Special reinsurance, The 2016 January renewal

Having depicted the situation of the market in 2015, and having referred to the recent mergers-acquisitions wave, the second part of this publication shall be devoted to the market perspectives and to reinsurers’ strategy. Also available is an overview of the status of reinsurance in the Middle East and Africa. A third and last part of this file will be published in the next issue. A description of the new risks, alternative reinsurance and regulation will be on the agenda.

As a supplement to the special edition on reinsurance, we will be publishing early January on Atlas Magazine website (www.atlas-mag.com) the 2016 Reinsurance Special Directory, a survey dedicated to the major reinsurers operating in Africa, the Middle East and around the world. You can have full access to the first edition of «2015 reinsurance directory» in the premium section of the website.

|

The degradation of tariffs noted in 2015 is likely to continue during the January 2016 renewal, especially for non-affected business. The reasons behind the tariff erosion witnessed in recent years are still there, with reinsurers being cornered and left with very little margin for negotiation.

Nonetheless, most rating agencies agree that this decline is expected to happen at more moderate levels. According to Swiss Re and Hannover Re, the tariffs should stabilize for some businesses. It is therefore unlikely that price decline would exceed 5% during next renewal.

Main reinsurers, that is to say, those detaining diversified portfolios and substantial premium volumes are in a better position to make it out of this situation. They are able to choose the most profitable reinsurance programs. In addition to size, rating remains a fundamental criterion in difficult times.

Reinsurers’ strategy in a soft market period

In the so-called “soft market” period, reinsurers make recourse to different strategies ranging from tightened control over costs to external growth, with view to maintain a certain premium volume and to generate satisfactory return on equity for their shareholders.

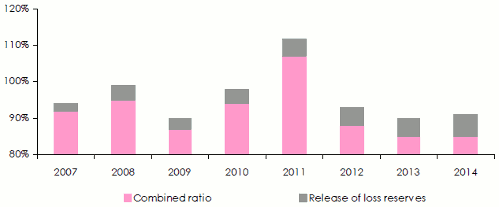

To fulfill this objective regarding return on equity, they release part of their reserves. The current period, characterized by poor natural catastrophe loss experience, is particularly favorable to this strategy.

Combined ratio and release of loss reserves : 2007-2014

Sources: S&P et SCOR

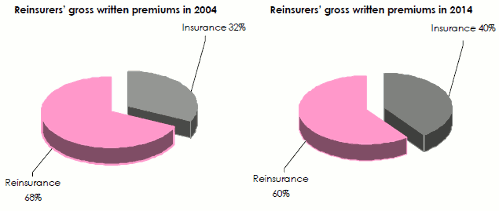

Sources: S&P et SCORIn this competitive environment, other reinsurers are taking advantage of their diversification in terms of products and distribution. They turn particularly toward the direct insurance sector, regarded to be more stable. The chart below highlights the clear evolution for the business for major continental and Bermudan reinsurers, clearly shifted toward direct insurance during the last ten years.

Evolution of insurance and reinsurance activities between 2004 and 2014

This trend plays out among several world groups such as Munich Re whose reinsurance share in the global turnover went from 56.15% in 2004 down to 54.92% in 2014. The group Berkshire Hathaway has also reported an increase of its direct insurance premiums at the expense of those reported in reinsurance. The latter went from 45.8% down to 35.9% over the same period. ACE Group follows the same trend. Over a 10 year-period, its reinsurance revenues declined by 61%, set at 5.26% in 2014 compared to 13.46% in 2004.

The search for new markets is also another way of absorbing the effects of the crisis. As the mature markets in Europe and the United States are saturated, many reinsurers, especially the leading ones, have started conquering emerging markets. China, India and Brazil stand as favorite targets thanks to their more sustainable growth and to the numerous advantages they offer including the less acute competition of the «Bermudans», being less present in that part of the world.

The search for new markets is also another way of absorbing the effects of the crisis. As the mature markets in Europe and the United States are saturated, many reinsurers, especially the leading ones, have started conquering emerging markets. China, India and Brazil stand as favorite targets thanks to their more sustainable growth and to the numerous advantages they offer including the less acute competition of the «Bermudans», being less present in that part of the world.

External growth, made possible by takeover moves over companies or reinsurance portfolios, has turned out to be an easy solution to get hold of market shares and grow. This strategy has picked up momentum during the last two years with record high figures of this kind of transaction. As a reminder, the number of mergers-acquisitions in insurance and reinsurance has grown by 73% between the first half of 2014 and the second half of 2015 going from 44 to 76 transactions within a few months.

The rising value of the acquisitions reveals that some reinsurers are willing to disburse huge sums in order to get hold of new business portfolios. Between November 2014 and August 2015, nine major mergers-acquisitions (M&A) transactions were reported in the reinsurance business for the global amount of nearly 57 billion USD. The Swiss group ACE has disbursed 28.3 billion USD to lay hands on its American competitor Chubb.

Eventually, not having attractive projects and possessing important cash flow, reinsurers opt for the purchase of their own shares. This strategy leads to believe that there is no other more profitable investment alternative. In times of crisis, this kind of operation supports share-based profitability and attracts investors. It also allows, among others, to shield from take-over bids and to make the share value more liquid.