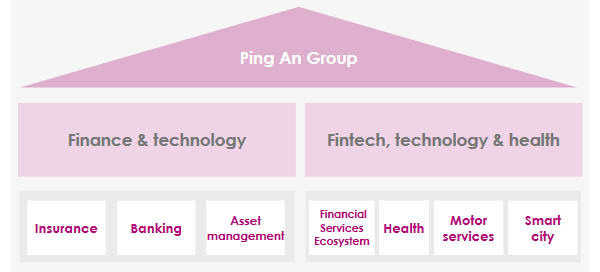

Ping An Group structure

These subsidiaries themselves have a large network of companies, distribution channels, offices, etc. Frontline subsidiaries include:

Ping An Life

Ping An Life- Ping An Property & Casualty

- Ping An Annuity

- Ping An Health

- Ping An Bank

- Ping An Trust

- Ping An Securities

- Ping An Asset Management

- Ping An Technology

The group’s operations come in an integrated platform model that promotes the sharing and centralized management of information and technology.

This integration strategy is carried out in four stages:

- From 2000 to 2003, unification of underwriting and claims services at the provincial level and database consolidation,

- From 2004 to 2006, pooling up all insurance companies into one group, with Ping An establishing the national integrated operations center in Zhangjiang (Shanghai) in 2006. The latter structure promotes the development of a centralized platform to which insurance, brokerage, trust and banking back-office operations are linked,

- From 2007 to 2009, merging non-insurance operations in a single structure that the group attaches to the integrated platform,

- The fourth integration, initiated in 2010, encompasses a wide range of services peripheral to the core business such as client and network data processing, process development, claims research.

This integrated business model has enabled the holding company to:

- simplify back-office procedures,

- reduce management costs,

- optimize direct and cross-selling,

- establish a one-stop shop,

- simplify access to data,

- improve risk management,

- take advantage of new technologies such as Web 2.0, digitization and artificial intelligence,

- distribute significant dividends to shareholders,

- achieve remarkable turnover growth,

- provide its customers with high performance services.

Main activities of Ping An Group

Ping An's activities can be broadly grouped into two areas:

A first division that integrates the finance and technology activities and that is logically subdivided into three categories:

- Insurance,

- Banking,

- Asset management.

A second division, called Finance and Ecosystem, which includes a core business, health, and other business areas:

- Healthcare,

- Financial Services Ecosystem,

- Motor services,

- Smart city.

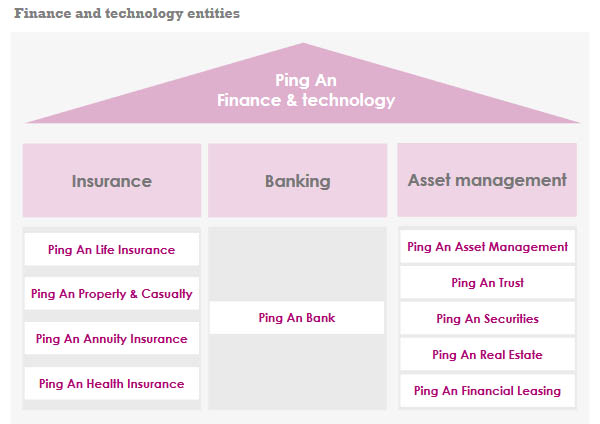

Ping An Group: finance and technology division

By 31 December 2022, the Ping An Group has 114 subsidiaries operating in the financial sector, offering a wide range of products and services which they distribute through multiple channels.

Ping An's financial activities are divided into three main areas: insurance, banking and asset management.

The entirety of the group's financial activities supported by a large number of start-ups, fintech and other technology services.

Ping An Group : the insurance activity

Ping An has four insurance structures established between 1988 and 2014.

| Insurance companies | Activity | Date of creation | Ping An’s shares in 2022 (1) |

|---|---|---|---|

| Ping An Life Insurance Company of China | Life | 1988 | 99.51% |

| Ping An Property & Casualty Insurance Company of China | Non-life | 2003 | 99.55% |

| Ping An Annuity Insurance Company of China | Life annuity | 2004 | 94.18% |

| Ping An Health insurance Company of China | Health | 2014 | 74.33% |

(1) Direct shares held by the group.

Ping An Life is the second largest life insurance company in the country after China Life. By 31 December 2022, the company has 35 branches including seven telemarketing centers and more than 3 250 sales outlets.

