federal State comprising seven neighbouring emirates, Abu Dhabi, Ajman, Sharjah, Dubai, Fujairah, Ras Al- Khaimah and Umm Al- Quwain.

© Hégésippe Cormier (modified picture), CC BY-SA 3.0

© Hégésippe Cormier (modified picture), CC BY-SA 3.0 The Gulf Cooperation Council

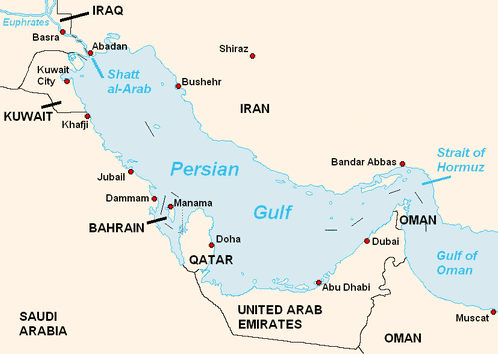

Set up in 1981, the Gulf Cooperation Council comprises six regional states: Saudi Arabia, Kuwait, Oman, Qatar, Bahrain, and United Arab Emirates. Apart from the common defence policy, GCC endeavours for the institution of a common market and for the adoption of a unique currency in 2010.

Management of the oil manna

Port of Jebel Ali, Dubai © Imre Solt, CC BY-SA 3.0 Port of Jebel Ali, Dubai © Imre Solt, CC BY-SA 3.0 |

Unlike previous decades when a large portion of their revenues was invested in the West, the Gulf producing states have come to a change of strategy. Henceforth, they are investing further more in the region. This trendy change is accounted for by several factors.

The perspective of depleting reserves compels these countries to come up with alternative solutions to the post-oil era.

The asset freeze measure and the stiff control on financial flows exercised by the United States within the framework of its campaign to combat terrorism have led to the reflux of Middle Eastern capital. The recent bankruptcies and crises sustained by the American financial markets have induced producing countries to be more cautious and to withdraw their assets. This awareness has led this money to be used either for the economic development of these countries or in the context of trade globalisation, as a leverage tool on the financial markets where they aspire to become the main stakeholders.

Record high revenues to serve mega projects

Palm islands

Palm islands The six GCC countries stand as the 16th world economic power with a steadily-growing GDP which is poised to maintain the growth trend up to 2012.

With the current price hike that seems unstoppable, the oil manna which is spilling over the region has reached enormous figures. If we consider the average price of 100 USD for the oil barrel, the six GCC member states' revenues would amount to 1400 billion USD in 2008, and records will only keep coming.

The investments forecast up to 2020 are estimated at 3 200 billion USD, which makes the region look like an immense work site. All sectors of activities are involved: industries, infrastructure, real estate, tourism, communication, transport, education, culture and media. Colossal projects have been launched. Ports, airports, bridges, artificial isles, new cities are being erected with an overdose of luxury and new technology, as if an undeclared contest as to who would build the world's highest tower, the most spectacular commercial compound, the most prestigious media-covered or cultural athletic event.

900 hotel projects are listed for the whole region along with the acquisition of 875 big carrier aircrafts. According to the International Air Transport Association IATA, the Gulf countries are reporting the highest passenger-cargo air traffic (+18,1% in 2007).

The insurance market

A limited market

The housing frenzy and the multiplication of big-budget projects are creating large business opportunities for the insurance industry in a market that remains of limited dimension, though. In 2006, the insurance penetration rate (1.1%) and the per capita premium (about 500 USD) are below the average rates of the industrialized countries (4 000 USD).

The Saudi market is an exceptional case with insurance being prohibited there until the promulgation of a law in 2003 which allowed the establishment of about 47 companies, ever since.

But generally speaking, the local market is characterized by the proliferation of small-scale players on a cramped territory. Most of the companies have ties with industrial groups with captive business portfolios. The weakness of the insurance base is accounted for by that of the population. By cultural tradition, the population is not inclined to recourse to insurance, especially in the life class of business which accounts for a meagre share of the market (11%). The presence of a large population of immigrant workers has not been directly beneficial to the sector, with most of the savings being sent to the countries of origin.

