Alternative reinsurance

Joined under the phrase "alternative reinsurance", these techniques were first focused on capacity issues which insurers and reinsurers had faced after Hurricane Andrew in the USA in 1992 and the 1994 Northridge earthquake in California.

With the development of financial markets and the growing needs in capacity for insurance and reinsurance companies, these instruments have created appropriate responses in areas as diverse as the need for funding, the contribution of additional capital, and access to insurance and reinsurance coverage at competitive costs

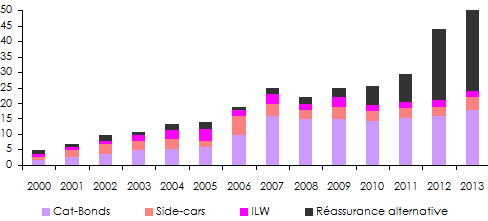

Since the appearance of the first transaction in non-life insurance, alternative reinsurance has evolved considerably, getting more sophisticated with multiple innovations. The capital invested in alternative solutions for non-life reinsurance attained 50 billion USD in 2013, compared to 45 billion USD in 2012. The reinsurance capacity generated by these instruments has been increasing in recent years.

Evolution of alternative capital

in billions USD Source: Aon Benefield

Source: Aon BenefieldART techniques most commonly used to date are securitization and structured reinsurance.

The status of alternative reinsurance

Investors’ interest in alternative reinsurance remains strong, especially on part of hedge funds. This craze has triggered a decrease in the prices of alternative products: AON has reported a 30% drop in the prices of ILS since the second quarter of 2012. This decrease is exacerbating competition between alternative and traditional reinsurance.

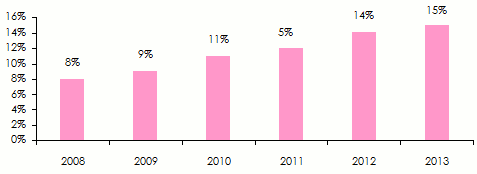

According to Guy Carpenter, the capacity emanating from alternative reinsurance has attained about 15% of overall limits engaged to cover natural catastrophes in the property damage insurance. This percentage, which was only 8% in 2008, is poised to reach 30% in the coming years.

Evolution of the capacity offered by the alternative reinsurance in % of overall limits covering natural catastrophe risks

Source: Fitch, Global Reinsurance Guide 2015

Source: Fitch, Global Reinsurance Guide 2015 Structured reinsurance

The techniques used by structured reinsurance are similar to those of traditional reinsurance.

ILS are not the only instruments providing solutions for the protection of balance sheets. This role is also entrusted to structured reinsurance whose emergence coincided with the financial crisis, the introduction of Solvency II and ERM (Enterprise Risk Management).

The new capital requirements as formulated under Solvency II have given rise to more pressing demand for this type of coverage. Usually featured in the shape of a quota share, these contracts, which run over several years, may reduce the need for regulatory margin, protect the balance sheet, reduce ceding companies’ results’ volatility or secure future profits.

They often apply to long-lasting liquidation classes such as motor third party liability and to well-defined business portfolios exhibiting good visibility.

Alternative reinsurance development impact

The advent of alternative solutions has helped develop new reinsurance capacity in an environment where natural catastrophes are becoming more and more expensive. Their use is however not without doubts.

Major rating agencies consider that the profitability of the sector is threatened by this type of capital whose inflow feeds the downward trend in reinsurance rates, a phenomenon particularly important in an environment that is said to be "Soft".

According to Fitch, alternative capital represents a real danger for traditional reinsurers who see their profit margins fall and their ability to absorb market volatility consequently strained. It is for all these reasons that the rating agencies downgraded from "stable" to "negative" the outlook related to global reinsurance.

The advent of alternative solutions has helped develop new reinsurance capacity in an environment where natural catastrophes are becoming more and more expensive.