Executives' remuneration according to the class of business

In a globalized world, employees and managers are not assessed and paid based on the same standards.

In a globalized world, employees and managers are not assessed and paid based on the same standards.

While salary policy governing employees still meets in-house corporate criteria, that of major leaders is gradually distancing itself from those criteria, focusing on external factors such as competition, reputation on the international market,...

Nowadays, executive remuneration, which is often in the headlines, is sometimes a source of unease within the company itself, raising the opposition of some shareholders in some cases.

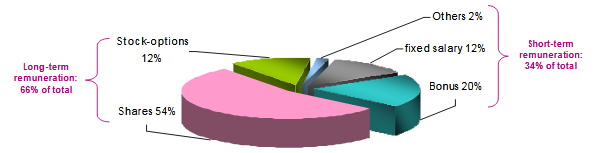

Executive’s remuneration model

(1) Case of a S&P 500, CEO 2015 data

Executives’ remuneration: public - private sector

While by and large, the private sector is sometimes less competitive in terms of remuneration than the public sector, this rule applies only to the categories of employees, supervisors, middle and senior managers. It does not concern the category of senior executives.

Remuneration of executives of big private companies is not to be compared to that paid to the executives of public companies and State high officials.

In the public sector, remuneration, including that of senior executives, is regulated and comes within the long term framework with a priority to job security and career.

In the private sector, remuneration policy is less rigid. It obeys the laws of the market only and can therefore be subject to strong fluctuations. The emergence of new activities and the resulting scarcity can propel a sector and its leaders to new heights. This is currently the case for new technologies: Google, Facebook, and Microsoft.

Financial activity, banking and insurance, is one of the most attractive sectors. Private sector executives enjoy a "risk premium" over their counterparts in the public sector, with perspectives set over the short term rather than the long term.

To discover: Executives' remunerations in the insurance sector

Executives’ remuneration and company size

Being the boss of a small structure or a large company seems, a priori, to be the same job. In fact, that is absolutely not the case. Running a team of less than 10 people or managing several subsidiaries in an international group does not represent the same burden, nor does it require the same skills.

Being the boss of a small structure or a large company seems, a priori, to be the same job. In fact, that is absolutely not the case. Running a team of less than 10 people or managing several subsidiaries in an international group does not represent the same burden, nor does it require the same skills.

In fact, executive remuneration is correlated with firm size. This observation is particularly true for those with an international dimension. With the increase since the 1960s in the size of companies, particularly in the financial sector, the responsibility of senior executives has steadily increased, pushing up the remuneration. Those of the executive of large enterprises, which were, on average, 20 times the minimum wage in 1965 can, today, reach 200 times and even in some cases 500 times that of the lowest wage paid by the enterprise.

Average net annual executives’ salary of a French company per size in 2015

In USD| Less than 20 employees | From 20 to 49 employees | 50 employees or more | Average | |

|---|---|---|---|---|

Financial and insurance activities | 106 863 | 178 452 | 241 789 | 125 250 |

Scientific and technical activities | 68 402 | 128 879 | 200 703 | 95 280 |

Information and communication | 59 613 | 101 503 | 152 284 | 86 683 |

Industry | 49 570 | 88 340 | 137 656 | 78 587 |

Primarily market services | 60 691 | 94 722 | 134 856 | 77 389 |

Trade | 51 820 | 84 900 | 114 717 | 69 056 |

To discover: Employment in insurance: recruitment and salaries

Executives’ remuneration and business line

The terms scarcity, shortage, and increased needs are particularly true in certain activities such as finance, communication and new technologies. The surge in wages and/or remuneration in the IT sector has been accounted for by the explosion of needs in robotics, big data, modeling,...

Likewise in high finance that has abundant need for high-level leaders capable of brewing huge capital.