A market with a high-potential growth

© Jjflavor, CC BY-SA 3.0 © Jjflavor, CC BY-SA 3.0 |

The regional market is endowed with unquestionable assets which provide it with an annual growth potential of about 25 to 30%. The turnover has doubled in the course of the recent five years. In 2006, the overall premium volume has amounted to 5.9 billion USD.

These perspectives account for the influx of numerous foreign investors on the market, targeting market shares in the coverage of the risks pertaining to the on-going mega projects.

The rising income and standard of living of the population triggers new consumption patterns and behaviours as well as new needs in terms of financial services. The governments' voluntarist action in the field of regulations plays a key role in the current evolutions.

Apart from the legislative incentives created, the institution of a compulsory insurance in various classes of business like motor, housing, health for the staff members of the private sector has had a ratchet effect on the local market.

The population growth is likely to boost insurance development, namely in the life and savings classes of business.

According to the experts' assessment which estimated its turnover at between 7 billion and 14 billion USD up to 2015, the takaful insurance segment, which is gathering momentum, stands as a key leverage tool for the sector's development.

This trend is stressed by the arrival of world insurance majors, which is generating a stimulating competition in terms of service and products quality improvements. Up to 2008, the big companies which have set foot on the market are: Royal & Sun Alliance (R & SA), AIG, AXA, Allianz, Mapfre, Hannover Re, Zurich International Life, Prudential, Aviva.

Today's risks and future perspectives

© Imre Solt, CC BY-SA 3.0 © Imre Solt, CC BY-SA 3.0 |

Is the economic miracle of the Gulf States not going to turnout as misleading as the desert mirage?

The question is not as unseemly as it first appears. Some analysts are starting to make reservations as to the solidity and especially the sustainability of such a success story and on the real resources at the disposal of these countries to ensure a balanced social and economic development.

The region is indeed on the roll, with the fashion effect on top of it, it is the destination towards which everyone is rushing. Big conferences are being held there along with award ceremonies for the best operators of the year. Scholarly studies and numerous publications are dedicated to it and new companies are being established there on a daily basis. Yet again, economic phenomena, unknown so far, are taking place. Unemployment is emerging in demanding sectors requiring high professional qualifications. Social movements are claiming wage revaluation. Inflation, fermented by excess liquidity, is taking alarming proportions. Furthermore, the population is faced with the runaway prices of foodstuffs, real estate, lands and services. In a region where the bulk of consumer goods is imported, the adjustment of the local currency on the American dollar is adding to the phenomenon. Abu Dhabi, Dubai and Doha are henceforth ranking among the world's most expensive cities.

The competing policies of the different states have contributed to the creation of the artificial financial bubble which is not devoid of risks. Considering the geographical, demographic and social data (absence of agricultural land, low population, local competency deficit), analysts estimate that a sustainable genuine economic development can be designed only at the scale of Middle East region extending to more populated countries such as Egypt and Yemen.

Three strong markets

In this new business eldorado, the Gulf region, three financial markets are in competition: Bahrain, Dubai and Qatar.

|

Bahrain

Area: 665 km²

Population (2006): 698 585 inhabitants

GDP (2006): 19.6 billion USD

Per-capita GDP (2006): 32 100 USD

GDP growth rate (2006): 6.6 %

Inflation rate (2006): 3%

Written Premiums (2006): 313 million USD

Insurance density (2006): 251 USD/inhabitant

Insurance penetration rate (2006): 0.7%

Engaged in the diversification of its operations as of the end of the 1970s, the emirate, which possesses no oil reserves, has focused its development on industry and financial services. In this regard, Bahrain is ahead of its immediate neighbours, thanks especially to the institution of legislative incentives well seasoned, and the availability of local competency.

