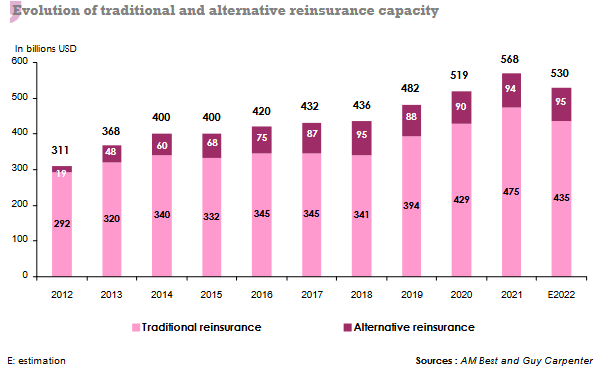

Traditional and alternative reinsurance capacity in 2022

The good performance of the equity markets during the first nine months of the previous year and the drastic improvement of the technical results have led to the increase of the reinsurers' equity.

The good performance of the equity markets during the first nine months of the previous year and the drastic improvement of the technical results have led to the increase of the reinsurers' equity.

The good, combined ratios achieved by the industry reflect the improvement of the operating results for the year 2021. In fact, these good results are accounted for by the upward revision of the 2021 renewal conditions imposed by the reinsurers.

Read also | Global reinsurance market

Lack of traditional reinsurance capacity in 2022

In contrast to 2021, the year 2022, challenged by strong headwinds, has exhibited a lack of reinsurance capacity which is expected to decrease to 435 billion USD, down by 9% over one year.

Risks that are too exposed or poorly modeled, and therefore not well controlled, are being shunned by reinsurers who have chosen not to offer any more capacity for certain perils and geographical areas.

Since April 2022, some reinsurers, including SCOR, have reduced their catastrophic exposures in Florida. Moreover, the French reinsurer is intent on controlling its exposure on catastrophic risks during the next renewal in January 2023.

Sirius, seems to be on the same path as SCOR. Shortly before the Baden-Baden meeting and in order to counter the multiplication and the intensification of the claims, especially in the fire class of business, the Bermudan reinsurer has notified all its clients about the implementation of a new underwriting strategy aimed at reducing, in particular, its natural catastrophe commitments.

Alternative reinsurance capital in 2022

Despite high claims experience, the alternative capital offered by the financial markets remains stable in 2022. The first six months of this year have seen a buoyant ILS market. Supply and demand have played their full role in determining the price of these products and their placement.

It is worth noting that more and more investors are interested in liability-backed products, not quite a new trend, but one that has been gathering momentum.

The Covid-19 crisis has mobilized a significant amount of alternative capital that managers are now trying to close. This approach allows them to reposition themselves on transactions that are expected to be more lucrative in 2022, particularly in the field of natural catastrophes.

In this respect, the placement of Cat bonds, supported by a significant rise in rates, has been very successful during the current year.

Read also | World's largest reinsurers

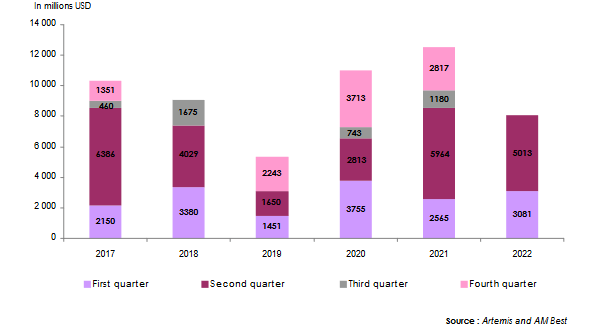

Cat bonds issuance: 2017-2022

Overall, 2022 has showed signs of rising rates in the alternative capital markets. Catastrophe programs have witnessed significant rate increases. ILS managers are trying to reposition their products to covers that emphasize loss intensity over loss frequency.

To optimize their results, some prefer to increase their rates while others are focusing on the structure of the agreements or the terms and conditions of the contracts.