Top annual executives’ remuneration by business line, year 2017

In millions USD| Sector | Company | Country | Payment (1) |

|---|---|---|---|

Cosmetics | Estée Lauder | USA | 51.03 |

Banking | JP Morgan | USA | 29.71 |

Pharmacy | Pfizer | USA | 27.31 |

Oil | Chevron | USA | 22.88 |

Automotive | General Motors | USA | 22.40 |

Automotive suppliers | Magna | Canada | 21.44 |

Aeronautics | Lockheed Martin | USA | 20.72 |

Hotel industry | Hilton | USA | 19.88 |

Sotwares | VMWARE | USA | 18.81 |

Insurance | Marsh & Mclennam | USA | 17.37 |

Food industry | Mondelez | USA | 15.93 |

Airline companies | Delta Air Lines | USA | 13.78 |

(1) Including fixed, variable, valuation of shares and stock options granted for 2017. Excluding pensions and benefits in kind

Source : Capital Magazine of 29/1/2019No European company executive stands at the top of industry-based pay list.

Difference between the highest remuneration of a manager and that of an unskilled worker in France and the United States

In the vast majority of countries, remuneration, especially for executives, is traditionally not disclosed to the public. It's a taboo subject that we do not talk about.

In the vast majority of countries, remuneration, especially for executives, is traditionally not disclosed to the public. It's a taboo subject that we do not talk about.

However, in recent years under the pressure of the authorities, stock exchanges, unions, employees and other minority shareholders, companies are increasingly forced to report on all salaries including those of the bosses.

In the United States, where money is the standard for success, big bosses are more willing to publishing their pay. There are, however, huge income gaps between the CEO and the employees. This difference can range from 1 to 300.

| 1979 | 2012 | 2017 | |

|---|---|---|---|

France | 1/40 | 1/162 | 1/257 |

United States | 1/46 | 1/422 | 1/312 |

Executives and employees’ pay gaps worldwide, year 2017

The ranking below based on the gap between the national average income and that of a leader always brings out the United States in the first place, with India, the United Kingdom, South Africa following in descending order.

| Country | Gap | Country | Gap | ||

|---|---|---|---|---|---|

| 1 | United States | 265 | 12 | Hong Kong | 89 |

| 2 | India | 229 | 13 | Israel | 85 |

| 3 | United Kingdom | 201 | 14 | Finland | 71 |

| 4 | South Africa | 180 | 15 | France | 70 |

| 5 | Netherlands | 171 | 16 | Denmark | 68 |

| 6 | Suitzerland | 152 | 17 | South Korea | 66 |

| 7 | Canada | 149 | 18 | Sweden | 60 |

| 8 | Spain | 143 | 19 | Japan | 58 |

| 9 | Germany | 136 | 20 | Singapore | 56 |

| 10 | China | 127 | 21 | Austria | 49 |

| 11 | Australia | 110 | 22 | Norway | 20 |

List of the five highest CAC 40 executives’ remunerations, year 2018

In millions USD| Name | Year of taking office | Company | Activity | Salary | Variable remuneration | Total remuneration |

|---|---|---|---|---|---|---|

Bernard Charlès | 1995 | Dassault Systèmes | Computer services | 1.590 | 24.545 including 22.82 of stock option | 26.193 |

François-Henri Pinault | 2005 | Kering | Luxury group, clothing and Accessories | 1.373 | 12.562 including 10.236 of stock option | 13.954 |

Dough Pferdehirt | 2017 | TechnipFMC | Energy | 1.190 | 11.781 including 9.39 of stock option | 12.971 |

Jean-Paul Agon | 2006 | L'Oréal | Industrial group specializing in cosmetics | 2.516 | 8.384 including 6.051 of stock option | 10.900 |

Jean-Marc Chery | 2005 et 2018 | STMicroelectronics | Electronic microchips | 0.898 | 9.379 including 3 of stock option | 10.294 |

* The CAC 40 is the main stock index of the Paris Stock Exchange

Read also: Actuary: wage and training

Total executives’ remuneration: in some countries in 2017

The amounts shown below reflect the average remuneration (excluding retirement contributions, severance pay or equivalent) of corporate chief executives listed in 2017 in the Dow Jones, FTSE 100, AEX, Euro Stoxx 50, CAC 40 and IBEX 35.

In millions USD| Average annual remuneration | |

|---|---|

United States | 20.7 |

United Kingdom | 9.5 |

Netherlands | 7.1 |

Average Europe | 6.6 |

Germany | 6.2 |

France | 5.9 |

Spain | 4.1 |