Bahrain owes its financial expansion to a combined set of factors related to its geographical position and to the events which occurred in the Middle East region.

For having served as a background to the financial institutions operating in Saudi Arabia, and established sound business relationships with Iran, the emirate has developed infrastructure, services and very elaborate know-how.

|

Moreover, Bahrain has benefited from the transfer of capital and activities caused by the Lebanese war in the 1975-1985 period. The same process was repeated with the post 9/11 context which resulted in the massive withdrawal of Arab capital from the American financial market, hence the new boost given to the economy of Bahrain.

Financial operations are one of the three pillars of the national economy. They account for 25% of GDP. Set up in 1973, the supervisory authority of the Bahrain Monetary Authority (BMA) has been replaced by the Central Bank of Bahrain (CBB).

The insurance sector reported a 2006 overall premium volume of 313 million USD.

Twenty-two local companies are active on the domestic market, the most important of which are:

- Bahrain National Insurance Company

- Gulf Union Insurance Company

- Bahrain Kuwait Insurance Company

- Al Ahlia Insurance Company

- Takaful International

- Solidarity

|

The United Arab Emirates

Area: 82 880 km²

Population (2007): 4 400 000 inhabitants

GDP (2007): 190 billion USD

Per-capita GDP (2007): 41 700 USD

GDP growth rate (2007): 7.5 %

Inflation rate (2007): 13.5%

Written Premiums (2007): 3 555 millions USD

Insurance density (2007): 812 USD/inhabitant

Insurance penetration rate (2007): 1.9%

The ambition of becoming a financial hub at the regional level was affirmed during the 1990s. Within the same country, two financial markets were competing for the lead — with projects and communication build-up — Dubai and Abu Dhabi.

Dubai took the lead. In 2004, it set up the Dubai International Financial Centre (DIFC), an off-shore zone providing an environment and incentives for the benefit of International financial establishments (international standard regulations, tax exonerations, capital detention and repatriation). In 2008, DIFC counted 550 licensed financial companies.

The second stage of the process was the institution in 2007 of a regulatory commission in charge of the financial sector, the Dubai International Financial Authority.

Regarded as one of the most developed in the region, the UAE market, which reported a 2007 overall premium volume of 3.555 billion USD, includes 47 operators, 23 of which are national companies and 24 foreign ones. The market's main companies are Oman Insurance, Abu Dhabi National Insurance (ADNIC), Arab Orient, Al Ain Ahlia, Emirates Insurance and Al Buhaira National.

|

Qatar

Area: 11 437 km²

Population (2007): 800 000 inhabitants

GDP (2007): 59 billion USD

Per-capita GDP (2007): 75 350 USD

GDP growth rate (2007): 5.8 %

Inflation rate (2007): 13.5%

Written Premiums (2007): 539 million USD

Insurance density (2007): 640 USD/inhabitant

Insurance penetration rate (2007): 0.9%

The last of the troika wishing to join the leaders' playground, Qatar is the country which reports the highest regional growth rate (about 8% in 2007). The GDP is estimated at 59 billion USD in 2007, and the emirate has one of the world's highest per-capita income, about 75 350 USD in 2007.

© Darwinek , CC BY-SA 3.0 © Darwinek , CC BY-SA 3.0 |

Qatar detains the world's third gas reserves behind Russia and Iran, estimated at more than 25 000 Mdm3 (a 250-year exploitation).

Investments in infrastructure works are evaluated at 150 billion USD during the current 2005-2010 five-year plan and at approximately 130 billion USD for the next 2011-2015 five-year plan.

In the recent three years, the country has invested 145 billion USD in value-generating projects.

To attract the big financial firms, Qatar has adopted legislation in conformity with international standards and set up the Qatar Financial Centre (QFC) in 2005 and the Qatar Financial Centre Authority.

Five companies control 84% of the insurance market:- Qatar Insurance Company

- Qatar General Insurance and Reinsurance

- Al Khalij Insurance Company

- Qatar Islamic Insurance Company

- Doha Insurance Company