Reinsurance: evolution of loss experience

The use of alternative capital, especially in retrocession, was able in the past to spare traditional reinsurance market high loss experience. This, however, has impeded adequate adjustment of traditional reinsurance prices by delaying the impact of the 2017 claims.

The use of alternative capital, especially in retrocession, was able in the past to spare traditional reinsurance market high loss experience. This, however, has impeded adequate adjustment of traditional reinsurance prices by delaying the impact of the 2017 claims.

The 2018 loss experience, including the California fires and Japan's Jebi typhoon, pinpointed the inappropriate tariffs in force and poor exposure management. After the disastrous 2017 year, reinsurers have continued their recourse to models that were inconsistent with the underlying risks.

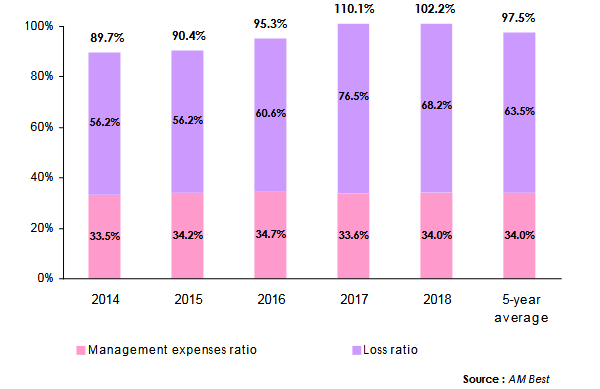

The traditional risk underwriting approach was relinquished for an exclusively modeling-based approach, which cost reinsurers heavy losses. The combined ratio reached 110.1% in 2017 (with a loss ratio of 76.5%) and then 102.2% in 2018 (with a loss ratio of 68.2%). The average combined ratio for the last five years is 97.5%.

The series of poor results significantly reduced the reserve margin designed to soften the results of the bad years.

Read also | Reinsurance: capital supply

Reinsurance: evolution of ratios (2014-2018)

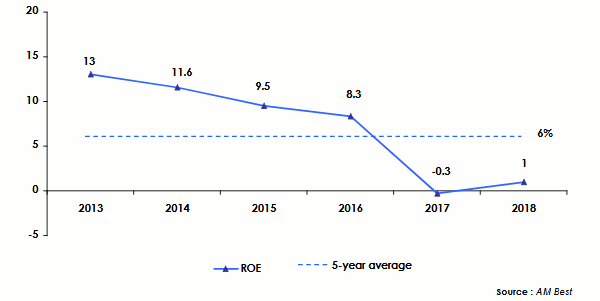

Reinsurance: return on equity (ROE)

Strong competition among reinsurers, rising claims, volatile financial markets and lower interest rates have adversely impacted market profitability, hence the growing difficult to release margins in reinsurance. Return on equity has deteriorated sharply since 2013, from 13% back then to 1% in 2018. Set at -0.3%, ROE was negative in 2017.