The insurance business appealing for GAFAMs

| 2019* | 2020** | |

|---|---|---|

| Non-life premiums | 3 376 | 3 500 |

| Life premiums | 2 916 | 3 100 |

| World total | 6 292 | 6 600 |

* Sigma data **Atlas estimates

The GAFAMs will find it hard to get hold of a significant part of this jackpot. These mega-companies of the net, which enjoy a quasi-monopoly situation, are generally active in fields that are often poorly regulated or totally new with a great freedom of maneuver, a leeway not usually available in the insurance sector, which is a regulated activity that is supervised by strict supervisory authorities.

To protect policyholders and beneficiaries, various legislators have established numerous barriers and regulatory safeguards to entry into the insurance business and to the exercise of the insurance activity.

Insurance digitalization

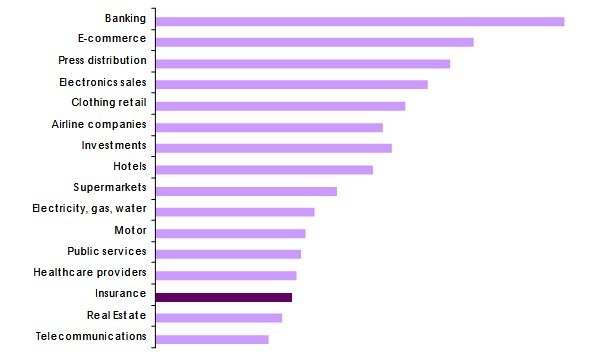

The digitization of the insurance industry is lagging behind, trailing behind other activities such as banking or e-commerce.

This digitalization of insurance is all the more essential as professionals in the sector need to reduce their costs and administrative tasks that mobilize a lot of personnel.

For insurers, digitalization is not only a time and money saver but also a synonym of freedom, allowing them to focus on their core business and to move away from non-value added tasks. Finally, it offers insurers an opportunity to get closer to their customers.

GAFAMs can meet all the expectations of insurers and their customers. It is therefore in this gap that they want to slip into the profession with powerful IT solutions, outstanding networks and a well-honed customer relationship.

Read also | GAFAMs' market capitalization

GAFAMs in the insurance industry

Traditional insurers are not, facing a head-on competition from GAFAMs, to date. The latter companies have not yet uberized the sector.

Traditional insurers are not, facing a head-on competition from GAFAMs, to date. The latter companies have not yet uberized the sector.

High-tech companies are following a long-term investment strategy in insurance. They are recruiting teams and are currently focusing on various collaborations to enrich their knowledge in the field. They are, actually, in no hurry.

Thanks to their mastery of networks and their ability to analyze data, they are able to provide insurers with offers that best meet the needs of their customers :

- online underwriting,

- competitively priced insurance products,

- insurance products tailored to a specific customer base,

- broad accessibility to insurance services.

The advantage of GAFAMs over insurtechs and insurers, lies in their databases that they enrich by analyzing the habits of internet users. The segmentation that is done allows them to customize their offers and target the most profitable markets and portfolios.

The business model of the web giants basically revolves around the collection and resale of data. In addition to collection, GAFAMs are endowed with the knowledge and insights to exploit the data, along with the expert tools, IT solutions, and data analytics that are easy to implement.

Ultimately, GAFAMs' goal is to give consumers an advantage so that they can enjoy greater competition. This strategy allows them to drive down prices while optimizing insurance coverage.

Health insurance and GAFAMs

The primary objective of GAFAMs is medicine and, by extension, the insurance of this class of business. In the field of health, the success of these groups is due to the fact that intelligent medicine is becoming a major public health policy issue, the area of business where traditional insurance companies have failed.

They have not been able to provide a relevant solution to users at reasonable costs. In all countries, the medical world, social and prevention organizations are looking for a high-quality care monitoring project: rapid detection of diseases, improvement of patient treatment times, progress in time and resource management, cost reduction, etc.

Read also | Insurance: the net giants are on the lookout

Non-life insurance and GAFAMs

Non-life personal lines motor comprehensive homeowner’s insurance are also on GAFAMs' agenda. They have been exploring the industry for a long time, either through investments in insurtechs or through agreements with insurers.

Google and Apple, both involved in the development of driverless cars, could be inspired by Tesla, which recently started marketing its own car policies in the US state of California.

Google and Apple, both involved in the development of driverless cars, could be inspired by Tesla, which recently started marketing its own car policies in the US state of California.

The Mountain View company would not be at its first incursion into the field, with Google having launched in 2013 in Germany, France and the United Kingdom its own car insurance aggregator. As the expected success was not achieved, the Google Compare project was abandoned in March 2016.

For its part, Amazon has ambitions to distribute homeowner’s insurance. The e-commerce company intends to achieve this by complementing its growing range of smart home automation devices controlled via its home assistant, Alexa.

This means it can offer a low-cost home insurance policy to consumers who agree to install an Amazon-branded alarm system in their home.

The e-commerce giant has already been trying to market motor insurance in India since 2020.

To this effect, Amazon has tied up with insurtech Acko in which it invested 12 million USD in 2018. The policies can be underwritten on the website of the online payment service, Amazon Pay.