Reinsurance: capital supply on a growing trend

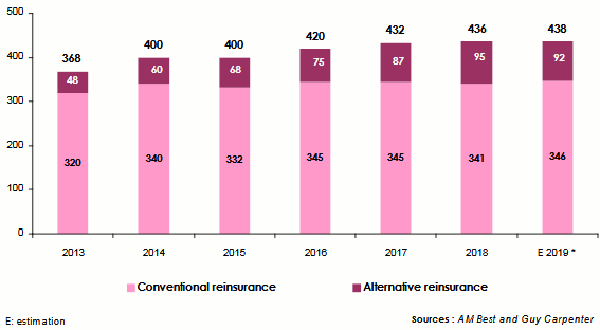

It is noteworthy that the figures provided by AM Best are significantly different from those published by Aon Securities which refer to a capital amounting to 605 billion USD at the end of the first quarter of 2019 and 540 billion USD by the end of 2013.

It is noteworthy that the figures provided by AM Best are significantly different from those published by Aon Securities which refer to a capital amounting to 605 billion USD at the end of the first quarter of 2019 and 540 billion USD by the end of 2013.

Still according to AM Best, the level of traditional capital has more or less stabilized since 2014, currently estimated at 346 billion USD versus 340 billion USD in 2014.

Total reinsurance capacity

In billions USD

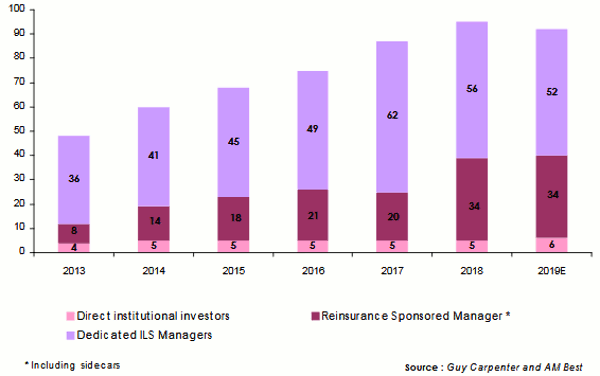

Capacity of the alternative market

Today, markets have adapted well to alternative capital, which has been growing over the past five years. This development is accounted for by several reasons: low interest rates, the emergence of new forms of capital, and some rapprochement with traditional capital. However, while the rise was clear until 2018, the market has slowed down ever since.

According to AM Best, the fall in alternative capital in 2019 results from the losses sustained in 2017 and 2018. This phase of digestion, however, risks to fade in 2020 due to the persistence of low interest rates that tarnishes the attractiveness of other asset classes.

A closer look at the supply of alternative capital since 2013 shows that after a solid rise until 2017, the decline in insurance-linked securities type of products has been sharp since 2018. The heavy losses suffered in 2017 and 2018 slowed investor momentum. Second finding: institutional investors and traditional reinsurers underwriting through third parties specialized in alternative capital supply did not offset this recent withdrawal.

In billions USD