With a nationwide network, Ping An Life offers a full range of life products and services.

Ping An P&C is the second largest general insurance company in China after PICC Property and Casualty.

The company distributes more than 1 000 insurance products covering the risks of 70 million policyholders (individuals and companies). The company is endowed with a network of 43 branches and more than 2 800 sales outlets across China.

Ping An Annuity is the first pension company in China. It is a professional asset management, pension fund, care and health service company. With assets under management worth 1300 billion CNY (204 billion USD), Ping An Annuity has a portfolio of 490 000 companies and 233 million individuals.

Ping An Health Insurance is one of the first licensed health insurance companies in China. Its network covers more than 200 regions and/or countries, offering various insurance and medical solutions.

Read also | Insurance status within the Ping An Group

Ping An Group: banking and asset management

As with insurance, the banking and asset management segment comprises several entities, the largest of which were established between 1991 and 2012. Six of them account for almost all of the group's banking and asset management turnover, including one bank.

Banking and asset management entities

| Banking and asset management | Type of activity | Date of creation | Ping An’s shares in 2022 (1) |

|---|---|---|---|

| Ping An Bank | Banking | 2004 | 49.56% |

| Ping An Asset Management | Asset management | 2005 | 98.67% |

| Ping An Trust | Asset management | 1996 | 99.88% |

| Ping An Securities | Asset management | 1991 | 40.96% |

| Ping An Real Estate | Asset management | 1995 | 100% |

| Ping An Financial Leasing | Asset management | 2012 | 69.44% |

(1) Direct shares held by the group

Banking activities

Founded in 2004, Ping An Bank became one of China's largest retail banks by the end of 2022. Equipped with a broad digital platform, the bank offers services to individuals and companies. It operates through a network of 109 branches and 1 177 sales outlets, agencies, counters, ...

By 31 December 2022, the bank's assets under management amounted to 3 587 billion CNY (520 billion USD), up 12.7% compared to 2021. The total revenue from banking operations amounts to 282 billion CNY (41 billion USD), accounting for 23% of the group's total revenue. This business also accounts for 42.37% of the group’s net profit.

Asset management

Ping An Asset Management is one of the most influential institutional investors in China. It is engaged in asset management business for foreign banks, insurance companies, enterprises and customers such as foreign sovereign wealth funds and institutional investors.

By 31 December 2022, its assets under management amounted to 4.37 trillion CNY (631 billion USD).

In addition to Ping An Asset Management, asset management is also provided by:

Ping An Trust: a major Chinese trust company (capital management company).

Ping An Securities: a smart securities service platform.

Ping An Financial Leasing: a leading leasing company in the energy, metal, education, construction and motor financing sectors.

Ping An Group: fintech division, technology and health

As with insurance, Ping An conducts its technology and healthcare business through subsidiaries, associates and joint ventures, including many fintechs such as Autohome, Lufax Holding, OneConnect and Ping An Health.

| Fintech Business | Type of activity | Head office | Date of creation | Ping An’s shares in 2022 (1) |

|---|---|---|---|---|

| Ping An Health (2) | Health | Shanghai | 2014 | 39.41% |

| Ping An Technology | Technology | Shenzhen | 2008 | 100% |

| OneConnect (2) | Services | Cayman Islands | 2015 | 32.12% |

| Lufax Holding (2) | Finance | Cayman Islands | 2011 | 41.44% |

| Autohome | Motor | Cayman Islands | 2005 | 41.71% |

(1) Direct shares held by the group

(2) Entities associated with Ping An Financial Technology, a subsidiary of the Ping An Group.

Ping An Health, also known as Good Doctor, is China's largest digital health platform, providing medical services, developing distribution networks and offering technological expertise.

Lufax Holding the first personalized financial services technology platform for Chinese small and micro enterprises.

OneConnect technology provider for financial institutions including digital services for banks and insurance companies.

Autohome the first online automotive service platform in China.

Ping An Group: the contribution of technology

Ping An dedicates 1% of its revenues, or 10% of its annual profits, to research and development (R&D) activities. The group's growth strategy is based on innovation and new technologies, which are considered essential for the success of its activities.

Ping An's approach is focused on process automation using artificial intelligence, blockchain, cloud computing, machine learning and facial recognition.

By the end of 2022, more than 4 500 scientists and 110 000 employees are working in the group's R&D structures (financial services, healthcare, motor, real estate services, smart city) whose mandate consists in renovating the financial services and consolidating the group.